Is Facebook (FB +10.30%) a disease -- and is a worldwide flight the inevitable cure?

A study released last week by Princeton Mechanical and Aerospace Engineering department researchers John Cannarella and Joshua D. Spechler makes that argument, by drawing on the mathematically designed epidemiological models used to predict and track the outbreak of infectious diseases. When you think about it, the comparison certainly seems apt. What are social networks if not a basic form of online virality? Facebook's network effect grows stronger as it "infects" more people around the world. Using these models, Cannarella and Spechler make an extraordinary claim: nearly 1 billion Facebook users -- 80% of the site's current user base -- could be cured of their current social media plague by the end of 2017.

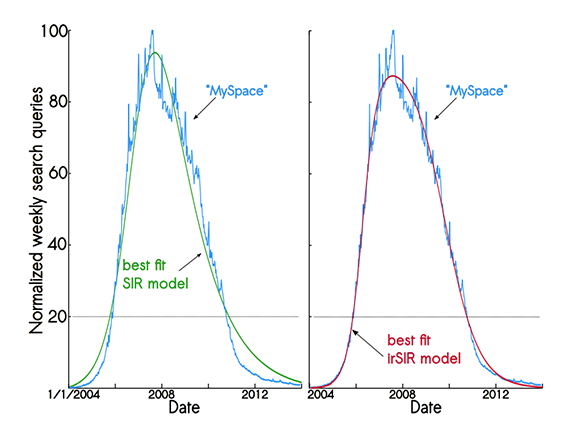

There is evidence that this might happen. All we have to do is look back at the death of MySpace, which the study uses as its primary historical example. When examining search queries made for "MySpace," the researchers found a rather tight fit between the standard SIR (Susceptible, Infected, Recovered) epidemiological model, and a modified SIR model using infectious recovery dynamics that require recovered people to help "cure" infected social media users:

Source: Cannarella and Spechler, "Epidemiological modeling of online social network dynamics".

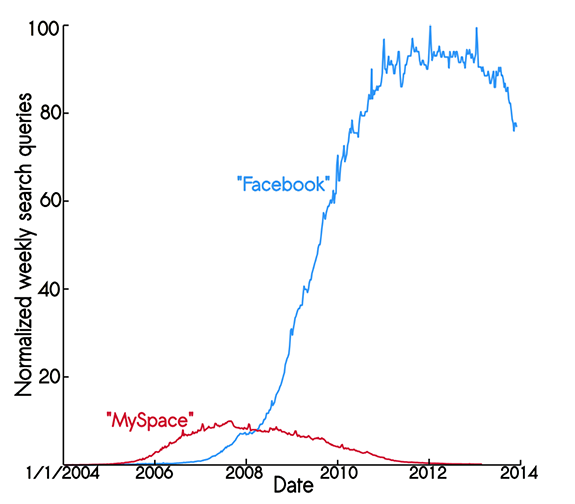

What does that mean for Facebook? Well, the results are already starting to show a downward slope on the way to global recovery:

Source: Cannarella and Spechler, "Epidemiological modeling of online social network dynamics".

There are a few caveats to point out, however. First, the study has not been peer-reviewed, so other researchers (ideally those whose work focuses on social media dynamics) have not had a chance to put its claims to the test. It's also worth noting that, while the decline in MySpace's search interest actually matches up fairly closely to the erosion of its visitor numbers, Facebook's search interest peaked well before its user base -- the first mid-2010 top occurred at roughly 500 million users, which is less than half the reported 1.26 billion users found last fall, at a point when search interest was purportedly in rapid decline.

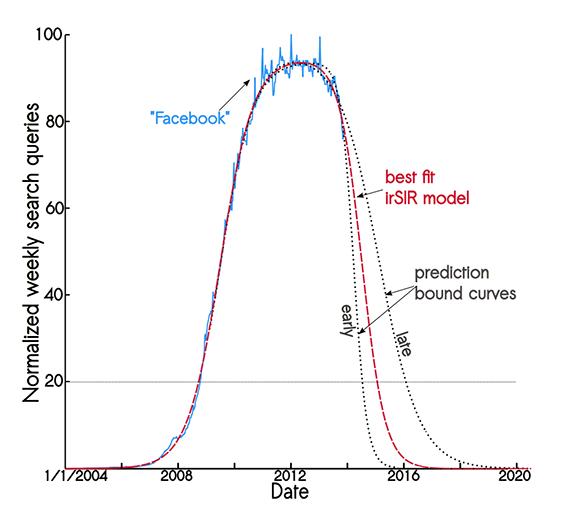

Despite this easily found evidence to the contrary, Cannarella and Spechler extend the downward slope of Facebook's search-interest curve to determine just when this supposedly doomed social network will lose a billion of its 1.26 billion (and counting) users:

Source: Cannarella and Spechler, "Epidemiological modeling of online social network dynamics".

After a certain point, it no longer seems relevant to use search interest as Facebook's primary interest gauge -- the site is one of the world's most popular smartphone apps, and its name is now virtually synonymous with "social media." Most of the people who would have searched for "Facebook" are probably already on it by now, so why do they need to do anything other than click a bookmark, or tap on the app's logo on their phone?

What seems more likely, at least to me, is that Facebook simply runs up against the natural limits of the global Internet user base. Shortly after it went public, I estimated that the company would reach roughly 1.21 billion users in 2013 assuming a steady 20% growth rate. By the end of this year, those same estimates would see the site grow to a user base of roughly 1.45 billion people. Facebook could reach that number, but it seems just as likely that growth will gradually slow now that over half of the world's non-Chinese online population is already on Facebook.

MySpace's demise didn't come because it fit neatly to an infectious-disease recovery curve. It died off because Facebook killed it. We're still waiting for the Facebook-killer. Cannarella and Spechler admit that it's possible to foresee "a solution in which Facebook continues indefinitely at a constant size... determined mainly by deviation from the post-2012 data." It's still possible that Facebook will reach an upper limit and then drop down into the recovery phase of the curve, but we won't know for sure until we see its user numbers decline, not its search interest.