Today, Wells Fargo (WFC 1.23%) reported earnings of $1.00 per share in the fourth quarter, an increase of roughly 10% over the $0.91 per share in the fourth quarter of 2012 and a 1% growth relative to the $0.99 reported in the third quarter of 2013. For the 2013 fiscal year its saw its earnings per share jump 16% to $3.89 relative to the $3.36 posted in 2012. This all came despite its revenue dipping slightly from $86.1 billion to $83.8 billion.

“Wells Fargo had another outstanding year in 2013, including strong growth in loans and deposits, and double-digit growth in earnings,” said Chairman and CEO John Stumpf. “In the five years since our merger with Wachovia, we have grown our businesses, invested in our franchise’s future and contributed to the U.S. economy’s recovery.”

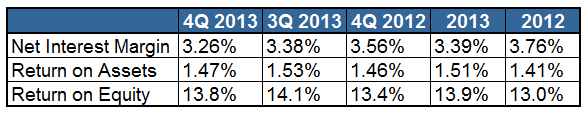

Wells Fargo did see its profit margins dip slightly in the fourth quarter relative to the third thanks to a more challenging rate environment as shown in the chart below. However, the results were favorable when comparing the full year and also the fourth quarter of 2013 relative to the fourth quarter of 2012:

Source: Company earnings report.

"The fourth quarter of 2013 was very strong for Wells Fargo, with record earnings, solid growth in loans, deposits and capital, and strong credit quality," added Chief Financial Officer Tim Sloan in the company press release. "We also grew both net interest income and noninterest income during the quarter, despite a challenging rate environment and the expected decline in mortgage originations."

The San Francisco-based bank, which is the fourth-largest U.S. bank by assets, controls about a third of the U.S. mortgage market. Much of its lending business has been coming from mortgage refinancing, which was reduced by the spike in interest rates.

Wells Fargo funded $50 billion worth of mortgages in the fourth quarter, down from $125 billion a year earlier.

In total, Wells Fargo’s net income was up to $5.61 billion in the fourth quarter, an increase of $520 million relative to the fourth quarter of 2012, and $32 million ahead of the third quarter. For the full year, income was up nearly 16% to $21.9 billion compared to the $18.9 billion seen in 2012.

All three of Wells Fargo’s principal business lines -- community banking, wholesale banking, as well as wealth, brokerage, and retirement saw their net income rise for both the full year and when comparing the fourth quarter of 2013 to the same period in 2012.

However, community banking saw its income dip slightly relative to the third quarter while the wholesale banking and wealth, brokerage, and retirement lines saw income rise. Community banking income fell 4% quarter over quarter thanks to a provision for credit loss increase of $250 million.

Stumpf concluded his remarks by noting, “Strong earnings power and capital levels, and an improving economic outlook are major reasons why we look ahead to 2014 with optimism.”

-- Material from The Associated Press was used in this report.