The water sector has long been favored by long-term investors who like thematic trends. The critical necessity of water in industrial and commercial applications, and the need for potable water supply for a growing global population means that the sector has strong long-term prospects. However, while the trend maybe upward, the water industry is notably exposed to demand from new housing and commercial construction project, and that hasn't been a great place to be in recent years in the West. However, with these end-markets looking set to pick up in 2014, companies like water products manufacturers Pentair (PNR +0.11%) and Watts Water (WTS +0.43%) look well placed.

Watts Water and Pentair look set for growth

Foolish readers know why commercial construction is a good sector to be in next year. Simply put, the commercial construction sector tends to follow the residential sector, and with the housing market in good shape going into 2014, investors in the commercial construction sector should be feeling optimistic about the coming year.

Indeed, a quick look at what analysts have penciled in for Watts and Pentair reveals a positive consensus for the next few years.

| Forecast EPS Growth Rates | 2013 | 2014 | 2015 | 2016 | 2012-2016 CAGR |

| Watts Water Technologies | 4.5% | 25.4% | 21.0% | 13.3% | 15.8% |

| Pentair | 33.8% | 23.8% | 22.5% | 9.5% | 22.1% |

Source: Nasdaq.com

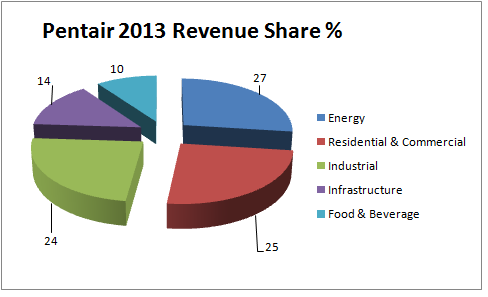

Pentair is attractive in its own right, but its forecast revenue mix for 2013 demonstrates that residential and commercial activity only represents 25% of its end market.

Source: Company presentations

Pentair's diversified exposure is fine if you want an industrial play, but for those investors looking specifically for a residential and commercial play then Watts Water is better placed. Pentair's diversification would normally be seen as a major plus point, but not if you want to focus on commercial construction.

Watts transforms itself

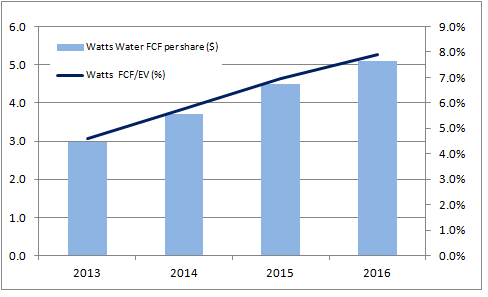

Watts stands out for its cash flow generation. For example, Watts has converted around 150% of net income into free-cash flow, or FCF, over the last three years.

Assuming that Watts converts 130% of net income into FCF in future, and using these rates and analysts' earnings-per-share forecasts from the table above, can give an idea of FCF per share. For the sake of simplicity, assume that EV is equivalent to current values.

Source: Nasdaq.com, author's estimates

Watts Water looks like a good value. The impressive thing about Watts is that although its trailing-12-month revenue of $1,452 million is marginally above its 2008 level of $1,432 million, the company has increased gross margins from 33.7% to 36.1% over the period. In other words, should revenues start to increase in the future, Watts has a good opportunity to generate higher profits thanks to better margins. Moreover Watts generates 50% of its revenue from commercial operations, so it's heavily exposed to a pick up in commercial construction.

On a more negative note, Watts generated only 52% of its sales from the U.S. in 2012 with 40% coming from Europe, the Middle East and Africa, or EMEA. In fact, its guidance for 2013 assumes that EMEA will decline by 4%-5% with North American core business sales estimated to grow 3%-5%. While Europe is likely to remain soft, Watts will come up against some easier comparisons in 2014. In addition, in its latest investor presentation, management outlined that "overall market confidence appears to be improving" in EMEA, while is North American commercial market is "starting to see signs of a pick-up". Both statements are good signs.

The bottom line

If you are looking for an overall industrial play then Pentair is worth a closer look, but for a developed market play on a resumption in residential and commercial construction spending then Watts is better placed. The company has internally transformed itself over the last few years in order to improve cash flow generation and its return on invested capital. As long as the U.S. housing market remains in recovery mode, it's a good bet that commercial construction will follow, and Watts is well placed to outperform.