Source: Walgreen.

Walgreen (WAG +0.00%) was rising by nearly 3.3% on Tuesday after reporting solid earnings for the second quarter of fiscal 2014. The drugstore leader operates a solid business in a defensive industry, and the stock is fairly valued in comparison with competitors such as CVS Caremark (CVS +1.56%) and Rite Aid (RAD +0.00%). Is Walgreen a buy, hold, or sell after reporting earnings?

Healthy performance

Sales came in at $19.6 billion during the quarter, a 5.1% increase versus the same period in the prior year and marginally above analysts' estimations of $19.5 billion. Total comparable-store sales increased by 4.3% during the quarter, and front-end comparable store sales grew 2%, while customer traffic in comparable stores decreased by 1.4% during the period, and basket size increased by 3.4% versus the prior year.

Prescription sales accounted for a big 62.2% of sales during the quarter, increasing by 7% versus the prior year on the back of a 5.8% growth rate in prescription sales at comparable stores. According to management, Walgreen increased its retail prescription market share by 20 basis points to 19%, based on data from IMS Health.

Revenues were quite strong on several fronts, but earnings per share came in below expectations at $0.91, versus an average Wall Street analyst estimate of $0.93.

Margins during the quarter were negatively affected by multiple factors, such as slower generic-drug introduction, a less severe flu season, a notoriously harsh winter with negative implications on customer traffic, and aggressive promotions hurting margins on front-end sales.

Solid fundamentals

With almost 8,700 locations in all 50 states, Walgreen is a leading player in the pharmacy industry, and the company's wide geographical presence provides a valuable competitive strength. Opportunities for differentiation are minimal in the industry, so consumers tend to go to the drugstore offering the most convenient location, and Walgreen is well positioned from that point of view.

The company's business is supported by secular tailwinds, as demand is expected to grow strongly over the coming years because of factors like an aging population, broadening health-care insurance coverage, and technical advancements in the health-care industry.

Walgreen plans to increase its store base by between 55 and 75 new locations in fiscal 2014, and store base expansion will likely remain at moderate levels in the future. On the other hand, a maturing store base usually generates growing profit margins because of enhanced efficiencies over time.

Competitive landscape

With more than 7,600 stores, CVS is Walgreen's main competitor, and the company has interesting scale advantages by combining its pharmacy retail operations with its position as one of the biggest pharmacy benefit managers in the United States.

CVS reported a total increase of 4.6% in sales during the fourth quarter of 2013, with the pharmacy services segment growing by 5.2% and retail pharmacy operations expanding by 5.6% during the quarter. Retail pharmacy same-store sales increased by 4% during the period, so Walgreen and CVS are generating similar financial performance lately.

With less than 4,600 stores, Rite Aid is materially smaller than Walgreen and CVS, but management seems to be taking the company in the right direction, as Rite Aid has been leading an impressive turnaround over the past several quarters by improving profitability and stabilizing sales trends.

On the other hand, Rite Aid is still underperforming its bigger competitors. Same-store sales increased by 1.5% during the five weeks ended on March 1, and pharmacy same-store sales increased by 3.1%, but front-end same-store sales declined by 1.8% during the period.

Fair valuation

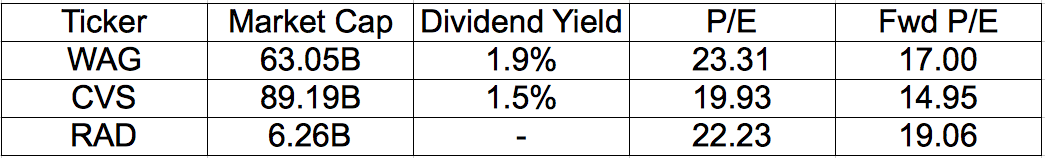

When comparing valuation ratios for Walgreen versus CVS and Rite Aid, the company looks fairly valued. Walgreen is a bit more expensive than CVS in terms of P/E and forward P/E ratios, but the dividend yield is more attractive at 1.9% for Walgreen, versus 1.5% for CVS.

Data source: FinViz.

Rite Aid trades at a premium P/E versus both Walgreen and CVS, which is probably a reflection that investors expect the company to continue on the road to recovery over the coming years, and the company pays no dividends.

Speaking of dividends, that's one of the main advantages of a position in Walgreen. The company has paid recurrent dividends for 81 consecutive years, and it has raised those distributions for the past 38 years in a row, including a big increase of 14.5% announced last July.

With a safe payout ratio in the neighborhood of 36% of earnings estimates for fiscal 2014 and a sound business generating reliable cash flows, investors have valid reasons to expect growing dividends from Walgreen in 2014 and beyond.

Bottom line

Walgreen is a market leader in a mature industry, so growth rates will probably remain at moderate levels in the coming years. The business is supported by strong secular tailwinds, and the stock trades at a reasonable valuation. If you are looking for a reliable company distributing consistently growing dividends over the years, then Walgreen may be just what the doctor ordered.