Whatever your view is on Obamacare, its aim seems to be working if Sen. Harry Reid's figures are anything to go by. The Nevada Democrat recently said that around 9 million Americans now have health care when they didn't have it before, so one of the major considerations is likely to be keeping costs down for all involved.

Of course, drugs aren't cheap to research. They take a long time to gain approval, and there are inevitably a significant number of failures for each blockbuster drug produced by the likes of GlaxoSmithKline (GSK 0.61%) and Bristol-Myers Squibb (BMY 1.41%).

They focus their efforts on the research of new drugs, and their business models are very much geared toward finding the next "wonder drug" that will mean sky-high margins for a limited period.

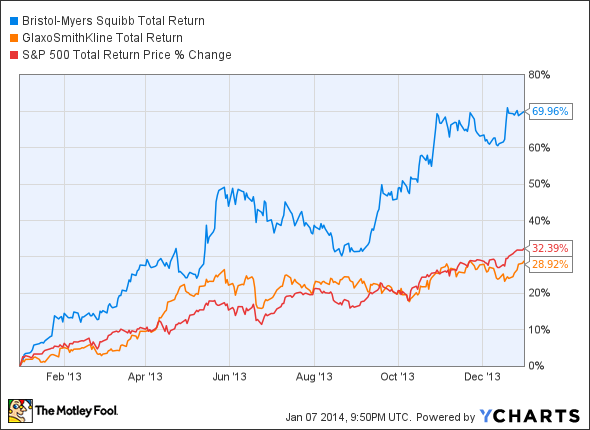

Furthermore, they both seem to be doing well out of it, with GlaxoSmithKline pulling back from the consumer goods companies it owns to focus on research and development. Meanwhile, Bristol-Myers Squibb has sold its part in the diabetes alliance with AstraZeneca to focus on other parts of the business. While GlaxoSmithKline lagged behind the broader market in 2013, its unique innovation platform and robust pipeline bodes well for the future. Bristol-Myers Squibb, on the other hand, had a stellar year, posting massive returns.

BMY Total Return Price data by YCharts

Where does Obamacare fit in?

While the Affordable Care Act, also known as Obamacare, is obviously keen to see new drugs come along to help those in need, as I mentioned, a major consideration is likely to be keeping costs down.

Here's where Hospira (NYSE: HSP) comes in.

It focuses on high-quality, low cost generic medicines and can best be thought of as the company that carries the baton after patents have expired and the likes of Bristol-Myers Squibb and GlaxoSmithKline have moved on.

Therefore, while it's already the world's leading provider of injectable drugs and infusion technologies, demand for its products could increase significantly under Obamacare and any further health-care developments in the United States.

Allied to this demand is a balance sheet that's in good shape. For instance, Hospira's debt as a proportion of equity is just 57%. Furthermore, Hospira doesn't trade on too much of a premium versus the wider index when the potential for increased future demand is taken into account. For instance, its price-to-earnings ratio is 19.9 (trailing 12 months), which is only 6% higher than the S&P's P/E of 18.8.

Certainly, the potential for one-off, positive surprises is less than for the likes of GlaxoSmithKline or Bristol-Myers Squibb, and as such, many investors may not see Hospira as exciting enough.

However, with Obamacare covering 9 million Americans who previously didn't receive health care treatment and the potential for the U.S. health-care system to become more comprehensive and inclusive in future, a focus on costs could benefit companies such as Hospira.