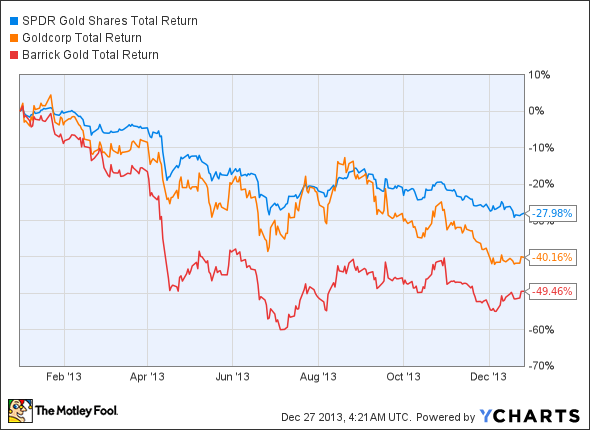

Gold bugs had a rough 2013 and with the Federal Reserve slowing its monthly bond-buying program from $85 to $75 billion monthly gold's favor has likely run out. The thesis that drove gold and the $34 billion SPDR Gold Shares (GLD 0.14%) popularity have run their course and the result is a fast abandonment of a supposed safe asset.

GLD Total Return Price data by YCharts

Here's why gold is down so far in 2013 and why I think 2014 will be another bad year for gold.

Rampant inflation never showed up

In the late 2000s, there were multiple reasons investors thought inflation would soon be out of control and gold was the best hedge against that inflation. The federal government was spending more than a trillion dollars each year that it didn't have, which of course would eventually lead to printing money to pay down debt. Worse yet, the Federal Reserve was pumping money into the economy to keep interest rates low and the more dollars there are floating through the economy the less each dollar is worth.

On the surface, both arguments make a lot of sense. The problem is that neither rings true forever and inflation that gold investors expected never actually showed up.

US Inflation Rate data by YCharts

In fact, the inflation rate is currently so low that the Federal Reserve has to be worried about deflation, which would be devastating to the economy.

The falling dollar never fell

All of this money printing should have also led to a sharp decline in the value of a dollar. Over the past decade, the U.S. Dollar Index is down, but it's only down 8.7%.

It's also being crushed by the Dow Jones Industrial Average's return. One of the reasons is that the dollar is considered a safe haven for investors, so its value is boosted in rough times. Again, this thesis for why gold is so valuable didn't play out.

The hedge against everything and nothing

Some people will tell you that gold is a great hedge against a bad economy, a falling dollar, inflation, government deficits, a falling stock market, or other investments. The truth is that gold isn't really a hedge against any of those things. Like a dollar, it only has as much value as the market puts on it.

When markets are panicking, there can be a high value on gold, but long-term it's not really a hedge at all because historically it hasn't moved in the opposite direction as inflation. It's just spiked during recessions and then settled into a long-term lull.

Miners will suffer in 2014

As the price of gold falls, the profit of gold miners will suffer. I showed above that shares of Goldcorp Inc. (GG +0.00%) and Barrick Gold Corporation (ABX +1.39%) have plummeted in 2013 and next year I expect more of the same.

Goldcorp had all-in sustaining costs of $992 per ounce last quarter and Barrick Gold has costs of $916 per ounce. Neither price leaves much room for error in 2014. Gold is now $1,216 per ounce, so a 20% decline next year would leave both companies with nearly no net income.

All gold miners will face the same challenge in 2014, and that's why I'd stay far away from their stocks.

Make money in the market long-term