Recently, America's largest automaker, General Motors (GM +1.35%), shook up some analysts when it announced that it would no longer be hosting its monthly conference call to discuss sales and trends with the automotive media. This comes after its earlier decision to stop publishing monthly production numbers. Both moves are controversial with the media because essentially the company is becoming less transparent. Many believe it's a bad move, but I applaud GM and Foolish investors should as well. Here's why.

Buy and hold, forever

Here at The Motley Fool, we strive to help the world invest better. We preach about buying and holding good businesses forever. Note that I said businesses, not stocks. While the majority of Wall Street analysts focus only on the short-term, quarterly performance of their stocks, the best returns for investors are often found by holding superior businesses with competitive advantages and innovative products for the long haul. With that said, the following quote is music to Fools' ears: "We are ending the call to concentrate on conferences and other forums that allow us to discuss our strategy and our result with a long-term view and in a very holistic way," GM spokesperson Jim Cain said on the final sales call, according to Automotive News.

What's the big deal?

The move will end a 20-year tradition at General Motors of holding these monthly sales calls. Sure, it won't give GM its typical time to spin certain results in a positive light, but who are we kidding? We know these calls are mostly marketing spin moves and most details should be taken with a grain of salt. More importantly, General Motors will still be handing out the sales information -- it'll just be up to the media to do its due diligence and get the facts straight.

GM's Chevy Impala. Source: General Motors.

That's fine by me. I'll gladly dig up my own inventory or incentive figures and come to my own conclusions. And you, GM, you keep on worrying about growth in China. Focus on your long-term strategy with new CEO Mary Barra, and how you're going to successfully replace, redesign, or refresh 90% of the industry's oldest vehicle portfolio by the end of 2016. You have plenty to do without another monthly conference call.

Moreover, General Motors will still be participating in roughly six or seven major industry conferences, where analysts are invited to discuss its global trends and long-term strategies -- that's in addition to the company's highly detailed quarterly conference calls.

Carpe diem

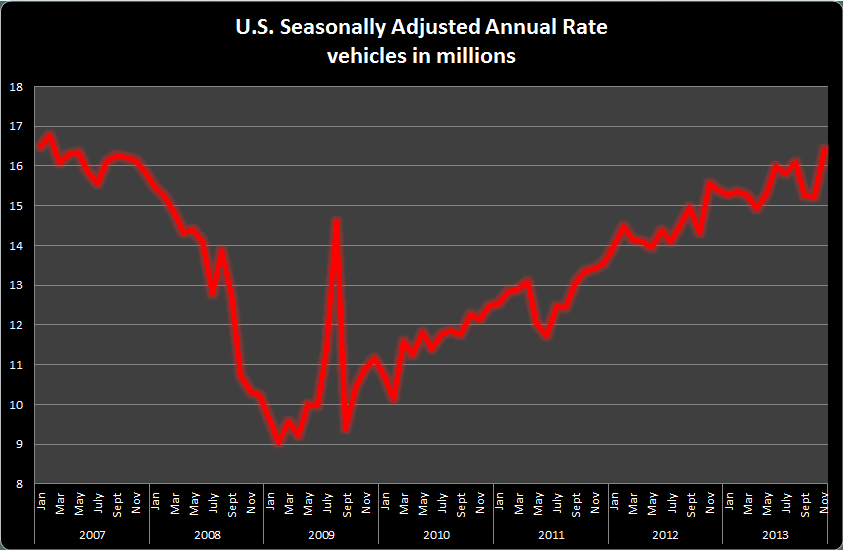

Investors who follow the automotive industry know how important the rebound in automotive sales has been over the last few years.

The industry's SAAR continues its steady growth. Source: Automotive News DataCenter.

For the first time in decades American automakers are mounting a comeback in terms of market share and vehicle quality. This is the time for Ford, General Motors, Chrysler, and even Tesla, to take advantage of pent-up demand and a surging sales rate.

Mark Fields, Ford's COO, called it "the most exciting time for the auto industry in the last 25 years."

He's right. The decisions made during the rest of this decade will change the automotive industry and its dominant players as we know it. While many analysts are scratching their heads at General Motors' decision to end monthly sales calls, we at the Fool understand this approach, and I applaud the recent decision to focus on long-term strategies rather than short-term results.