Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Monster Beverage (MNST +0.35%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Monster's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Monster's key statistics:

MNST Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

70.6% |

Pass |

|

Improving profit margin |

(10.4%) |

Fail |

|

Free cash flow growth > Net income growth |

59.8% vs. 52.9% |

Pass |

|

Improving EPS |

63.5% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

184.2% vs. 63.5% |

Fail |

Source: YCharts.

*Period begins at end of Q3 2010.

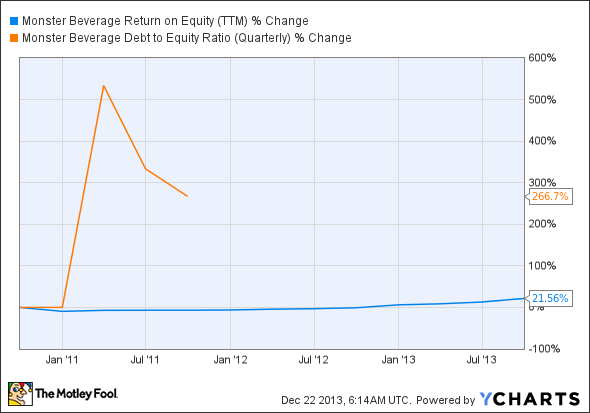

MNST Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

21.6% |

Pass |

|

Declining debt to equity |

No debt |

Pass |

Source: YCharts.

*Period begins at end of Q3 2010.

How we got here and where we're going

Monster improved on last year's score by two passing grade in its 2013 assessment, finishing with a much stronger five out of seven passing grades for the year, thanks in part to free cash flow improving at a narrowly better rate than net income. However, Monster's share-price growth has outpaced gains on the bottom line at much greater rate than it did last year, which could be a warning sign to investors that the stock's days of heady growth may be coming to an end. Can Monster rev its profit engines in 2014 and become a better stock than it is today? Let's dig deeper to find out.

Monster posted single-digit sales growth and fell short of Wall Street's expectations in the third quarter, a result blamed on negative sentiment and potential regulatory risks surrounding energy. Fool contributor Ted Cooper notes that Monster faces a lawsuit from the San Francisco city attorney, which is pushing Monster to cut down on the caffeine in its energy drinks, and also seeks to add warning labels to Monster's cans and clamp down on its marketing to teens. However, Monster CEO Rodney Sacks defended Monster's energy drinks containing the amino acid taurine, which is thought to be good for healthy hearts according to a research report presented at the Radiological Society of North America's annual meeting. In fact, Starbucks' regular coffee bears twice the amount of caffeine as most Monster Energy drinks, which knocks anti-energy-drink crusaders down a peg or two. Monster's growth story may turn in part on impending decisions by the Food and Drug Administration over caffeine-based energy drinks, but this seems unlikely to hurt the long-term growth of energy-drink manufacturers.

Distribution partner Coca-Cola Enterprises (NYSE: CCE) recently reported a whopping 25% jump in its Monster Beverage sales in Europe, which is pretty impressive in light of macroeconomic headwinds and dismal still beverage volumes for the overall industry. Coca-Cola (KO +0.72%) has proven critical to Monster's continued North American success, since it distributes Monster products in the U.S. and Canada. However, Ted Cooper notes that Coca-Cola takes major control in its distribution agreements, which puts Monster at a significant disadvantage. As a result, Monster has been working to strike out more on its own.

Monster has already aggressively expanded its geographical presence around the world, and it now plans to make a move into India. In an effort to boost margins, the company also has ambitious plans to build additional production plants in Southern Europe and South Africa, which will curb international freight and damage costs. Monster also plans to develop more extensive distribution networks in Japan and Brazil to reduce its reliance on international third-party distributors.

Putting the pieces together

Today, Monster Beverage has many of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.