Drugstores can be an interesting sector for investors looking to position their portfolios in defensive companies supported by strong secular tailwinds due to rising health-care demand in the long term. With their owns weaknesses and strengths, companies like CVS (CVS 0.37%), Walgreen (WAG +0.00%), and Rite Aid (RAD +0.00%) have plenty to offer investors.

CVS is the quality play

CVS benefits from a high-quality, integrated business model. The company is not only one of the largest U.S. pharmacy retailers, but also a leading pharmacy benefit manager, or PBM. This vertical integration provides diversification and multiple growth venues for the company, and it also produces negotiation and scale advantages for CVS versus smaller players in the industry.

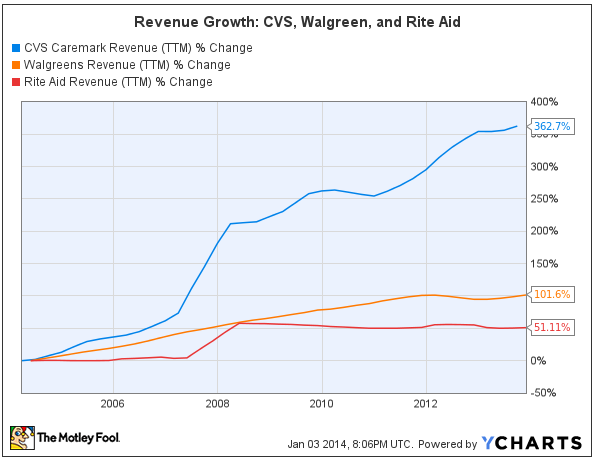

CVS has outgrown competitors like Walgreen and Rite Aid by a wide margin over the last 10 years, and the company has superior profit margins in the area of 6.4% at the operating level versus operating margins near 5.1% for Walgreen, and 3.9% for Rite Aid.

Source: YCharts

The company seems to be entering 2014 with strong financial momentum; on Dec. 18, management reaffirmed guidance for an increase of between 10.25% and 13.75% in earnings per share during the coming year. In addition to this, CVS rewarded investors with a big increase of 22% in dividends per share.

Executive Vice President and Chief Financial Officer Dave Denton sounded quite optimistic in the press release:

CVS Caremark has a strong track record of meeting or exceeding our financial targets. The outlook for 2014 is bright, and we are focused on strategies that will lead to solid, long-term enterprise growth.

Healthy dividends from Walgreen

Dividends may be one of the biggest advantages Walgreen has over the other companies in the industry. The company has a rock-solid track record of dividend increases, as it has paid a dividend in 324 straight quarters -- more than 80 years -- and has raised its dividend for 38 consecutive years, including a 14.5% dividend hike for 2013. During the last five years, the company has increased dividends from $0.45 per share to $1.26 per share, resulting in a compound annual growth rate of nearly 23%.

The three companies trade at similar valuation ratios when looking at forward P/E levels: Walgreen has a forward P/E of 14.5 versus 15.7 for CVS, and 14.9 for Rite Aid. When it comes to dividend yield, on the other hand, Walgreen is clearly the most attractive one in the group with a yield of 2.2% in comparison to 1.2% for CVS, and no dividends for Rite Aid.

Walgreen reported better-than-expected earnings on Dec. 20; adjusted earnings per diluted share jumped by a remarkable 24.1% year over year to $0.72 per share on the back of a 2.4% annual increase in front-end comparable-store sales, and a rise of 5.9% in total revenue during the quarter.

President and CEO Greg Wasson has a moderately positive vision about the company´s financial performance during the quarter: "Given the continued soft economy, we were generally satisfied with our top-line growth where we increased both traffic and sales for the quarter as well as our pharmacy market share."

Small size and big potential with Rite Aid

With a market cap below $4.5 billion versus $53.5 billion for Walgreen, and nearly $85 billion for CVS, Rite Aid is by far the smallest company in the group. This has some disadvantages in terms of scale and financial resources, but it also means higher growth potential for Rite Aid when compared to bigger industry players.

The company is implementing a remarkable turnaround during recent quarters by closing unprofitable locations, focusing on cost control, and introducing more generic drugs to boost sales and increase profitability. This is an added source of uncertainty and volatility for investors in Rite Aid, but it also provides further upside potential if management continues leading the company in the right direction.

The stock crashed by more than 10% when Rite Aid reported earnings on Dec. 19 -- many investors seem to have felt disappointed by management´s conservative guidance. However, Rite Aid recovered a considerable portion of that decline, jumping by more than 8.5% on Friday as the company announced a healthy increase of 2.9% in same-store sales during December.

All in all, even if a turnaround is always a risky situation, the company seems to be on the right track in terms of sales and financial performance during the last several quarters.

Bottom line

CVS offers superior quality and has shown better financial performance during the last few years, while Walgreen is the dividend play in the sector due to its higher yield and rock-solid track record of dividend growth. For those with a higher risk tolerance and looking for more upside potential, Rite Aid may be the way to go. Whatever the doctor orders, these drugstores can deliver.