Walt Disney Company's (DIS 1.97%) decision to cut about 700 jobs from its interactive unit, a quarter of the division, should be a boost to shareholder confidence that the company is committed to staying lean and profitable. While the company has reiterated that it plans to continue investing in the division, the shift from focusing on in-house production to more of a licensing model and an increased focus on mobile will ultimate help the company to keep all of its segments consistently profitable. Investors have shown their encouragement for Disney's operating strategy with a share price that is up over 9% already in 2014. Continued commitment to profitability should spur this increase higher still.

Disney's Infinity game series bring the beloved characters to life through interactive animation and play. Photo: Disney.com

Interactive is the one segment for which Disney reported a loss in the financial year that ended on Sept. 28, 2013; the net loss was $87 million. While profit was actually up $55 million for the first quarter of this year, CFO guidance was that the second quarter would be back to a net loss of about an equal amount. One highlight of the interactive segment during 2013 came from the release of Disney Infinity, a console game, in August. The company has said that it plans to continue focusing on Infinity and is planning to release another console game, Fantasia: Music Evolved, later this year.

How will Disney turn its new, leaner division into a profit generating segment?

Through partnering and licensing. While the interactive division had been focused on producing original content for consoles and social gaming in the past, Disney Interactive president James Pitaro said that the company will now focus more on licensing. Going forward, game development will be led by companies that already focus on games as their core business.

At the same time, the segment will scale back its sagging social games areas on platforms such as Facebook or Disney.com. In 2010, Disney acquired Playdom, a producer of social games, for $563 million. The purchase was a hope for successful viral social gaming similar to that of Zynga's (ZNGA +0.00%) Farmville, which exploded with a user base increase of over 500% during the first six months of 2010 alone. However, Zynga is also feeling the effects of a decrease in social gaming, and reported in January 2014 that it would also be cutting 15% of its workforce.

Instead of online social gaming, the company will now focus more on mobile. It will target those games played on smartphones and tablets, including Disney Infinity, which is already available on iPad. "The industry has shifted from social games to mobile games," Pitaro said. "Our focus is now mobile first."

Disney Infinity now available on iPad. Photo: Disney.com

This mobile trend has not been missed by other competitors. Dreamworks Animation (DWA +0.00%) is taking it one step further by developing its own tablet that kids can use to download games and animated content. Along with technology partner Fuhu, the Dreamworks tablet is being developed so that it can be programed like a handheld cable program. Jim Mainard, head of digital strategy at DreamWorks, said that "We could push out a new character moment every day of the year." This means that little eyeballs will be watching more often and staying true Dreamworks fans.

Diversification is still a winning strategy for Disney

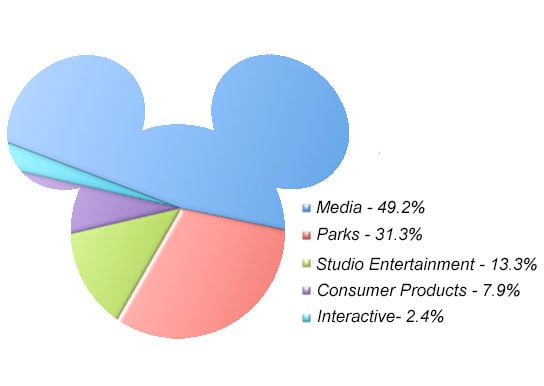

One strength that Disney has in the industry is its many different income streams. The company's operations include five segments: media (involving movie production and TV networks), parks and resorts (including theme parks and the Disney cruise line), studio entertainment, consumer products, and interactive. Of Disney's $45.05 billion global revenue in fiscal year 2013, only half came from media production. By creating highly diversified operating segments, the company has set itself up for more growth with less risk. The company also has plenty of opportunities to experiment within a single segment, as it is now doing in its interactive division.

Disney's percentage of 2013 revenue by operating segment.

Source: Disney 2013 year end earnings release

Parks and resorts is an example of a segment that has proven to be a profit booster for Disney. The company reported a 9% overall revenue increase in this segment during 2013 year-over-year, ahead of the 7% year-over-year revenue growth for the company as a whole. Another company seeking to replicate Disney's success in diversifying with theme parks is Twenty-First Century Fox. Fox is already beginning construction on its first ever theme park in Malaysia. In partnership with local casino resort company Genting, Fox World Malaysia is set to open in 2016.

Foolish conclusion

Disney's cuts to its interactive division and switch of focus to licensing games instead of producing them should not be seen as a sign of weakness. Instead, it's just another example of how the company is staying lean and committed to profitability. Through diversification, the company has the flexibility to experiment with interactive, its smallest segment; its experiments won't affect overall profitability. This smart operating move is another bullish sign for why Disney is a long-term winner.