Last week, struggling chipmaker Advanced Micro Devices, (AMD +1.19%) reported its second straight quarterly profit. For Q4, it managed to post adjusted EPS of $0.06, a penny ahead of the average analyst estimate. That was also a big improvement from AMD's adjusted loss of $0.14 in Q4 of 2012.

However, investors shouldn't get too excited. AMD is still one or two bad quarters away from a serious liquidity crisis. Moreover, I continue to believe that over time, AMD will be left in the dust by top rivals Intel (INTC +3.02%) and NVIDIA (NVDA 1.48%) in the CPU and GPU markets, respectively.

AMD intends to counteract these headwinds by rapidly growing sales of semi-custom and embedded products. However, these chips carry much lower gross margins, which may not be able to cover AMD's operating expenses without improvements elsewhere in its business. Unless AMD's margin profile starts to improve, I would recommend avoiding the stock.

The bright side of things

AMD's management appears to be pleased with the progress of the company's turnaround plan. CEO Rory Read highlighted its 38% year-over-year revenue jump in Q4 and projected continued revenue growth and positive earnings for 2014.

AMD's revenue growth was primarily attributable to the launch of the PlayStation 4 and Xbox One game consoles during the quarter. Combined, Sony (SNE 1.31%) and Microsoft (MSFT 2.40%) sold more than 7 million units in the first two months, driving a sales spike for AMD's semi-custom chip business.

There are some other bright spots, too. The company recently released a new line of GPUs, which are helping AMD stabilize its market share vis-a-vis NVIDIA. AMD has also won a significant amount of business from Apple (AAPL 0.46%) recently. Most notably, the new Mac Pro uses AMD professional GPUs. That's a good sign, considering that NVIDIA has historically dominated that market segment.

Trouble under the surface

In spite of these achievements, AMD faces some fundamental problems in the near term. First, the semi-custom chips that are driving AMD's revenue growth are low-margin products. This caused non-GAAP gross margin to contract from 39% in Q4 2012 to 35% last quarter.

This lower gross margin profile would be acceptable if AMD could expect to "make it up in volume." However, following the initial spike in game console demand, sales are expected to level out. As a result, AMD is projecting a 16% sequential revenue decline in Q1 -- which would be worse than the typical seasonal trend -- while gross margin will remain at 35%.

Second, AMD's rebound in the GPU market may be short-lived. Right now, it's benefiting from the timing of the product cycle; NVIDIA released its first Kepler GPUs nearly two years ago. However, NVIDIA will start releasing GPUs based on its next-generation Maxwell architecture during 2014. This will provide a performance boost that will shift the competitive balance back in NVIDIA's favor by the end of the year.

The real problem

While AMD will face some near-term challenges in generating meaningful earnings, the longer-term story is much more troubling. In order to cut costs, AMD has been slashing R&D spending, which is dangerous at best and suicidal at worst.

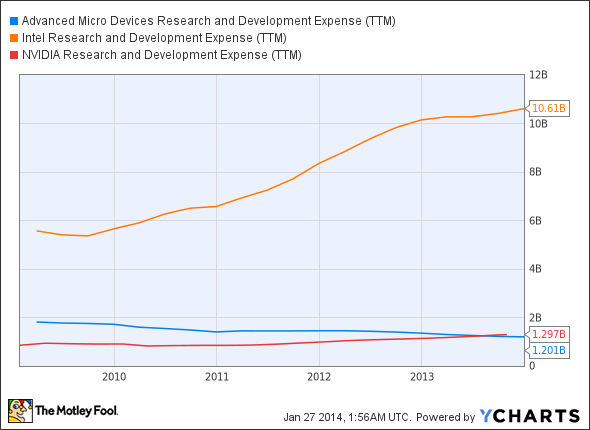

AMD Research and Development Expense (TTM) data by YCharts.

As the chart above shows, Intel and NVIDIA have significantly boosted their R&D spending in the last five years. Meanwhile, AMD has cut its R&D budget by a third. Intel's R&D budget already dwarfed AMD's, and that gap is growing wider every year. Meanwhile, NVIDIA's R&D budget has overtaken that of AMD.

AMD Research and Development Expense (TTM) data by YCharts.

In 2014, AMD will reap the benefit of its previous R&D spending while saving money in the present day due to its recently executed cost cuts. However, in a few years, it will be relying on today's R&D work to generate competitive products. I'm very skeptical that AMD will be able to take on Intel, NVIDIA, and other chipmakers on its current shoestring budget.

Foolish bottom line

CEO Read has stabilized AMD's financial position for the time being, but the company is living on razor-thin margins with a weak balance sheet. That doesn't leave very much room for error.

Meanwhile, other chipmakers are vastly outspending AMD on research and development. This puts AMD's long-term competitiveness at risk. It's certainly possible that AMD will manage to walk this tightrope and release good-enough products on a much smaller R&D budget, but the chances aren't good enough to justify investing in the company.