If you hate big banks, I've got some bad news for you.

The latest data reveals the grip the four biggest banks have on the American consumer is only poised to tighten as the years progress.

Staggering size

At the end of the third quarter, the Federal Deposit Insurance Corporation noted the four biggest banks by deposits in the United States were, unsurprisingly, Bank of America (BAC +0.72%), Wells Fargo (WFC 0.65%), JPMorgan Chase (JPM +1.04%), and Citigroup (C +0.49%). While they represented only 0.06% of such institutions -- there were 6,891 banks in the U.S. at last count -- those banks held 37.3% of the total deposits in the United States:

Bank Deposits In the U.S. | Create Infographics.

Staggering growth

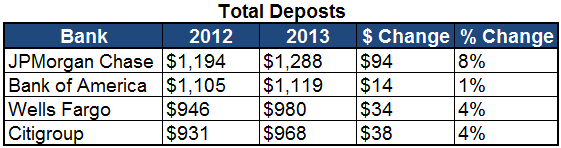

Not only are these banks big already, but they're getting bigger. A quick glance at total deposit growth reveals the four top banks in total added $180 billion in deposits (domestically and internationally) from the end of 2012 to the end of 2013:

Source: Company earnings reports.

While it isn't an exact comparison, a bank with $180 billion in deposits would be the ninth largest bank in the U.S.

The reasons for their colossal size and growth are endless. From their presence in every market, a full suite of products and offerings to consumers and businesses alike, their ability to be true beneficiaries of economies of scale, and countless other things, there is no refuting the reality that these banks are big now and will only continue to grow as the years progress.

Staggering potential

In addition to all of that, a new J.D. Power retail banking study revealed 34% of the customers at the six biggest banks in the U.S. were designated as Generation Y, also known as Millennials -- the individuals who were born from the early 1980s to the early 2000s. This compares to just 25% of customers at regional, midsized, and community banks. It went on to note:

And while the Generation Y segment is currently less-affluent than other segments, they do present potential bottom-line growth as their income levels increase and they enter the market for mortgages, education plans for children, loans, etc.

The ability of Big Banks to provide functional "digital banking technology" (website, mobile, advanced ATMs) is attractive to tech-savvy younger customers, and smaller institutions need to be competitive in this space in order to "steal" younger customers from Big Banks.

This is important because when a person considers an investment, he or she must look at both past performance but also understand future directions and trends. The biggest banks appear to have a strong hold on the younger generation poised to begin using the full scale of bank services as they enter the prime of their careers. This could be one more reason why these institutions will only continue to become more profitable and larger as the years progress.

Many companies are lauded because they appeal to younger consumers and are thought of as being harbingers of the new frontier, or of having the biggest potential for growth because of the demographics of their customers. The biggest banks are also due some of that excitement.