Photo credit: Encana Corp.

There's a growing trend among energy companies that has the potential to deliver some really rock-solid returns. Energy companies like Chesapeake Energy (CHK +0.00%) and Encana (ECA +2.13%) are literally focused on rocks to deliver returns in the year ahead. Here's why that matters to investors.

Why rocks matter

The North American energy boom started when companies figured out that the combination of horizontal drilling and hydraulic fracturing could unlock oil and gas trapped in tight rock formations. Over time energy producers have found that some rocks simply held more accessible resources, with the most valuable holding oil or massive quantities of natural gas.

As producers explored and appraised the various resource plays discovered over the past few years, certain areas of each play really stood out. What producers found in these core areas were rocks that were more saturated with oil and gas.

Producers like Chesapeake Energy and Encana, which were burned in the past by just drilling to hold on to land assets, are now focusing drilling capital on only the best rocks. This is key because these rocks tend to hold the most recoverable oil and gas, enabling each well drilled to ultimately produce more over its lifetime. That's important because the more a well produces, the higher the returns it can earn for a driller. Furthermore, these wells tend to produce higher initial production rates that enable producers to earn a faster payback on these wells.

Producing returns

Having the best rocks in a location is a huge competitive advantage. For example, Range Resources (RRC 0.96%) can earn a 96% internal rate of return when it drills a $6 million well in the dry gas part of the Marcellus Shale, with natural gas prices around $4 per thousand cubic feet(Mcf). As good as those number are, Cabot Oil & Gas (NYSE: COG) can do even better. A $6 million well yields a before-tax internal rate of return of 150% with natural gas at $4 per Mcf.

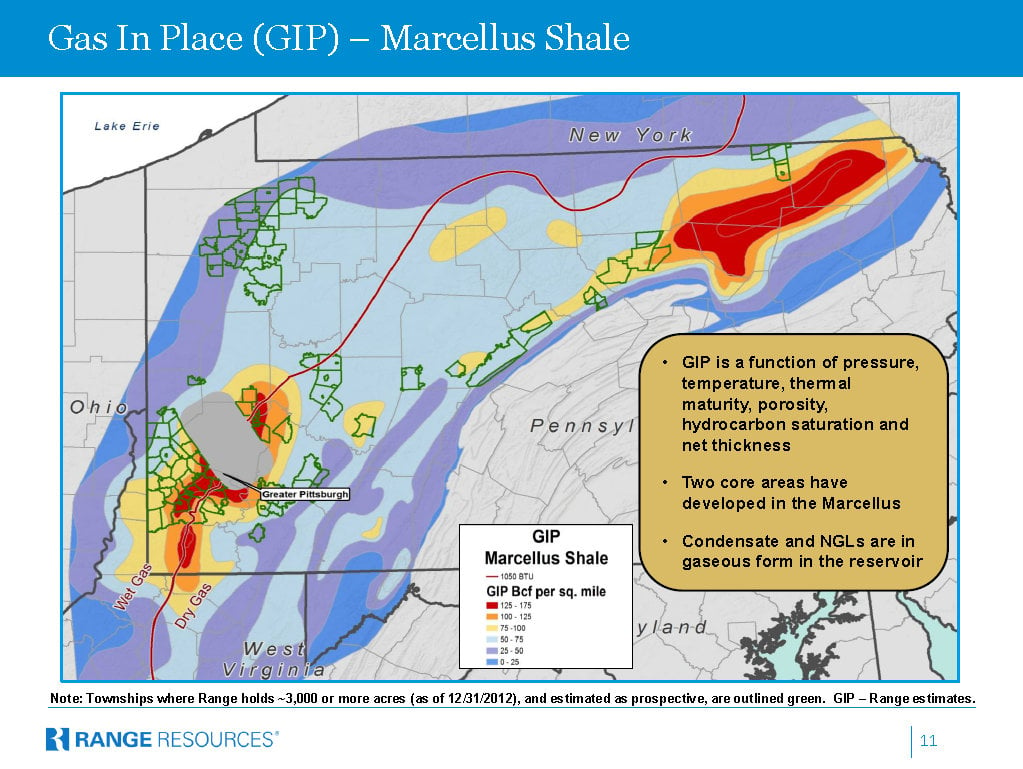

Other producers aren't so lucky. The following map shows the areas of the Marcellus that hold the most gas in place.

Source: Range Resources.

Cabot Oil & Gas' core position is in the red hot area in Northeastern Pennsylvania. Meanwhile, Range Resources has a great core position south of Pittsburgh. That's why the returns of both companies are so good, while peers including Encana, located in colder sections, are basically abandoning the Marcellus.

We find this same story in virtually every other resource play. Those companies that have locked up a core position that holds the best rocks are able to earn top-tier returns. This is also why we find both Chesapeake Energy and Encana focusing on the best rocks to drill in 2014. For Chesapeake that likely means spending more capital on its best spots in the Eagle Ford and Utica Shale plays. Meanwhile, Encana is focusing on five main plays in the year ahead, with the Duvernay in Canada showing world-class resource potential.

Investor takeaway

Gone are the days of grabbing as much acreage as possible. Instead, companies are focusing on developing what was acquired during the great land grab, but with a focus on just the best rocks. This is great for returns, as producers will focus most drilling on areas that have the best potential for short-term gain via high initial production rates while also producing a long-term win thanks to high estimated ultimate recoveries. That's a winning formula for producers, which also has the makings of a rock-solid investment thesis for 2014.