Housing starts, an economic data point, is one of the best indicators of the overall health of the housing market and what the home building industry expect the market to do in the near future. Let's take a close look at the recent data and what it may be telling us about the year to come.

The newest data

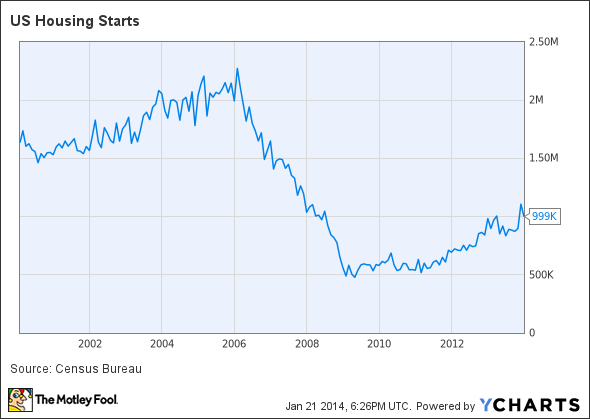

According to December's data, housing starts fell after surging to their highest level in years in November; however, the drop was much less than expected. Starts fell to an annual pace of 999,000 units, a bit better than the expectation of 990,000. Permits to build new homes only fell by 3%, indicating a potential rebound in the months to come.

Overall, housing starts increased by more than 18% from 2012, which is especially impressive when you consider the spike in interest rates in the second half of the year.

History of housing starts

As you can see from the chart below, housing starts have nearly doubled their annual pace since the post-crisis lows of 2009, but are still a long ways off from historical levels. While we probably won't return to the homebuilding craze of the mid-2000s, the 1.5 million unit annual pace of the early 2000s seems achievable and sustainable, once inventories of existing homes (particularly foreclosures) work their way out of the market.

In other words, although the recovery has been great so far, there is still a ways to go for new home construction. As long as the economic conditions stay favorable, we could see the steady climb in housing starts from the last few years continue for several more.

What does it mean for 2014?

The fact that this year's new home construction data was so high, despite mortgage rates rising more toward "normal" levels, is pretty impressive. What it may tell us is that the overall housing market in the U.S. is beginning to return to normal.

There was a widespread fear that without artificially low interest rates, people would stop buying homes, and the progress made in housing over the past few years would all evaporate. However, the numbers tell a different story.

Housing starts include both homes that are being built for a specific customer and those homes that builders are constructing on spec, meaning they plan to find buyers after the home is built. During the peak of the recession, newly built spec-homes were virtually nonexistent in many markets; builders were simply too nervous to build homes that were not yet matched with buyers.

Now, homebuilders aren't going to increase the number of homes they build unless they see a clear rise in demand. One building company in Illinois says that about 60% of the homes they are building are spec homes, as opposed to virtually zero just a few years ago. They also said the typical spec home they build is selling within 30 days of completion.

The data here, especially regarding permits (which represent future construction), indicates that homebuilders see high demand for new homes in 2014. The average pace throughout 2013 was 923,400 starts, and the fact that the permits issued in December correspond to an annual pace of 986,000 homes tells me that builders are seeing another good year ahead.