Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Thermo Fisher Scientific (TMO 0.33%) fit the bill? Let's take a look at what its recent results tell us about its potential for future gains.

What we're looking for

The graphs you're about to see tell Thermo Fisher Scientific's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's take a look at Thermo Fisher Scientific's key statistics:

TMO Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

20.5% |

Fail |

|

Improving profit margin |

7.3% |

Pass |

|

Free cash flow growth > Net income growth |

22.4% vs. 29.3% |

Fail |

|

Improving EPS |

47.3% |

Pass |

|

Stock growth (+ 15%) < EPS growth |

144.1% vs. 47.3% |

Fail |

*Period begins at end of Q3 2010. Source: YCharts

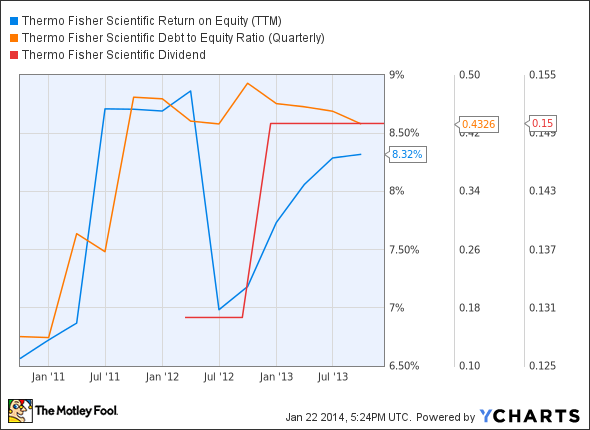

TMO Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

26.8% |

Pass |

|

Declining debt to equity |

208.1% |

Fail |

|

Dividend growth > 25% |

15.4% |

Fail |

|

Free cash flow payout ratio < 50% |

12.7% |

Pass |

*Period begins at end of Q3 2010. Source: YCharts

How we got here and where we're going

Thermo Fisher Scientific earns a rather mediocre four out of nine passing grades on our test today, but there are certainly opportunities for the company to grab some low-hanging fruit next year. One of its failing grades was only awarded because net income narrowly surpassed free cash flow during our three-year-tracking period -- however, Thermo-Fisher's nominal free cash flow has been consistently higher than its net income throughout the past three years. Thermo-Fisher's shareholders have enjoyed robust growth over the past three years, and shares have actually surpassed bottom-line growth as investors flock to the increasingly diverse diagnostics company. But does that mean Thermo Fisher will keep outperforming in the future? Let's dig a little deeper to find out.

The global diagnostic market has boomed over the past few quarters, so diagnostic leaders Thermo Fisher and Illumina (ILMN 1.02%) have both gained significant traction on the back of rising demand for life-sciences equipment. Fool contributor Maxx Chatsko points out that the acquisition of genomic-analysis device and service provider Life Technologies brought Thermo-Fisher into the battle of genome-sequencing systems, which is already propelling costs for a complete genome sequencing below $1,000. While Life Tech's top-of-the-line machine is currently running behind Illumina's in terms of whole-genome sequencing costs, it's certainly conceivable that the tide will again turn in this year or the next, now that Life Tech has Thermo-Fisher's deeper pockets to draw on. The Life Technologies deal could ultimately result in cost synergies of $250 million per year, which is about as much as Illumina's spent on R&D over the past four quarters.

Illumina currently holds the lead thanks to the newly launched HiSeq X Ten sequencing system, which promises to sequence "at scale" by aggregating 10 HiSeq X machines together. The system boasts the ability to sequence up to 20,000 human genomes a year. Illumina also launched the NextSeq 500 desktop sequencer, which will compete head-to-head with the low-cost Ion Torrent desktop sequencer developed by Life Technologies. Fool contributor Sean Williams notes that Illumina also offers a low-price sequencer, the MiSeq, which is capable of handling cloud-based data to formulate decoding.

In nongenomic news, Thermo-Fisher announced the divestment of its HyClon cell culture, gene modulation, and magnetic beads business, which generated total revenues of around $250 million in 2013, for just over $1 billion earlier this month. Meanwhile, the company also has a $233.6 million contract with the Department of Defense, which is expected to run end in the middle of this year.

Putting the pieces together

Today, Thermo Fisher Scientific has some of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.