Since its modest beginning as a single pharmacy in 1888, Abbott Laboratories (ABT 1.10%) has been a health care innovator. Recently, the company has been the subject of analyst upgrades, and purchases by top-performing funds. Now that the dust has settled from the AbbVie spinoff, it's much easier to get a clear picture of the company's growth opportunities. Here are some factors to look out for in the months and years ahead.

A correctable mistake

Skittish investors often exhibit a knee jerk reaction to product recall news. Following the voluntary supplier recall of pediatric nutrition products last August, Abbott shares traded near their lowest levels in months. This was a voluntary recall without any associated health issues, that will probably lead to a year long reduction in topline revenue of 1%-2%. With a company as well diversified and financially sturdy as Abbott, this is exactly the sort of opportunity that smart long-term investors sink their teeth into.

The hit taken by Abbott's International Nutrition segment is likely to reverse before the end of the year. CEO Miles White, claims the voluntary recall of pediatric nutritional products in China that began in August 2013 reduced total company sales by about 1.7% for that quarter. During the first nine months of 2013, International Pediatric Nutritionals grew 14% despite the disruption, making it the company's fastest growing segment. It is likely to continue driving growth, especially once the disruption is mended.

Outside of pediatric nutrition, emerging market sales in general have been a strong source of growth, and the trend should continue. During Q3 2013, they rose more than 8% on year, but that figure might have reached 12% without the recall disruption.

Keeping the pipes open

Drug-eluting stents are a basically a scaffolding that slides into a narrowed or diseased blood vessel. They're most often inserted into coronary arteries to keep the blood supply to the heart from shutting off. While in place they slowly release drugs that continue to prevent the artery from becoming blocked.

A fiercely competitive space

While Abbott has perhaps the best selling drug-eluting stent on the market, competition and increasingly austere payers make this a difficult segment to manage. Before Abbot entered the space, Johnson & Johnson (JNJ +0.76%) had the best selling drug-eluting stents on the market. In 2009, its Cypher raked in more than $900 million in sales. Less than two years later the company announced it would exit the stent business altogether. This was due in no small part to the rapid success of Abbott's Xience stent. Although the Johnson & Johnson's medical device division continues to operate in cardiovascular care, it is still out of the stent business.

Another contender

Drug-eluting stents are a big part of Boston Scientific's (BSX +1.34%) turnaround story. Its annoyingly named Promus Premier Everolimus-Eluting Platinum Chromium Coronary Stent System has all the bells and whistles. Results of the PLATINUM clinical trial show that the device is likely to give Abbott's Xience a serious challenge.

Boston Scientific's device won FDA approval in November 2013, and a CE mark in February 2013. The company's international drug-eluting stent sales for the three months ending September 30, 2013 actually fell 2.5%. Device launches in the EU are notoriously slow compared to the U.S. market. It may be another two or three quarters before we can assess the impact of this next-generation stent on Abbott's market dominance.

Winning hearts and legs

In August 2013, Abbott completed its acquisition of IDEV Technologies. This added the SUPERA stent to its portfolio. Unlike most stents, this device treats blockages of the superficial femoral artery. Lower-extremity peripheral artery disease affects about 8 million Americans, and the device is currently under FDA review.

Expensive on the surface

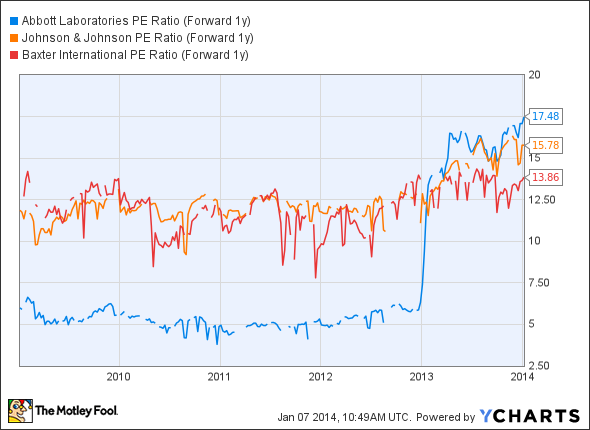

Like Baxter International and Johnson & Johnson, Abbott Labs operates largely in the pharmaceutical, and medical device industries. Compared to its peers, Abbott isn't looking terribly cheap at the moment. Its one year forward P/E Ratio of about 17.5 is at unprecedented levels, and currently higher than its peers. However, applying a DCF model the company does appear undervalued.

ABT P/E Ratio (Forward 1y) data by YCharts

Giving it back

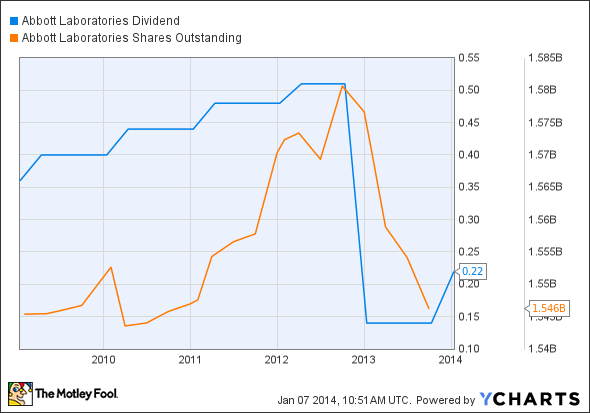

Recent Abbott investors will be happy to see the return of respectable quarterly distributions. Leading up to the spinoff of AbbVie, the company slashed its quarterly dividend from $0.51 to $0.14 per share. The distribution is now at $0.22 per share and should continue growing at a steady pace. Prior to the spinoff, Abbot consistently increased its dividend for 41 years.

ABT Dividend data by YCharts

Since the spinoff Abbott has reduced its number of shares outstanding by about 1.7%. Investors will be receiving an even bigger slice of the company's earnings going forward. Its board approved repurchases of $3 billion in June. At the end of Q3 2013, about $2.65 billion remained. That's roughly 4.3% of outstanding shares at recent prices.

Just getting started

Overall, it seems Abbott investors have plenty of reasons to expect another 125 years of good times from this industry stalwart. Emerging markets are providing opportunities for growth, while its entrenched positions in the U.S. remain steady. The stent segment is likely to endure a great deal of pressure from competition and the Obamacare rollout, but it is a relatively small part of this diverse company's total operations. Although it is too late to take advantage of the recall overreaction, I would definitely stay on the lookout for a similar opportunity in the near future.