With the American economic recovery well under way, there are three crucial ways to save money on your mortgage when shopping around for a new home.

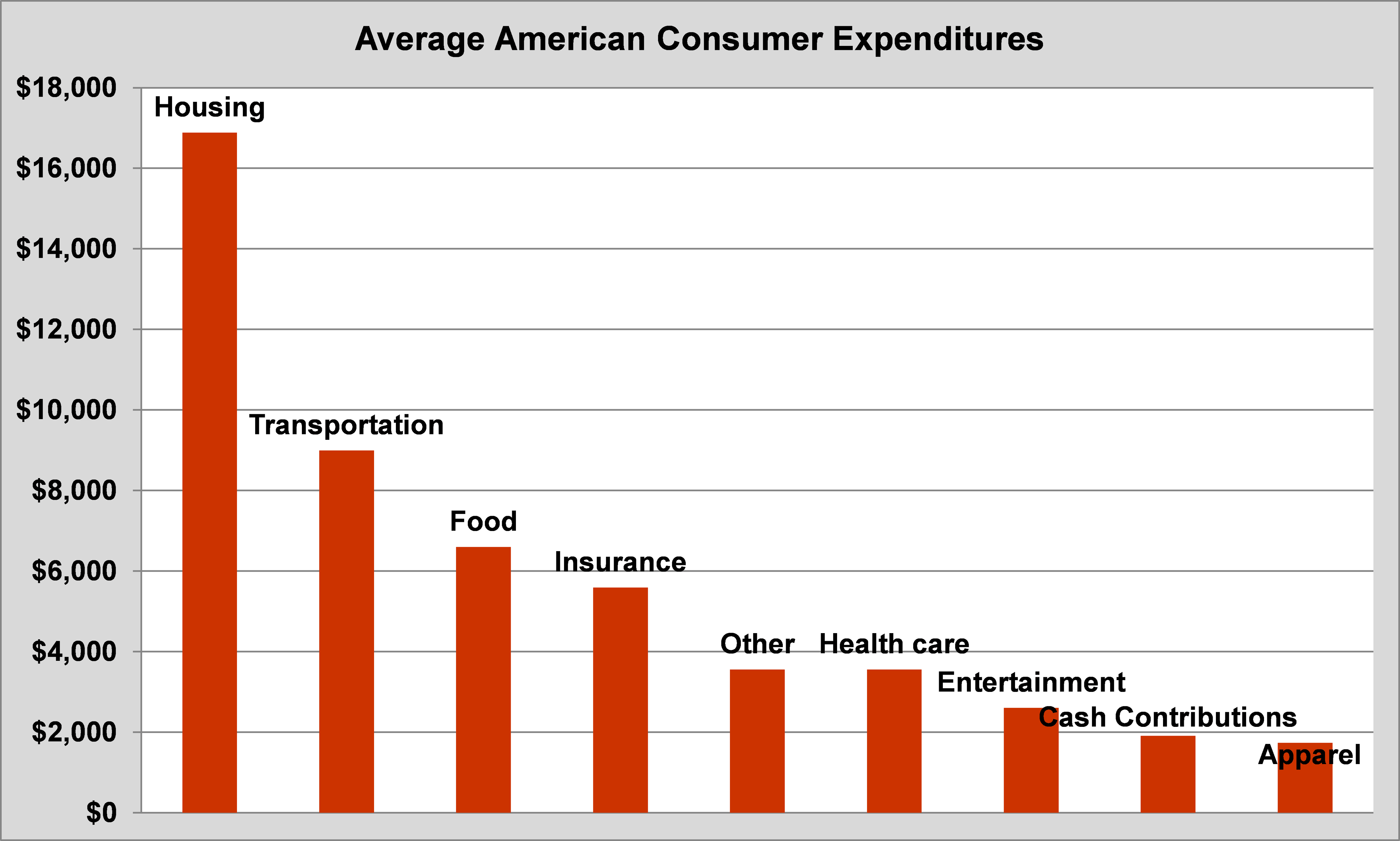

A home is often the biggest single purchase that many Americans make, and housing is the single biggest expense faced by almost every person in the U.S. Consider that according to the Bureau of Labor Statistics, the average American spent nearly $17,000 a year on housing in 2012. That was more than food and transportation expenses -- the second and third highest spending categories -- combined:

Source: Bureau of Labor Statistics.

While mortgage rates are still well below their historical averages, there are still plenty of ways to save when looking for a mortgage on a new home.

1. Understand what you can afford

Before even beginning the process of securing a mortgage, take a moment to really sit down and consider what you can afford. Freddie Mac notes when it comes to homes, a rough estimate would be a simply multiplying your gross income by 2.5. A husband and wife who make a combined $60,000 a year would then look for something around $150,000.

Source: StockMonkeys.com.

In addition, lenders also expect that a person's housing expense ratio -- the total mortgage payment dividend by a borrower's monthly gross income -- is no higher than 28%.

Also know that if a down payment of less than 20% is made, lenders will charge private mortgage insurance (PMI), which is a monthly fee in addition to the mortgage payment itself. While this may only last a few years, it's still a major expense that should be avoided if possible.

Finally, do yourself a favor and check your credit history, which according to the Consumer Financial Protection Bureau can be done once a year for free. The lower the score, the higher the interest rate on the mortgage, so by improving your score or correcting any possible errors, you could save thousands.

Know how much you can afford, then use that as a baseline for shopping around.

Source: 401(K) 2013 on Flickr.

2. Shop around

All too often, individuals walk into their local bank and ask for a mortgage without ever seeing what other options are out there.

Many people are comfortable trying to find the cheapest groceries in town, but finding the best deal on a mortgage can have monumental impacts. Consider a mortgage rate of 4.315% versus 4.415% on a $200,000 home with 20% down. While the difference in rates doesn't look that dramatic, that 0.1% makes a $4,000 difference over the life of the 30-year mortgage.

Of course, the total cost of a mortgage encompasses more than just the rate -- so seeing what possible points, fees, and possible cost of PMI is critical. Over a 30-year mortgage, each $10 savings on the monthly payment will represent $3,600 back in your pocket.

However, also remember that if the cost of that savings comes at the expense of upfront fees, it may not be worthwhile in the long run. Saving $3,600 over the life of the loan at a cost of $2,000 in fees upfront isn't worthwhile because of the time value of money.

Source: Images_of_Money on Filckr.

3. Don't be afraid to negotiate

After narrowing down your choices to a few specific lenders and the rates they have quoted you, try negotiation to see if you can get even better pricing. Ask for fees to be waved, rates to be lowered, and ensure all of it is done in writing. After that's complete, request a lock-in, which ensures that the agreed-upon terms are maintained throughout a certain period of time during loan processing and closing.

Mortgages are one of the biggest costs facing many Americans, so ensuring your payment is as low as possible from the outset is a crucial way to journey down the path of savings.