SJM Holdings, Macau's original casino monopoly company, announced year-end bonuses and salary increases earlier this year at its Grand Emperor Hotel, but its employees were not too happy about this. Pay increases of 5% didn't sit well with the employees, who felt that they had been an integral part of the revenue increase seen by the casino over the last year.

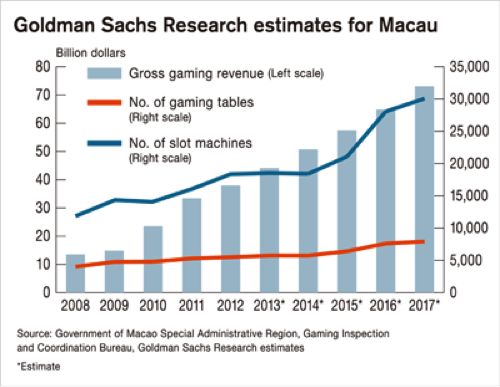

Workers believe that they have had a part in this amazing revenue

growth, and should be better rewarded for it.

The employees of SJM Holdings held a "work-to-rule" action for two days. This action meant that employees at gambling tables did not cover the shifts of other employees coming on late, and it lasted for one hour on each of the two days. True, maybe this was not the most aggressive protest, but it could indicate more widely-held sentiment in the gaming region. More than 1,000 employees participated in the demonstration. Cleaning staff also started a sit-in to protest pay and inadequate conditions.

Are other companies at risk because of disgruntled employees?

According to Macau Business Daily, an online news source, rumors have circulated about similar workplace issues and potential worker actions at casinos operated by the local subsidiary of Las Vegas Sands (LVS 0.17%), Sands China Ltd. According to the news source, a trade union representative said that Las Vegas Sands' year-end bonus, equivalent to one month's pay for the employees in question, had left them disappointed.

Las Vegas Sands had a blowout year in 2013. In the fourth quarter alone, the company brought in 3.67 billion, nearly 70% of which came from operations in Macau. The workers at these casinos know this just as much as any outside analyst does, and they know that it would not have been possible without their hard work.

Local subsidiary of Wynn Resorts (WYNN 0.53%) Wynn Macau Ltd. also announced a pay increase of 5% starting in March 2014 for all of its 7,600 employees, except for the top 1% of them. Additionally, the workers received a bonus equivalent to one month's pay, and the casino paid the bonus in early February.

Leong Sun Iok, vice-president of the Gaming Industry Workers Association, discussed Macau workers' sentiment and said, "Their frustration is understandable, as gross gaming revenue grew by nearly 20 percent last year, while visitor arrivals rose to another record." He also noted that another point of contention is the possibility of bringing foreigners to work in the same jobs. He said that "The workers also face more pressure because the idea of opening up croupier [the attendant that takes and pays out money at the gambling tables] positions to migrant workers has been raised, and the quality of the air in the workplace is worsening."

Protests in Macau in 2012 over rumors of foreign workers being allowed to work at casino tables. Photo: South China Morning Post

Without foreign employees, would there be labor shortages in Macau?

A report from Morgan Stanley Research Asia/Pacific in Hong Kong has noted that labor shortages could be a threat to the future growth of casinos on the island.In October 2012, thousands of employees at gaming companies in Macau protested against the possibility of bringing migrant workers to the island for work at the casino tables.

Photo: South China Morning Post

Currently government policy prevents this, and since the protests, the government has reiterated its stance on this issue and reassured Macau's permanent residents that the positions will be reserved for them.

However, the current unemployment rate in Macau in 2013 was a mere 1.8%. This means that as more megacasino resorts plan to open in Cotai in the coming few years, finding staff for these coveted positions may become an increasing challenge and expense. Leong Sun Iok noted that "With more casino-resorts expected to open in Cotai in the next few years, the labour market will be further strained, and sensitive topics like importing migrant workers will be raised again."

Are any companies raising pay in Macau at rates closer to their revenue growth percentages?

Or are they at least working toward fostering happier employees? MGM Resorts International (MGM +1.66%) has not announced a pay increase following its 2013 earnings, and the last company-wide wage increase was 5% in January 2012, according to the company's press releases. However, MGM and Unions struck a five-year deal in regard to its Las Vegas operations that received overwhelming support from the majority of employees, with as much as 97% approval.

The plan does not increase pay in the first year, but it greatly increases benefits and it allows for more negotiations in the fourth year. The employees of the Las Vegas casino applauded the new increases and showed their support in the landslide vote to approve it. While no news of similar action to be taken in Macau, MGM's commitment to employees in the U.S. might at least be a sign that the company is willing to take measures to keep employees happy.

Powerful employees should be kept happy

The workers in Macau know how much money the casino companies are making, and how much their revenue grew in 2013. Employees are disgruntled by wages that are not rising in-line with the revenue growth of these companies, nor even in-line with the rising cost of living in Macau due to the amount of money these casinos are bringing to the island, and this could lead to a bad situation where employees take action to get casinos' attention.

With the local government rule that only allows permanent residents to work the casino tables, these locals have a surprising amount of untapped power. Without them, labor shortages would mean the disruption of growth and further profits. Casino companies that incur the cost to appease these employees will probably be happy they did, as will their investors.