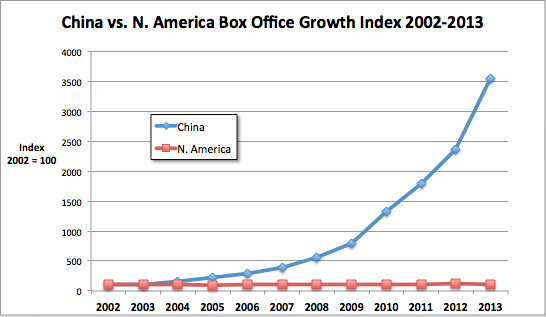

The Chinese film and media industry is booming, both in terms of viewers and in terms of production. PricewaterhouseCoopers projects a value for the industry of $6.49 billion in 2017, more than double its $3.26 billion value in 2012. China also makes up the largest pay-TV market with 223 million households subscribed to the service. Looking at the market's growth in the last decade, it's easy to see why these analysts bullishly expect China to become the largest film and media market in the world in the next few years.

Source: ChinaFilmBiz.com

A film industry that can bring in $500 million in revenue in one month, which outpaced the revenue for the full year for the same region in 2007, could offer a huge opportunity for Hollywood companies that seek to extend their international roots into growth markets. Hollywood companies have quickly realized that their best chances for getting in on this growth do not just involve licensing and screening movies in China, as they have been partnering with Chinese production companies and competing with on-the-ground operations to make media products specifically for Chinese consumers. Disney (DIS +0.28%) and Dreamworks (DWA +0.00%) compete in this area as they battle over which company will win the hearts and eyeballs of the Chinese film-goers.

Wandawood

The Hollywood of China

China's largest land development company, Dalian Wanda Group, develops and runs shopping malls, department stores, hotels, and over 500 cinemas, and this company is on a mission to assure that China leads the world in media production. The Wanda group is now constructing the "Hollywood of China," a media-production complex that will be the most impressive in the world.

The $8.2 billion project will include a 10,000 square-foot main studio, 19 smaller studios, a theme park, seven hotels, an IMAX (IMAX 0.95%) research center (the company has also inked a deal to place over 200 IMAX screens in Chinese cinemas), a film museum, a waxworks center, and even a year-round automobile and yacht trading center. The group's CEO, Wang Jianlin, has said that China will have the world's largest film industry by 2018. He predicts that China will surpass the U.S. in box-office revenue by 2018 and double U.S. box-office sales by 2023. Can Hollywood companies compete by making movies in L.A. and screening them in China, in the hope that the Chinese consumers will share their product tastes with Western audiences? Not for much longer.

Source: ChinaFilmBiz.com

Oriental Dreamworks becomes a "Chinese content company"

Dreamworks has already started to make large investments in China. Dreamworks partnered with Shanghai Media Group and three other separate local entertainment investment companies in a joint venture that includes production studios and attractions in Shanghai. Directors of the new venture called Oriental Dreamworks a "Chinese content company." Dreamworks Animation holds a 45% stake in the venture with the remaining 55% split between the three Chinese partners: China Media Capital, Shanghai Media Group, and Shanghai Alliance Investment.

The company intends to involve itself not only in animated TV production, but also in live-action films, live-action TV, and mobile and Internet content. Oriental DreamWorks already has four feature projects in development that will include Kung Fu Panda 3, one other U.S.-Chinese co-produced animated feature, and two live-action Chinese-language projects. Twenty-First Century Fox (FOX +0.00%) might get in on this action too. Fox replaced Paramount as DreamWorks Animation's main distributor in January. Oriental DreamWorks has not yet settled its distribution relationships, but if it decides to let Fox in on its China operations both companies may benefit.

Disney matches and prepares for battle

Disney won't be left out of this booming Chinese film business. The company has struck a multi-year deal with one of the same Chinese media companies with which Dreamworks has a deal, Shanghai Media Group, to begin producing content specifically for a Chinese audience. The partnership seeks to co-develop Disney-branded movies for Chinese consumers.

In the partnership, Disney will link U.S. screenwriters with writers and directors in China to work together on film projects in the classic Disney style, but they will contain "Chinese elements" in the hope that this will make the products appealing to Chinese families. Disney Studios president Alan Bergman said that "Disney's collaboration with [Shanghai Media Group] adds an exciting chapter of new stories for the next generation of global Disney fans."

Disneyland Shanghai is sure to help Disney continue building brand loyalty in China. Photo: Disney

Of course Disney as a company is not new to working in China. Disneyland Hong Kong has been operating since 2005. Plans for expanded accommodations at this property that could serve more guests appeared as a highlight of the company's 2013 fourth-quarter results in its parks and resorts segment. This segment grew 9% for the full year 2013 over 2012, ahead of the company's overall revenue growth of 7% during the same time-frame. Disneyland Shanghai, the first resort on the China mainland, is under development and set to open in 2015.

Working with the Chinese government will be no easy task

The Chinese government limits the number of foreign films allowed in the country each year, and often requires edits before granting approval. Strong partnerships will help these companies steer the choppy government waters in China and gain the right connections and relationships to move production along smoothly.

This is especially true for Oriental Dreamworks considering that the chairman of one of the partnered companies happens to be the son of China's former president Jiang Zemin, who held office just two presidencies ago from 1993 to 2002 and still wields massive power in the country.Disney has already established good relationships with the Chinese animation industry, as it partnered with the Ministry of Culture in China in 2012 to help improve the animation industry in the country.

In 2012, Disney executives met with officials from the Chinese Ministry of Culture to help advance China's animation industry.

Photo: Walt Disney Company

Inability to work through governmental hurdles stopped Time Warner (TWX +0.00%) on its first attempt to enter the Chinese market. Time Warner used to operate movie theaters in China through a joint venture with a local partner, but it pulled out in 2006 after China tightened foreign ownership restrictions. As of last summer, Time Warner has been slowly dipping a toe back in the market, as it invested about $50 million in the fund China Media Capital. This portfolio of companies mainly targets the growth of the television and film content business in China, which includes investments that touch Oriental Dreamworks. As of now Time Warner seems like it has only gotten involved through a monetary investment, but this may signal an urge to get back on the ground in China.

Massive growth could come from China, but only if these companies commit to the market

Entertainment companies can benefit from growth in China as hundreds of millions of Chinese consumers become regular movie viewers in the coming few years. Disney Studios president Alan Bergman said that "Disney's collaboration with [Shanghai Media Group] adds an exciting chapter of new stories for the next generation of global Disney fans." Smart investors will keep watching to see which companies, such as Disney, Dreamworks, and IMAX, take advantage of this trend and produce content specifically for Chinese audiences by committing to on-the-ground operations. These companies will surely win a piece of this market.