Despite its household name, $700 million in annual marketing expenses, and solid results, Discover Financial Services (DFS +0.00%) flies under the radar of many investors.

Discover is often considered the fourth best credit card issuer and is often an afterthought for consumers and investors alike. And while it's often thrown into the same category with Visa (V +0.64%), MasterCard (MA +1.52%), and American Express (AXP 0.60%), the reality is, it has a very different business model.

Sources of revenue

Consider for a moment the sources of revenue for the four companies broken out by type:

Data: Annual for Discover and Visa. First nine months for American Express and MasterCard.

More than 70% of Discover's revenue comes from the typical banking income statement line item "net interest income," which is the difference between what it receives from loans versus what it pays out on deposits and other sources of funding. In fact, American Express is the only one of the other three that even makes money from net interest income at all, but that represents only 15% of AmEx's revenue.

It's vitally important to understand a company's business model before making an investment decision in it, and in the case of Discover, it should be viewed more along the lines of a bank than a credit card firm. With that in mind, it turns out Discover had both an impressive fourth quarter but, more importantly, a great full year in 2013.

Revenue on the rise

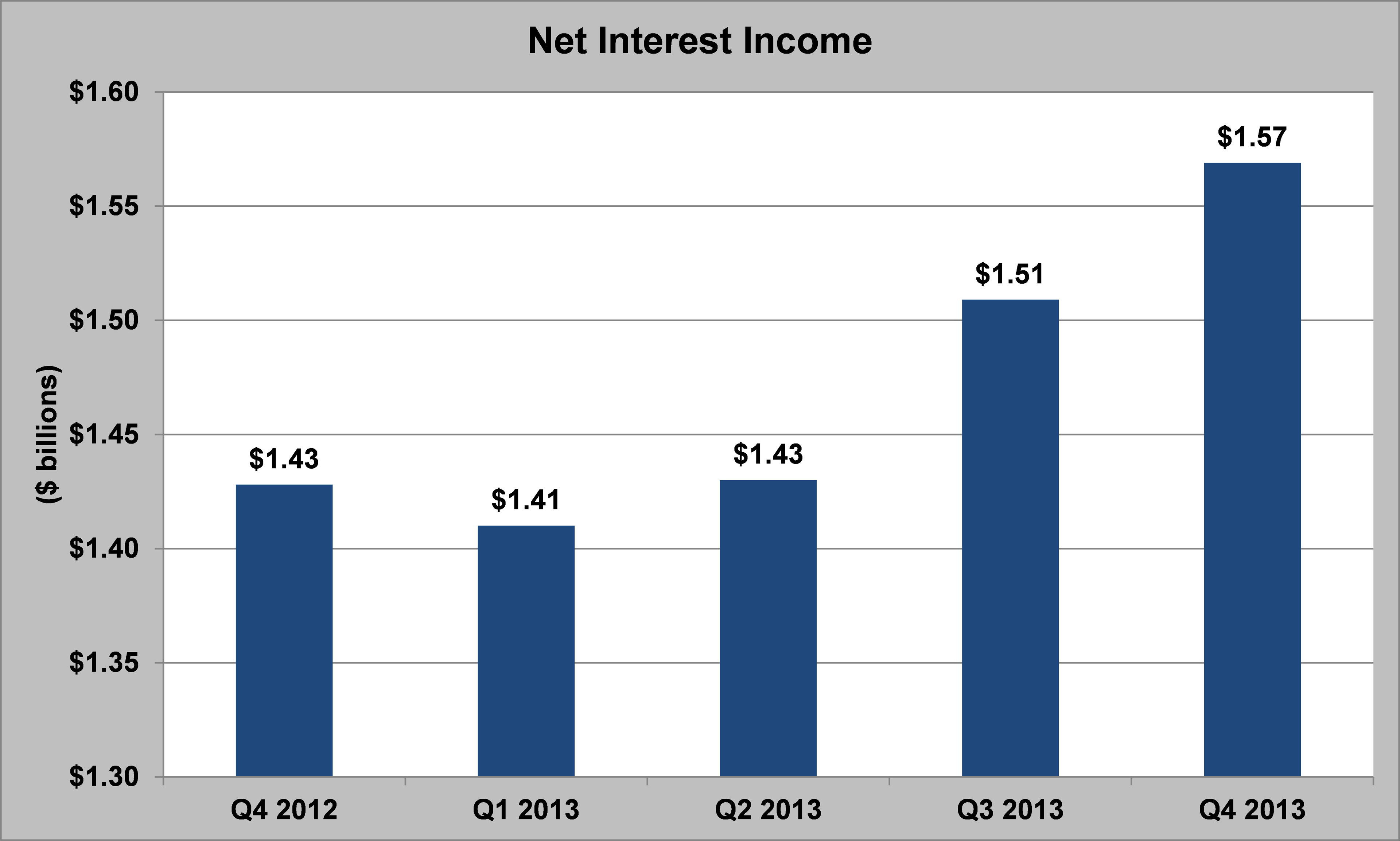

Knowing that its net interest income is its principal source of income, Discover has watched that vital line item rise dramatically as interest rates around the world rebounded from record lows:

Source: company investor relations.

For the full year, Discover saw its net interest income jump by 9%, and American Express saw its net interest income rise by just 2% through the first nine months of the year. And although they are very different, Wells Fargo saw its net interest income drop by 3% on the year, as its net interest margin compressed by nearly 10% to fall from 3.8% to 3.4%.

While the reason for this expansion in income at Discover included both a rising net interest margin -- from 9.3% to 9.6% -- and a 4% increase in average earning assets, it shows that Discover is able to increase both its profitability and its market share. And with 2014 interest rates expected to continue their rise as the American economy continues to improve, this will probably be a big boost to Discover both this year and beyond.

One trend to keep an eye on

With revenue rising by more than $500 million on the year and expenses rising by roughly only $120 million, it would be easy to think that Discover would have an astounding growth in net income, but its net income was up only $119 million, or 5%. This was largely a result of rising provisions for loan losses -- another key bank indicator that represents what a company expects to lose on its loans -- which rose by $230 million, or 27%, on the year.

While the data for the full year isn't yet available, American Express had seen its provision for losses rise by 17% through the first nine months of 2013 relative to the first nine months of 2012.

However, the biggest reason for this was the increase in total loans. Discover's reserve rate, which is its allowance for loan losses divided by total loans, and a better picture of credit quality, fell from 2.9% to 2.5%. If this began moving upward, it would be somewhat troubling, but the increase in net provision for loan losses was more an indicator of increasing size instead of increasing risk.

A great thing to see

As a final point to note, Discover was able to reduce its common share count by 5% on the year, as it continued its repurchasing efforts, which caused its earnings per share to jump 10% despite "only" a 5% increase in net income. And it was also able to boost its book value per share by 15% on the year.

All told, by almost every standard, Discover had another great year in 2013, and it's one company that should be on the radar of many investors.