In an economic environment in which finding successful department stores is a steep challenge, Macy's (M 0.04%) continues to outperform its peers. For instance, Macy's stock has appreciated 36.8% over the past year while Dillard's (DDS 0.65%) has seen stock appreciation of 10.6%, and J.C. Penney's (JCP +0.00%) stock has plummeted 60.6%.

In some instances, stock performances don't match underlying business performances, which can be frustrating for investors. Fortunately, in this case... that's not the case. We'll take a quick look at an example prior to examining what Macy's has in store to drive future growth.

Quick peer comparisons

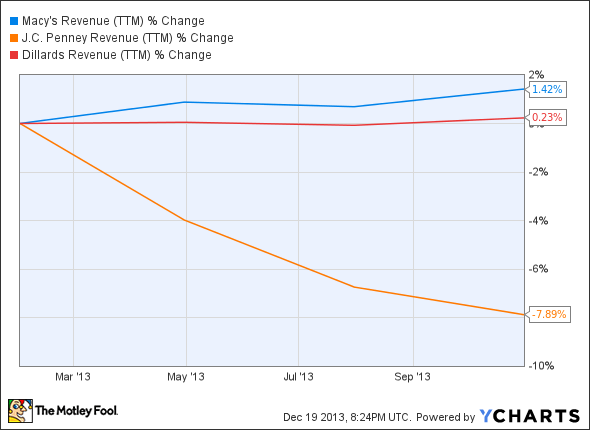

Macy's hasn't been a standout on the top line over the past year, but as long as revenue is growing in this consumer environment, it's a positive. Dillard's has barely managed to stay north of the border, and J.C. Penney seems to have gone for a visit to some friends down under:

Macy's revenue (trailing-12-month) data by YCharts.

To make matters worse for J.C. Penney, it has generated negative operating cash flow of $1.5 billion over the past year. This fact alone is going to make it extremely difficult for the company to turn itself around. Though it is possible, it would make more sense to consider a company like Macy's, which has generated positive operating cash flow of approximately $2.2 billion.

Macy's is using much of this capital to put toward reinvestments in its business, with a focus on the customer first. Macy's is taking the approach that it's willing to take a short-term hit financially as long as the customer is taken care of, which is likely to lead to customer loyalty and long-term company rewards. We'll see how Macy's is accomplishing this goal through its omnichannel initiatives in a moment.

But first, let's not leave Dillard's out of the cash-flow-generation conversation. Dillard's generated $475.8 million in operating cash flow over the past year. This allows for reinvestments in the business as well as a slight dividend. Dillard's currently yields 0.3%. Better than nothing, but not nearly as generous as Macy's 1.9% yield. For the record, J.C. Penney doesn't offer a dividend. Now let's take a look at how Macy's plans to continue to drive its top line.

Demanding consumers

Back in the day, consumers would walk into a department store, or any store, for that matter, pick up the products they wanted and be on their way. Today, if a department store allowed such a simplistic approach, it would likely lose share to its competitors in short order. Macy's is well aware that today's consumer isn't just looking for bargains, but wants to have a positive shopping experience. If a consumer sees that a department store is faltering in one area, that consumer is likely to check out a competitor. I'd like to tell a quick related story.

I recently went out to lunch at a casual-dining establishment. I ordered a burger and a soda and then made my way to the restroom. When I entered the restroom, I found a flood on the floor, unkempt stalls, an "Employees Please Wash Your Hands" sign resting against the mirror instead of hanging, and a broken faucet on the sink. I quickly let the waitress know that I just received an important phone call and had to run, and I asked her to cancel my order. I went to a casual-dining establishment down the street.

The point here is that I'm one of today's consumers, desiring the best value in every facet whether it be a T-shirt or a burger. Any company that isn't willing to go out of its way for its customers shouldn't be considered for purchases or investments.

By offering a top-notch omnichannel experience, Macy's caters to today's consumer needs. For instance, a Macy's customer can research a product online, order it, and pick it up in-store. This isn't true of all locations yet, but those locations that do offer it have reported success. This also works the other way around. For example, if a consumer sees something at a brick-and-mortar location and they don't want to lug it home, they can order it online for delivery.

Due to recent trends, Macy's also now has much of its inventory online, which might increase shipping costs, but that's better than markdowns.

Additionally, some Macy's locations now offer shopBeacon, which already has 6 million users through the shopkick app. Using this app, you can select what you like. When you visit the store, the app will guide you to that product. You can earn "kicks" when you use shopBeacon, which can be redeemed for discounts on merchandise.

The bottom line

Investing in a department store in today's consumer environment isn't easy, but the retail environment is becoming more about winners and losers than industrywide trends. Thanks to a proven management team, fiscal strength, a strong brand, and consistent consumer-focused initiatives, Macy's appears to be a winner.