Source: Dick's Sporting Goods.

Dick's Sporting Goods (DKS 4.42%) announced better-than-expected sales for the fourth quarter of 2013. In addition, the company raised its earnings-per-share guidance, which is quite uncommon in the current retail environment. Dick's is attractively valued in comparison with peers such as Cabela's (CAB +0.00%), Hibbett Sports (HIBB +0.00%), and Big 5 Sporting Goods (BGFV +0.00%), so the company looks well positioned for superior returns.

Playing to win

Dick's Sporting Goods announced on Monday that sales during the key fourth quarter of the year exceeded the company's expectations. The company reported a big 7% increase in comparable-store sales adjusted for the 53rd week in fiscal 2012. The figure was materially better than management's previous estimate, in the range of a 3% to 4% growth rate.

Even better, the company raised its earnings-per-share guidance for the quarter to between $1.10 and $1.11 per share versus a previous guidance of $1.04 to $1.07. Wall Street analysts are forecasting $1.07 per share for the quarter, so the company's updated guidance will probably generate upside revisions in the coming days.

While most retailers are being hurt by weak customer demand and harsh weather conditions, Dick's Sporting Goods is not only reporting solid sales performance, but it's also generating higher-than-expected margins in spite of the aggressively promotional retail environment.

CEO Edward W. Stack is feeling quite confident about the company's prospects in 2014: "We enter 2014 with a robust and growing omni-channel network and exciting merchandising opportunities, which we believe will translate into double-digit earnings growth."

Management estimates that the company will make between $3.03 and $3.08 in earnings per share during fiscal 2014. That means a growth rate in the range of 13% to 15% versus earnings-per-share guidance for fiscal 2013. Not bad at all, especially considering the challenging industry headwinds that are hurting many retailers lately.

Fair valuation

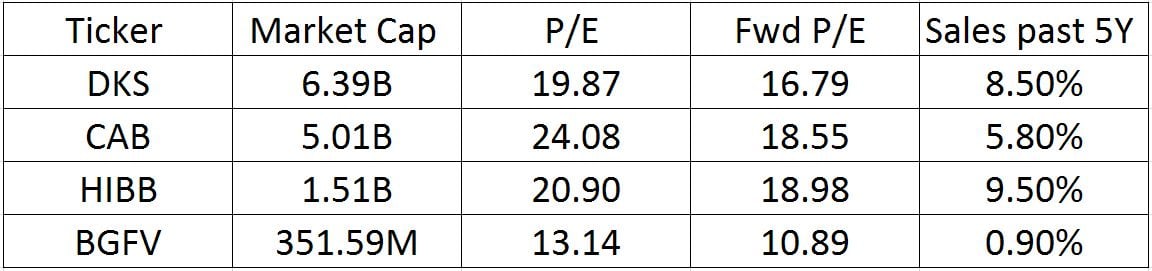

When compared against competitors such as Cabela's, Hibbett, and Big 5, Dick's Sporting Goods looks attractively valued. The company is a bit cheaper than Cabela's and Hibbett in terms of both P/E and forward P/E ratios. While Big 5 Sporting Goods is by a considerable margin the cheapest one in the group, the company is also clearly underperforming its competitors.

Data Source: FinViz.

Cabela's will report earnings for the fourth quarter of 2013 on Thursday. The report should be interesting to watch, since the company has performed particularly well lately. Sales during the third quarter of 2013 increased by 14.8% on the back of a 3.9% increase in comparable-store sales, and earnings per share grew by 16.7% during the period.

Hibbett reported mixed results for the third quarter of last year. Revenues increased by a moderate 2.5%, but comparable-store sales were quite strong, with a 4.8% growth rate versus the third quarter in 2012. However, margins fell during the quarter, and the company reported a 7% decline in earnings per share versus the prior year.

Big 5 announced a 1.8% increase in sales for the fourth quarter, but same-store sales decreased by 0.5%. The company also narrowed its earnings-per-share guidance for the year to between $0.21 and $0.23 versus a previous guidance of $0.20 to $0.28 per share. Management blamed the weak performance during the quarter on tough annual comparisons because of the surge of firearm and ammunition sales in 2012, as well as unfriendly weather conditions.

In all, considering the company's strong performance and healthy prospects, Dick's Sporting Goods is trading at attractive valuation levels in comparison to competitors in the sporting goods stores business.

Bottom line

Dick's Sporting Goods seems to be firing on all cylinders, and the company is entering 2014 with strong momentum and optimistic prospects for the year. This is nothing short of remarkable considering the difficult retail environment. The stock is also attractively valued in comparison with peers, so Dick's Sporting Goods is in a position of strength to deliver winning returns for investors.