Dividend aristocrats are a select group of companies which have proven extraordinary financial soundness by raising their dividend payments for 25 consecutive years or more. Among that special group of dividend powerhouses, Coca-Cola (KO 0.18%), McDonald's (MCD 1.19%), Chevron (CVX +0.04%), Clorox (CLX 1.09%), and Sysco (SYY 0.77%) stand out due to their dividend yields above 3%.

Coca-Cola continues sparkling

Coca-Cola owns a unique portfolio of brands in the nonalcoholic drinks business, a gigantic global distribution network, and abundant financial resources to invest in marketing, product development, and acquisitions. This means the company has the underlying strength to adapt to shifting demand as consumers around the planet change their traditional sodas for healthier alternatives.

Even if soda volume is stagnant in developed countries lately, the company is expanding its presence in areas like tea, juice drinks, sports drinks, and water. Besides, emerging markets still offer plenty of room for growth when it comes to both healthier alternatives and classic soda products.

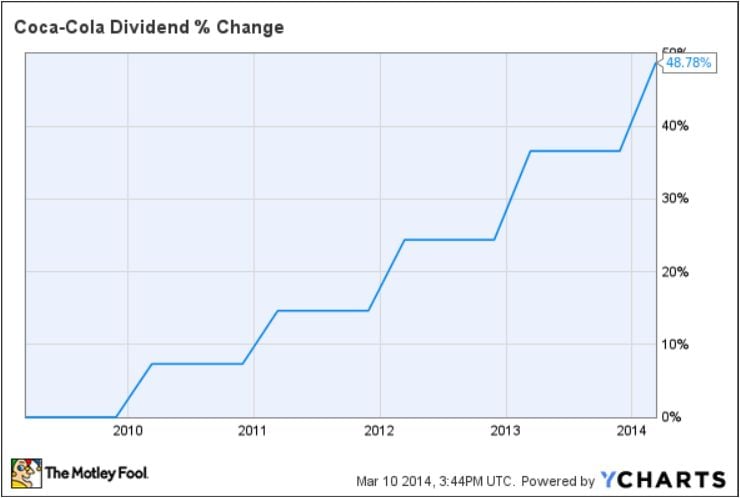

Source:YCharts

Coca-Cola has an extraordinary track record of 52 consecutive annual dividend increases, and management seems quite confident about the future considering that the company raised distributions by 9% on Feb. 20. The stock pays a sweet dividend yield of 3.2%.

McDonald's looks temptingly cheap

The fast-food industry is notoriously competitive, and the trend toward healthier nutrition represents a considerable challenge for companies in the business. In this context, McDonald's is facing serious difficulties when it comes to generating growth: Comparable store sales decreased by 0.3% on a global basis during February.

Source: YCharts

The good news is that the slowdown seems to be already reflected in the stock's valuation, McDonald's trades at a mouthwatering dividend yield of 3.4%. This is quite attractive for a company that has increased its dividends in each and every year since paying its first distribution in 1976; this includes a 5% increase announced in September of last year.

Chevron is full of energy

The energy industry is generally considered quite cyclical due to fluctuating energy prices and their financial impact on companies in the sector. But Chevron is particularly well positioned for growth in the years ahead due to successful exploration in areas like the Gulf of Mexico, Africa, Australia, and the Gulf of Thailand. Besides, the company is betting actively on LNG, which could offer abundant prospects for long-term growth thanks to the natural-gas revolution.

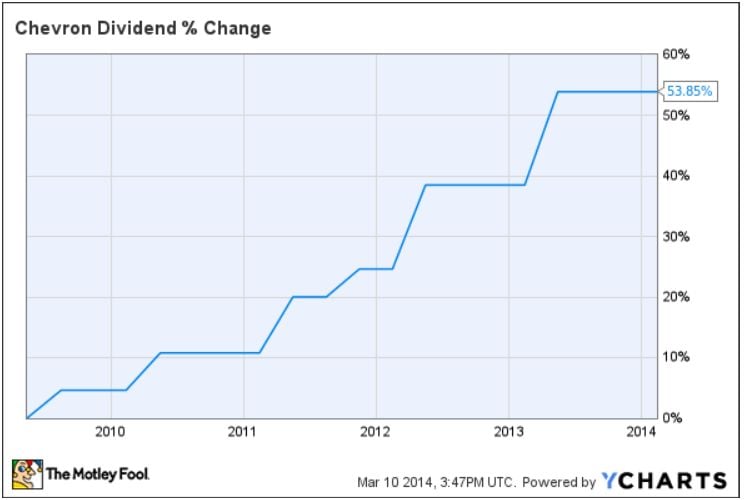

Source: YCharts

Chevron has raised its dividends over the last 26 consecutive years, and prospects for further dividend growth look particularly strong as the company has a comfortably low payout ratio in the area of 35% of earnings. In April of last year Chevron announced a big dividend increase of 11.1%, so investors have valid reasons to expect continued dividend growth from the company in 2014 and beyond.

Clorox for clean and shiny market leadership

Clorox owns a leading portfolio of recognized brands in defensive businesses like cleaning and household products, which includes names like Clorox, Glad, Hidden Valley, Kingsford, and Brita, among others. The company owns the first or second market share position in 90% of the markets in which it operates, and this leadership in stable and defensive industries means reliable cash flows for investors.

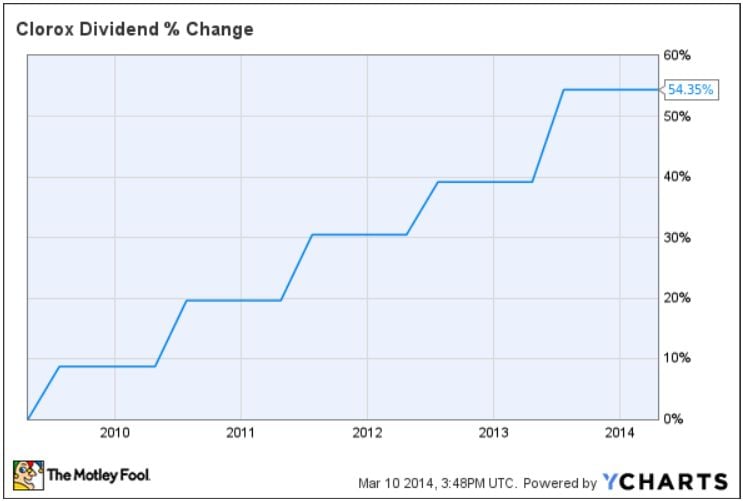

Clorox has increased dividend distributions in every year since 1977, including a raise of 11% announced in May of last year. The dividend yield is 3.3%, and the payout ratio near 63% of earnings looks sustainable for a solid company in a mature industry.

Sysco tastes good

Sysco is the global leader in the food service and distribution business. The company serves approximately 425,000 customers including restaurants, health care, and educational facilities, and lodging establishments, among others.

Sysco's scale advantages and distribution network differentiate the company from smaller players in the industry, and the company leverages its financial strength to recurrently acquire other companies and continue consolidating its competitive position over time. Sysco becomes stronger as it becomes bigger, and this allows the company to continue gaining size by swallowing smaller competitors.

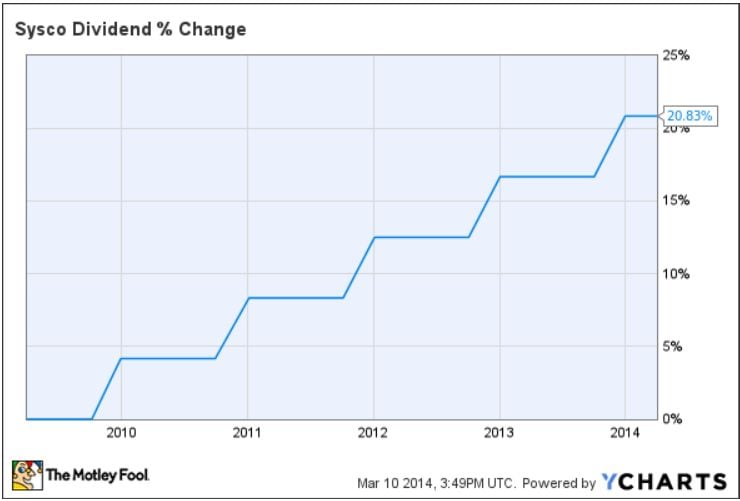

Sysco has raised its dividends for 45 consecutive years, even if the latest increase was not very exciting with a rise of 3.6% announced in November of last year. The dividend yield is quite succulent at 3.2%, and current dividends account for roughly 58% of average earnings estimates for the coming year.

Bottom line

What can be better than a big dividend yield? A big dividend yield coming from a company with a proven track-record of dividend growth and the fundamental strength to continue raising distributions over time. These five companies are worth some consideration from dividend investors looking for solid names with attractive yields.