Motorcycle powerhouse Harley-Davidson (HOG +0.10%) is slated to report its fourth-quarter and full-year 2013 earnings on Thursday before the market opens, followed by a conference call at 8 a.m. Central time. If you know what analysts expect and what to home in on in an earnings report before earnings are announced, you'll be better prepared to make level-headed decisions if an earnings announcement throws investors a curve ball.

Harley's report follows competitor Polaris Industries' (PII 0.28%) earnings announcement on Tuesday. Polaris slightly beat both revenue and earnings estimates, thanks partly to strong motorcycle sales, though shares closed down as the company issued 2014 revenue and earnings forecasts below consensus estimates.

Since Polaris launched its 2014 Indian models in August, Harley and Polaris are now competing more directly. Polaris is hoping the iconic Indian brand name paired with its engineering expertise will provide a winning combination to compete with Harley, which remains the undeniable king of the road. Given this increased level of competition, investors in Harley should monitor Polaris' progress.

Now, let's look at what to expect when Harley reports.

|

Analysts' Q4 EPS Estimate |

$0.34 |

|

Change From Year-Ago EPS |

9.7% |

|

Q4 Revenue Estimate |

$1.04 billion |

|

Change From Year-Ago Revenue |

3.2% |

|

Earnings Beats Past 4 Quarters |

1 (2 quarters on target, and 1 miss) |

|

2014 Revenue Estimate |

$5.77 billion (representing 9.5% growth over 2013 estimate of $5.27 billion) |

|

2014 EPS Estimate |

$3.93 (representing 20.2% growth over 2013 estimate of $3.27) |

Source: Yahoo! Finance.

Will margins continue to expand?

Analysts are looking for margins to continue expanding, as the consensus is for EPS growth to be about triple revenue growth.

Harley launched its new Project Rushmore line of bikes in August and said when it released its third-quarter earnings that the line contributed to its strong retail bike sales, which were up 15.5%. Investors should home in on all data and comments related to Project Rushmore bike sales in the earnings report and conference call. If this line continues to perform well, it should help Harley continue to beef up its margins.

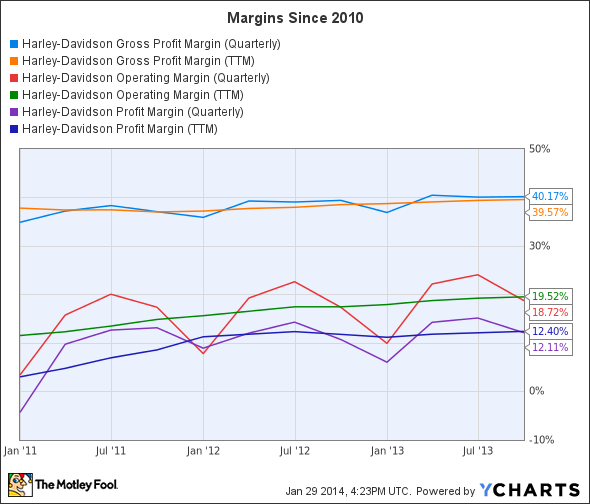

The motorcycle business is quite seasonal, with the fourth quarter being Harley's slowest. Thus, margins are historically lower in the fourth quarter. The following chart shows both quarterly and trailing-12-month margins for the past few years. Keep in mind these are overall margins, not just margins from Harley's core motorcycle and related parts and accessories business. Harley's bike business accounted for 89.7% of its $4.71 billion in revenue in the first nine months of 2013, while its financial services business kicked in $483.2 million, or 10.3%.

Harley's gross and operating margins for just its core motorcycle business were 31.8% and 5.3%, respectively, in the fourth quarter of 2012, compared with 31.2% and 3.5% in the fourth quarter of 2011. While one quarter is just one quarter, Harley needs to show further improvement in these core business margins when it reports on Thursday to maintain investor confidence that its restructuring plan, which is nearly complete, remains on track.

Data by YCharts

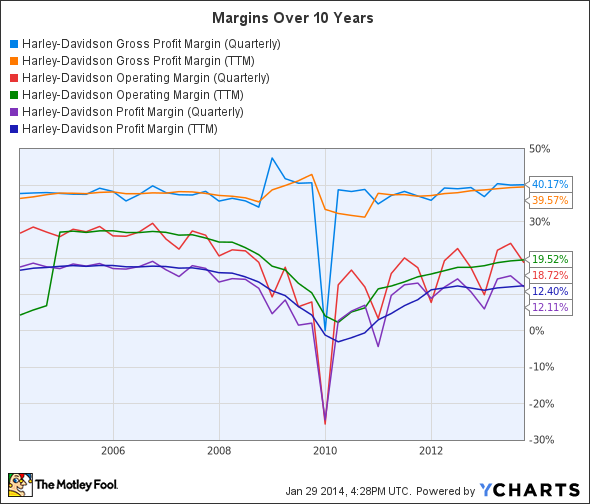

The following 10-year chart is a bit busy, but it clearly shows that, while Harley has been making progress on the margin front since the depths of the recession, its operating and profit margins are still considerably off what they were when the company was riding high in the mid-2000s and prior. Of course, Harley's five-year restructuring plan, which was implemented in 2009, is nearing an end, which will save the company an estimated $320 million annually in 2014 and going forward and, thus, help to increase margins.

Data by YCharts

Will Harley get its ol' mojo back?

Margin expansion has been a critical component in Harley's laudable comeback. That said, margin expansion as a means of increasing earnings can take a company only so far. Revenue growth over the long term is needed. While Harley has been doing a solid job of growing its revenue since the recession, its trailing-12-month revenue has not reached its peak level achieved in 2006.

Harley is essentially a one-product company that sells just to consumers. Its lack of diversity with respect to both product line and customer type (consumer, business, government) make it more vulnerable to changes in demographics.

Harley's core demographic has been middle-aged white males, and the size of this group has been declining since the 1990s, given the aging of the baby boomers (those now aged 49-66). Thus, Harley needs to appeal to women, younger buyers, and minorities if it wants to continue to grow revenue and, hence, earnings over the long term.

Data by YCharts

Bottom line

Investors should home in on margins, Project Rushmore bike sales, and Harley's progress in appealing to buyers outside its core demographic.