(image courtesy Green MPs, via Flickr)

Solar power is increasingly becoming a force in America. As consumers learn about the environmental benefits, cost savings, and innovative technology of using solar power, Solar firms have gained traction and profits. While utilities have been slow to adopt solar energy (surprise-surprise), residential solar adoption has soared. As more Americans install photovoltaic (PV) solar panels, continue to look for SunPower Corporation, SolarCity, and SunEdison to shine in 2014.

The Sun is power

SunPower Corporation (SPWR +0.00%) has been rated as a strong buy from Zacks Investment Research and has been tagged as overweight by JPMorgan Chase. These new stock ratings for SunPower are a harbinger of a profitable 2014 for the firm. the stock grew over 336% last year. While the stock did dip slightly in the fourth quarter of 2013 (and again this past week), rising power rates, public understanding of solar technology and increasing solar panel installations bode well for SunPower in 2014.

SunPower has been aggressively building its business by expanding it's products and services. It has quietly become the "general store" for customers wanting to harness the sun to slash or outright remove electricity bills. SunPower's approach is in stark contrast to its rival, First Solar (FSLR +1.46%). While First Solar concentrates on utility and large-scale power plants, SunPower has staked its claim in the residential and commercial space. SunPower's residential solar leasing product offering is becoming popular with consumers in the U.S market. These PV installations have been a boon for both SunPower and its customers because of the generous tax incentives in place for promoting sustainable green technology by the U.S. government. SunPower also makes money from these installation by charging customers a low monthly payment.

A growing customer base

The firm currently has 20,000 active leases. SunPower's lease numbers are growing fast and are certainly impressive, but they are well behind SolarCity (SCTY +0.00%). SolarCity is the largest residential solar installer in America. It commands 32% of the U.S. market—and growing. The surge in solar installation in America is really astounding. Americans are not content with putting on a sweater and paying rising electricity costs—they are turning to solar.

Residential solar photovoltaics (PV) installations are up 61%. SolarCity recently unveiled a new program to install solar panels for 30 homebuilders in over 100 U.S communities. The SolarCity Premium Service Package is the key component of the new program. Homebuilders are lining up to take part in this program since home buyers want solar panels—and homebuilders need to satisfy customers. Both SunPower and SolarCity will continue to grow as more people put solar panels on their roofs to mitigate higher electricity bills.

Sun and silicon mix

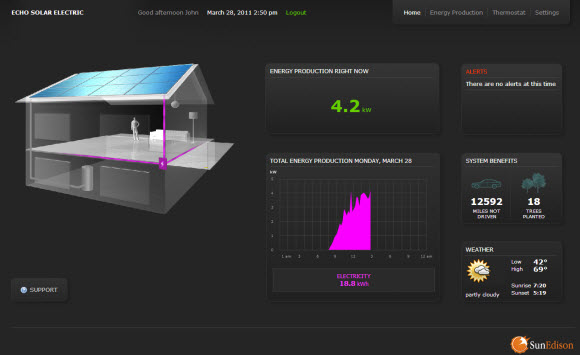

The Echo Solar web interface

SunEdison Inc (SUNE +0.00%) will be a winner in the solar installation game. It makes silicon wafers, the stuff that makes solar panels—solar panels. It develops and sells photovoltaic energy solutions, it develops surface features, electrical and crystal properties, and it ensures panel purity levels—all the technical stuff to make solar viable. This firm has some great residential products. The Echo Solar System is a complete solar solution that includes the external solar panels and other necessary equipment. This system also comes with a web dashboard for homeowners that allows them to monitor the entire system—all in the browser. SunEdison shares were recently upgraded by Gilford Securities from $13 to $18 per share.

Solar stock numerology

SunEdison shares are up over 10% for the year. At $14.41 per share, this stock is affordable. With a strong market cap ($3.8 billion) and healthy institutional ownership (90%), SunEdison is a safe solar play. SunPower is a more aggressive play, but has plenty of upside for those willing to take the gamble. This stock is up over 20% since January 2013. SolarCity shares have been on fire over the past year. They've slipped recently, but don't let this dissuade you. The trend is on SolarCity's side.The recent "Polar Vortex" electricity bills are sure to help..

The only "real" concerns for these firms are the DIY solar systems and Chinese competition. For many DIY will never be an option—people these days don't want to cut their own grass or cook their own meals, let alone install a PV system on their roof. The Chinese economy is also slowing down, and Chinese citizens are starting to bristle at all the pollution.

The three firms I've showcased add real value. They create products and services that solve problems, and that is what you need to be investing in—problem solvers.