Bank of America (BAC 0.53%) has seen its stock rise by almost 50% over the past year, but the best may still be ahead of it.

Yet as Winston Churchill famously noted, "A pessimist sees the difficulty in every opportunity; an optimist sees the opportunity in every difficulty." And a research firm recently revealed why Bank of America investors should be more optimistic than those of peers Wells Fargo (WFC 1.20%) and Citigroup (C +1.23%).

The ever important top line

Often -- and rightly so -- the discussion on banks centers on the bottom line net income numbers. In recent years, as a result of fewer losses from mortgage divisions and litigation, banks have seen astounding improvements in the money they can ultimately earn. Bank of America delivered a net income of $11.4 billion last year, which nearly equaled the $13.6 billion in net income it saw in the five years combined from 2008 to 2012.

However, top-line revenue numbers are critical because reductions in losses and expenses have a finite limit. Looking ahead for banks, the growth to their bottom lines will likely be the direct result of growth in the top line.

A quick glance at the revenues of the three largest banks reveals that Citigroup was surprisingly the winner over the past year:

|

Bank |

2012 |

2013 |

Growth ($) |

Growth (%) |

|---|---|---|---|---|

|

Bank of America |

$83.3 |

$88.9 |

$5.6 |

6.7% |

|

Citigroup |

$69.1 |

$76.4 |

$7.2 |

10.5% |

|

Wells Fargo |

$86.1 |

$83.8 |

($2.3) |

(2.7%) |

Source: Company SEC filings.

However, the growth at Citigroup wasn't the result of business growth and actual additions in revenue, as its net impairment losses -- which are subtracted directly from revenue -- fell 90% from $5.0 billion to $535 million, directly resulting in revenue growth.

Meanwhile, Wells Fargo is heavily reliant on mortgage banking revenue, and as broader refinancing plummeted in the latter half of 2013, so, too, did its revenue, which fell from $11.6 billion in 2012 to $8.8 billion in 2013.

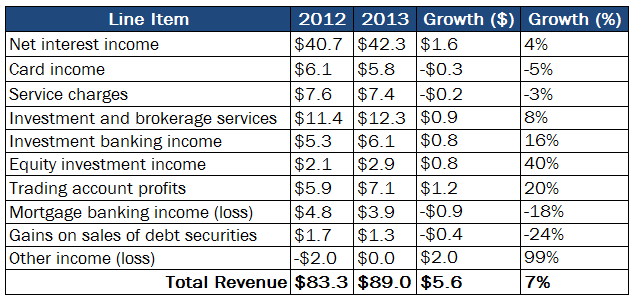

Of these three, Bank of America comes out the true winner. It saw improved results across its various sources of revenue:

Source: Company SEC filings.

The future prospects

So what about the future? Deloitte, a consultancy, provides a distinct reason for investors to be optimistic about Bank of America.

The consultancy, as the following graphic illustrates, notes that five areas providing a differentiated customer experience and compelling mixture of products will be the key to growing revenue at the biggest banks:

Bank of America has been executing on all of these initiatives over the past year, which could mean even greater growth in its top line in the future.

Just last week, Bank of America announced its "SafeBalance" account, in which it is transparent about its $4.95-a-month fee to customers. In addition, it has been aggressively pursuing growth in its Global Wealth and Investment Management business, which saw its net income rise 32% to $3.0 billion in 2013.

Yet not only is it focusing on product mix, but it's also providing the differentiated customer experience. Bank of America has distinctly focused on its mobile app and website services, as Brian Moynihan noted on the most recent conference call that the bank has invested $500 million "in the online mobile platform across the last three or four years, and we will continue to invest at that rate."

While many banks are focusing on driving top-line growth, Bank of America seems to be at the top of the ladder in its ability to execute across business lines and initiatives, which could mean big things for both it and its shareholders.