The U.S. economy continues to putter along five years after the end of the worst crash in a generation, according to the Bureau of Labor Statistics' latest jobs data. Another 175,000 jobs were added to the national workforce last month despite the ongoing bad winter, besting the economist consensus estimate of 149,000 new jobs and the dour Twitter #NFPGuesses consensus of 128,000 new jobs, which Business Insider culled from more than 100 respondents shortly before the BLS published its latest update.

The Dow Jones Industrial Average (^DJI +1.34%) surged in early trading in response to the report, and is leading the three major indices with a 0.4% gain at 12:20 p.m. EST after settling down somewhat as the day progressed. On balance, much of the jobs data was positive, but it was not unanimously bullish. Let's run through some of the key statistics from February's BLS employment situation summary.

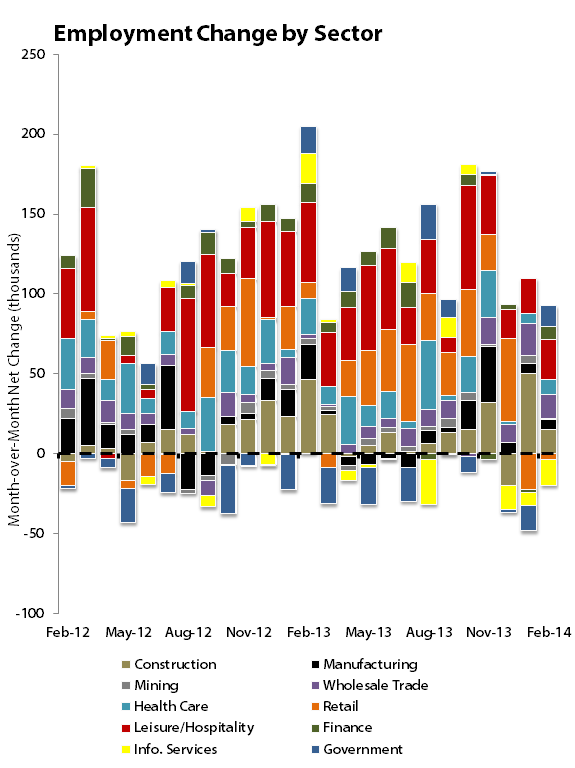

The headline establishment survey shows that 175,000 new jobs were created.

Source: U.S. Bureau of Labor Statistics.

The private sector created 162,000 of these jobs..

Of these jobs, 140,000 were in the service sector, with many of them added by the temporary-help (24,400 new jobs), health care and social-assistance (14,700 new jobs), or leisure and hospitality (25,000 new jobs) sectors.

The construction sector added 15,000 new jobs.

Government at all levels added 13,000 new jobs.

Source: U.S. Bureau of Labor Statistics.

Totals may not equal other results due to missing sector data.

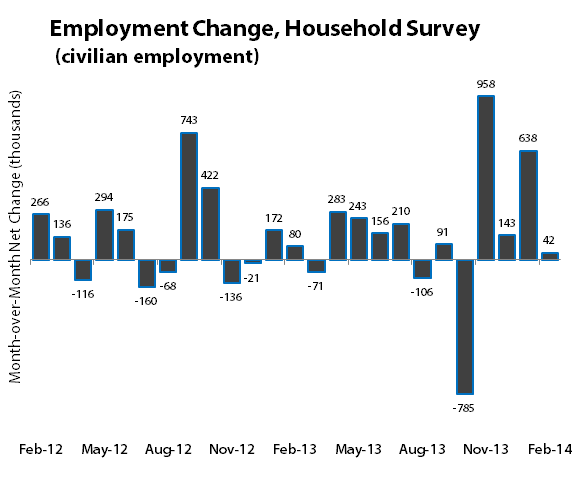

The household survey, which for January showed a huge 616,000 gain in new jobs, only reported 42,000 new jobs in February.

Source: U.S. Bureau of Labor Statistics.

The household survey also recorded 223,000 new unemployed people, which was the first uptick since last June and enough to boost the unemployment rate 0.1% higher to 6.7%.

Of these new unemployed people, most were among the long-term jobless -- 203,000 new people have now been without a job for 27 weeks or more. This is the first notable uptick in long-term jobless numbers since fall 2012, and the trend still shows a consistent decline over time.

The less-followed U-6 unemployment rate, which includes "marginally attached" workers and those working part time for economic reasons, fell 0.1% to 12.6%.

Teenagers continue to have great difficulty finding jobs: 21.4% of workers aged 16 to 19 were unemployed in February, up from 20.7% in January.

Workers without a high school diploma (up to 9.8% from 9.6%), those with some college or an associate's degree (up to 6.2% from 6%) and those with a bachelor's degree or higher (up to 3.4% from 3.2%) all saw their unemployment rates tick up. Those with only a high school diploma saw the only decline in unemployment, and are now unemployed at a 6.4% rate, down from 6.5%.

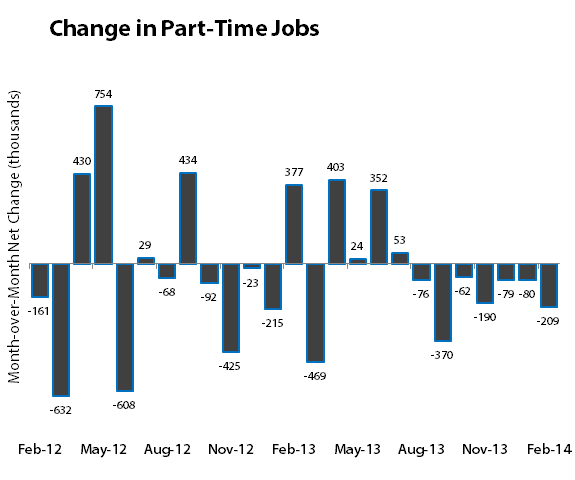

We're not (yet) becoming a nation of part-time workers, as there were 209,000 fewer part-time jobs recorded in the household survey for February.

Source: U.S. Bureau of Labor Statistics.

The employment-to-population ratio was unchanged from January at 58.8%.

Average weekly hours worked by all employees dropped slightly to 34.2 hours, and nonmanagerial employees saw their workweek drop to 33.5 hours, a decline blamed on the recent poor weather.

However, average earnings for all employees ticked up to $24.31 an hour, and nonmanagerial employees also saw their pay tick up to $20.50 an hour.

It's not the greatest jobs report in the world, but more people are finding jobs, fewer people are stuck in part-time jobs, and paychecks continue to slowly increase over time. As many of the jobs were gained in sectors driven by discretionary spending, it should come as no surprise that some of the Dow's strongest performers today are the financial intermediaries that most benefit from increased discretionary spending -- American Express (AXP +2.48%), Visa (V +6.50%), and JPMorgan Chase (JPM +2.34%) are all among the Dow's best performers today.