If the economic crisis that began in 2007 was largely the story of financial and housing-related stocks leading the market lower, the rebound initiated in 2009 was propelled higher by stocks of the same stripe that survived the crash. This was as true for components of the Dow Jones Industrial Average (^DJI +0.38%) as it was for the broader market.

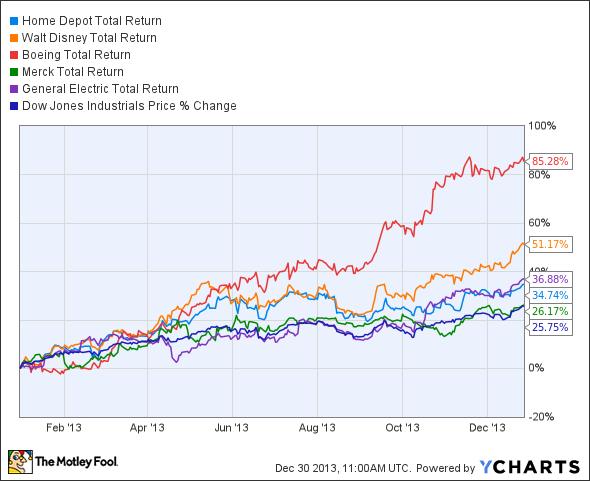

No nonfinancial Dow stock had a better post-crash performance than Home Depot (HD 2.81%), which has risen roughly 400% since the start of the rebound. However, 2013 saw this highflying, housing-focused mega-retailer's growth moderate somewhat as a number of nonfinancial components have outpaced Home Depot in year-to-date gains:

HD Total Return Price data by YCharts.

A 35% year-to-date growth rate is nothing to sneeze at, but it's hardly the supersized gains Home Depot investors have gotten used to since 2009. What kept Home Depot from trouncing the pack again this year? It could be weakening expectations, a weakening performance, or just a leveling-off of investor interest thanks to a variety of housing-related factors. Let's examine Home Depot's recent results to see whether that could be the cause of its relative slowdown this year.

|

Metric |

Trailing 12-Month* Result |

2012 Result |

Change |

|---|---|---|---|

|

Revenue |

$79.6 billion |

$74.8 billion |

6.4% |

|

Net income |

$5.4 billion |

$4.5 billion |

20% |

|

Earnings per share |

$3 |

$3.70 |

23.3% |

|

Free cash flow |

$6.2 billion |

$5.7 billion |

8.8% |

|

Dividends paid |

$2.1 billion |

$1.7 billion |

23.5% |

Source: Morningstar. *Includes fourth quarter of 2012, which was reported in early 2013.

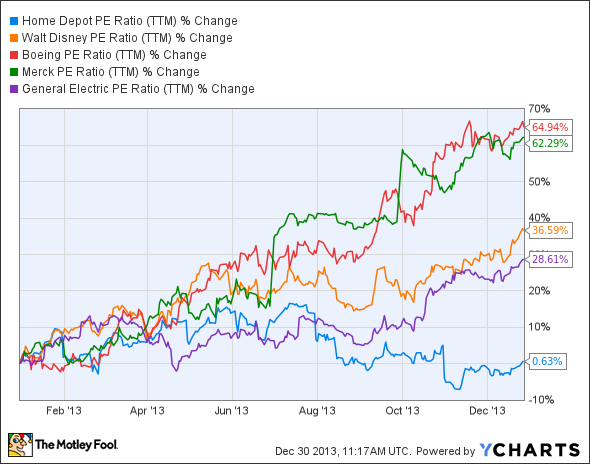

In a year marked by valuation growth across the market, Home Depot has done much to earn its gains -- a 23% improvement in earnings per share nearly lines up with the company's share price growth. In fact, Home Depot's P/E hasn't grown at all this year, which is more than you can say for any of its Dow-component peers from the original chart:

HD P/E Ratio (TTM) data by YCharts.

In our look ahead to Home Depot's 2014 potential, we've already seen that the company expects to continue posting double-digit earnings growth. In fact, its stated 17% EPS growth guidance is better than that expected of its Dow component peers on this chart: Analysts expect a 14% growth rate for Disney, a 12% growth rate for Boeing, a decrease of 1% in Merck's (MRK +0.40%) earnings, and a 4% growth rate for General Electric (GE +1.83%). Home Depot's actual P/E ratio, which sits at 22 as of this writing, is nearer the low end of this pack (GE's P/E is the lowest at 21) than the high end (Merck's is more than 33), which offers a bit of wiggle room in this valuation-driven market expansion. So what gives?

Home Depot certainly hasn't disappointed Wall Street this year -- it has beaten estimates in each of its past four quarters, and its most recent report also showed an impressive 7.4% rise in same-store sales, which is an envious figure for any retailer even close to Home Depot's size. As Fool contributor Joseph Solitro notes, Home Depot also had better revenue growth and net margin growth than peer Lowe's (LOW 2.94%) in the third quarter. To top things off, good news continues to flow from the housing sector despite fears of a 2014 taper. Housing starts absolutely soared in November, showing one of the fastest monthly rates seen in years:

US Housing Starts data by YCharts.

Home Depot isn't being held back by its fundamentals, it's not losing steam in its forward guidance, and the housing sector doesn't appear to be on the verge of a retrenchment. Long-term investors can probably conclude that the only reason Home Depot didn't have a better year was that major money simply wasn't as enthusiastic about the specialty retailer as it once was. That's an envious problem to have, and it's not likely to last over the long haul, as Home Depot has given investors no reason to doubt it, either in this year or the next.