Index funds capture broad market trends, so they suit busy or uninterested investors. However, these funds have a big downside that engaged investors try to avoid: An index includes many grossly overvalued, failing, or otherwise undesirable companies that an educated investor would never directly buy stock in. Thankfully, there is a stock that can diversify your portfolio while adding only sound companies: Berkshire Hathaway (NYSE: BRK-A) (NYSE: BRK-B).

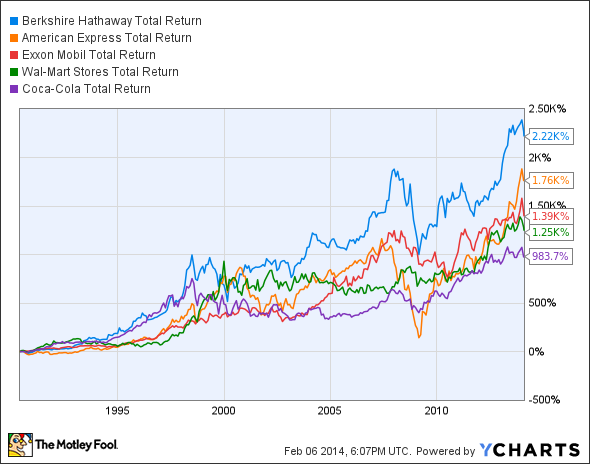

Berkshire owns dozens of companies across several industries, giving individual stockholders broad exposure with one holding, like an index fund. Yet unlike an index fund, Berkshire only holds companies that have been vetted by one of the best teams in finance. And, unlike a mutual fund or exchange-traded fund, Berkshire charges investors zero fees for that expertise. Even better, the stock has returned about 20% on average for nearly 50 years. Over time, 20% a year adds up, and Berkshire easily outpaces the S&P 500's gains (with dividends reinvested):

Berkshire's gains are backed by solid and consistent metrics. By nearly every measure, Berkshire outperforms the market and is more reasonably valued than the market or individual stocks with similar returns. Below, compare Berkshire's book value and P/E ratio to the S&P 500's:

The S&P comes with respectable metrics of its own, but Berkshire still does better.

Berkshire isn't perfect, and other portfolios can beat its returns. However, the company tends to outperform even its best-performing blue chips over the long run. Let's have a look at some examples.

American Express

Some companies outperform Berkshire for years at a time, and American Express is one of the best examples. If you had bought Berkshire and American Express (AXP +0.35%) a year ago, American Express would be the stock boosting your portfolio right now. American Express continued a five-year winning streak and returned 50% last year, handily beating the market and Berkshire. Even as its stock price reaches new all-time highs, the price appears to be in line with solid growth: Revenue has been increasing steadily every year, and with its combined card and services business, the company maintains several lucrative revenue streams. Old and new shareholders have plenty of reasons to be happy with stellar capital gains, steady dividend growth and repurchases, and reasonable valuation metrics like a P/E of 17.6.

For a long-term portfolio, however, Berkshire stays on top. One of the main reasons is volatility: American Express has a beta about three times greater than Berkshire's, meaning it can also erase value that much faster. For example, by the pit of the recession in March 2009, American Express had fallen 83% from its 2007 high, while Berkshire was down 30%.

Wal-Mart

Wal-Mart's (WMT 1.51%) stock has dropped recently following lackluster big-box retail sales and broad concerns about global growth. However, the drop may be misplaced contagion. Here, Berkshire outperforms because it is diversified across sectors -- it tends to drop only when investors question the entire economy, not just one part. Wal-Mart is diversified within retail, and the business is steadily adding billions onto its revenue every year, even with unimpressive performance in certain divisions including Sam's Club. From 2012 to 2013, revenue increased $464 billion to $474 billion and earnings per share increased 6.8%. Additionally, Wal-Mart continues to increase its dividend and currently yields 2.6%. Wal-Mart won't rival Berkshire's returns any time soon, but it is a solid business whose stock is currently on sale.

ExxonMobil

ExxonMobil's (XOM +1.07%) stock has taken a nose dive since the beginning of the year, and its recently reported fourth-quarter earnings haven't helped. Diluted EPS fell 13% from the prior-year quarter, and full-year diluted earnings were down 24% from the prior year. The only good news is that dividends have been steadily increasing. Berkshire may be getting a bargain with Exxon, but Exxon does not look to outperform the holding company anytime soon. Here, Berkshire's financial team shines: It cannot time the market, but it does do markedly better than most individual investors with regards to determining when the market's sentiments are not entirely based on a company's fundamentals -- and then buying low and selling high.

Easy decisions

If you are looking for an easy way to diversify, or if you are considering an index fund as one pillar of your portfolio, take a look at Berkshire Hathaway. The company has an unparalleled 50-year track record of delivering stable and market-beating returns to its shareholders. With no fund fees and dozens of excellent companies, this one stock can give your portfolio the benefits of an index fund and none of the downsides.