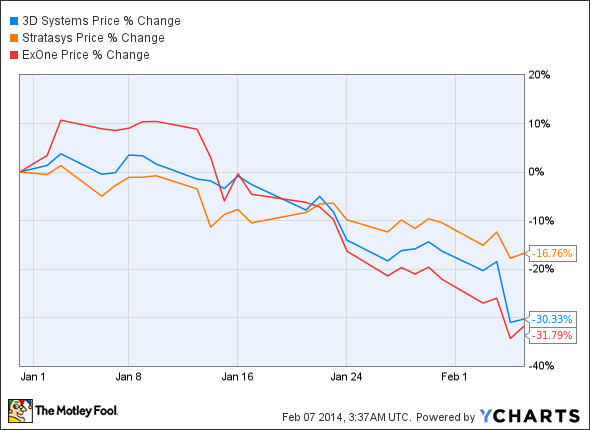

It's only been a month, but 3-D printing stocks are off to a terrible start this year. The culprit has everything to do with three negative developments that sent investors running for the exits.

Stratasys (SSYS +2.28%) kicked things off when it issued its 2014 full-year earnings guidance that fell short of expectations. Specifically, the company plans on sacrificing some short-term earnings potential in order to improve its business prospects over the long term.

ExOne (XONE +0.00%) wasn't far behind when it warned that its 2013 full-year results will fall significantly short of expectations due to sales timing issues. The company wasn't able to close five industrial 3-D printer sales before the close of its fourth quarter. It's now expecting these deals will close sometime this year.

3D Systems (DDD 1.24%) joined the party when it issued its preliminary earnings results and its 2014 full-year guidance. The wheels really fell off when its 2014 earnings-per-share estimates fell significantly short of the analyst consensus, sending shares plunging. Like its peers, 3D Systems plans on investing more of its earnings potential into growing its business longer term.

Because of these developments, 3-D printing stocks are much cheaper than before, and may present a great long-term buying opportunity for investors who are willing to deal with a high degree of volatility. In the following video, 3-D printing analyst Steve Heller gives investors reasons why now might be a great opportunity to get invested in the 3-D printing sector for the long haul.