Last year was certainly a forgettable one for investors in Intuitive Surgical (ISRG 1.15%), the manufacturer of the daVinci Robotic Surgical System, seen below.

Source: Intuitive Surgical.

Things got off to a rough start when a report in the Journal of the American Medical Association questioned the effectiveness and cost of using the daVinci for hysterectomies -- one of the most popular operations for which the robot is used. The president of the American Congress of Obstetricians and Gynecologists later echoed those concerns.

Those problems snowballed later in the year when the company reported that sales of new systems within the United States had shrunk for the first time in years. There were lots of theories as to why this occurred, but the most popular was that uncertainty surrounding the Affordable Care Act was holding hospitals back from making major purchases.

But last Friday, shares of the company traded up by as much as 10%. Could things finally be turning around for Intuitive or is this just a short-lived jump?

Finally, some positive news

The primary driver behind last Friday's jump was a report that appeared in the Journal of Endourology. The study found that "robotic-assisted radical prostatectomy (removal of the prostate and surrounding tissue) results in a shorter average hospital stay and lower overall complication rate compared to open surgery."

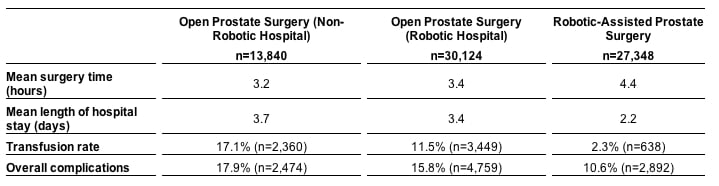

As you can see below, the robotic-assisted surgeries -- on the far right -- might have taken longer to complete, but they resulted in a 40% shorter hospital stay and far fewer instances of transfusions and overall complications.

Source: Intuitive Surgical.

Though this doesn't necessarily solve the issues seen with hysterectomies, this is an important report, as prostatectomies accounted for 17% of all procedures performed in 2012 for the company.

So is it a buy now?

Investors interested in purchasing shares of Intuitive need to keep their eyes on two things. The first is the ongoing debate within the medical community as to the efficacy of using daVinci in procedures, and if there's a real and sustainable advantage to using the robot. The second is the company's ability to tailor the daVinci to doctors' desires so that it can be used in evermore procedures. Hysterectomies and prostatectomies account for the vast majority of procedures now, but surgeons continue to test the robot in several other areas of surgery.

In addition, just this morning, an analyst at Northland Securities came out with a note saying that the daVinci was no longer "popular with hospitals", and that Intuitive was offering discounts of up to 50% to hospitals to buy the daVinci system.

While the company does get more than half of its revenues from recurring sources (parts for procedures), offering such steep discounts on the systems themselves would surely have an effect on profitability. As it stands now, I'm not buying or selling shares, and am comfortable with sitting on them and waiting to see how things play out.