If you live in Alaska, Michigan, Nevada, or Wyoming and feel that you are losing ground financially, you are probably right – if you are one of the bottom 99% of earners.

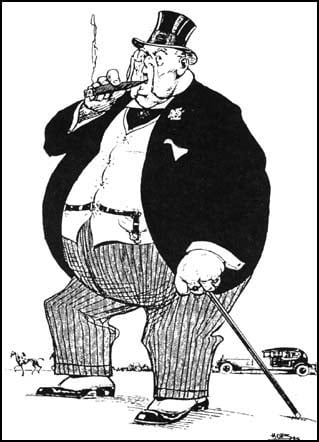

The Occupy movement highlighted the income inequality between the top 1% and the rest of the population, but even those activists would likely be surprised at the rate at which the haves gobbled up income gains in these states – at the expense of the have-nots.

In a nutshell, here are some facts uncovered by a new study by the Economic Policy Institute, which took a look at The Increasingly Unequal States of America from 1979 to 2007, and again, in the wake of the Great Recession.

Michigan

The former home base of the U.S. auto industry has certainly suffered over the past few decades, getting hit hard by the foreclosure crisis, and the bankruptcy filing by the city of Detroit last summer. Still, the state managed paltry income growth of 8.9% over the years – though all of it was absorbed by the top 1% of earners, while everyone else saw their incomes fall by 0.2%.

From 2009 to 2011, the top earners still did pretty well, scarfing up 91% of the 2.1% of the state's overall income growth for that time period, while the 99% gained only 0.2%.

Wyoming

Known as the Equality State because of its historically equitable treatment of women, the moniker rings false when it comes to income equality. From 1979 to 2007, the 1% saw their income grow by more than 350%, while the 99% fell behind by 0.8%. In the post-financial crisis years, the majority was able to gain 5.2%, but that couldn't compare with the 13.6% gain clocked by the state's biggest earners.

Wyoming also makes the list for the top 10 states showing the greatest gap between rich and poor, with the top 1% making 27.6 times the annual salary of the rest of the state's denizens. Wyoming's richest persons, the illustrious top 0.01%, made an average of $50.1 million per year – second only to Connecticut's $57.2 million, and one step above New York's $49.7 million.

Nevada

Nevada's slight income increase of 8.6% from 1979 to 2007 went entirely to the rich, while the majority saw income dip by 11.6%. The post-recession years were tough, with the state registering overall wage growth of negative 4.4%. Still, the top 1% managed to increase their own incomes by 4%, whereas the 99% posted a loss of 6.7%.

Like Wyoming, Nevada is one of the 10 states with an extremely wide income gap between the highest and lowest earners, with the top 1% making 29.5 times the yearly pay of the remaining 99%.

Alaska

Alaska was the only state to experience a deceleration of income growth from 1979 to 2007, with an overall decrease of 10.3%. Nevertheless, the 1% was able to boost its own rate of income growth by 118.6% -- obviously, at the expense of the rest of the state, which saw a drop of 17.5%.

"It's tough being a 99% moose..."

The tables were turned in the span of time from 2009 to 2011, however, when the top earners saw a dip in income growth of 1.2%, compared to a rise of 1.3% for the 99%. Overall, the state's wage growth was a positive 1%, a big improvement over its former negative income growth scenario.

As the authors note, income inequality is a rather new phenomenon; in 1979, for instance, Wyoming's top 1% held only 9.1% of all income, compared to the 31.4% observed by 2007. Also, the Great Recession hit all earners hard, including the richest – but that group's recovery has, on average, trumped that of the rest of the country since the recovery began in 2009. Since that time, the 1% has grabbed 95% of all income growth in the U.S. If this trend continues, it will likely be a long time until the wobbly economy truly gets back on its feet.