With unprecedented growth last year in Macau, every major casino company is looking to build new and bigger resorts on the island. Las Vegas Sands (LVS 0.17%) is planning its newest attraction, The Parisian Macau, which is scheduled to open in 2015. This $2.7 billion integrated resort will include more than 3,000 hotel rooms and suites, roughly 450 table games, 2,500 slot machines, a retail mall, and a replica of the Eiffel Tower at 50% scale.

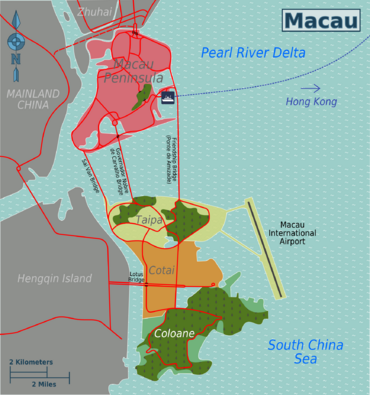

What's the one thing that that could stop this incredible growth? Macau is running out of room to keep growing. It is, after all, just a small island. The government has already "reclaimed" sections of land by filling in waterways, by literally importing sand, dirt, and other materials to create hard land where the water once was, to make more usable space on the island. This strategy can only add a certain amount of space, but Macau may have another solution in by way of a neighboring island.

Hengqin Island, a hopeful savior to Macau's space problem. Photo: Hengqin.com.cn

Welcome to Hengqin: Macau's neighboring special economic zone

Just to the west of Macau, separated by the Lotus Bridge, is Hengqin Island. Within the Zhuhai district of Guangzhou, and technically part of China's mainland, Hengqin has already been designated as a "special economic zone" which provides tax and other business development advantages that other Chinese cities do not.

Gambling is not legal in Hengqin, since the region is still part of the mainland where gambling is forbidden. However, the area should prove to be a great spillover for guests and tourists who are gambling just across the bridge in Cotai. Macau only has 28,000 hotel rooms, but has an average daily visitor count of 77,000, according to Citi analysts.

Map: WikiTravel.

The current drop-off point for visitors to Macau in the north is a choke point that often causes long wait lines. Opening up another entry point on the West side of the island would relieve this problem. And because that new entry point is at the booming Cotai strip, it encourages more visitors to resorts positioned there. That would be good news for companies such as Melco Crown (MPEL +1.65%), which Citi analysts have said has the best positioned resort in Cotai with its new Studio City. When their own new Cotai resorts are completed in 2016, MGM Resorts (MGM +1.66%) and Wynn Resorts (WYNN 0.53%) hope to draw in more players through Hengqin as well.

Photo of Hengqin resorts. Photo: Hengqin.com.cn

According to its government website, Hengqin island has about 28 kilometers of open land available to develop. The island itself is actually much bigger, though about two-thirds is reserved for preservation efforts. While visitors can't gamble in Hengqin, they have other entertainment options for the whole family, such as Chimelong theme park with its 1,888-room resort. This is the first of 10 proposed similar resorts planned in an effort to turn the isle into "the Orlando of China."

View From Macau Tower, Hengqin island is in the background. Photo: WikiCommons.

Hengqin has a strong chance of attracting investment dollars for new development. Hengqin is one of five "new areas" in China that receive preferential tax treatment support. Other such special economic zones in Tianjin and Shanghai have exploded in the years since their establishment, attracting businesses looking to take advantage of growth in China with a low tax rate.

Chinese developers plan for the growth of Hengqin. Photo: Hengqin.com.cn.

Supporting mass-market growth

Officials are working hard to ensure local infrastructure will support growth. Photo: Hengqin.com.cn.

Casinos in Macau have traditionally focused on VIPs, the high rollers of the gaming industry. VIPs require perks such helicopters from Hong Kong to the island, as well as luxury suites. These perks can be expensive and can drain per-player margins. However, new industry trends show that casinos can make more profit by focusing on mass-market gamers. This gaming segment provides higher margins for the casinos, and more players means more profits.

Morgan Stanley estimated that in 2014 growth from mass-market gamblers will top 28% in Macau, while VIP gamers will deliver 13% growth. Wynn Resorts' 2013 fourth-quarter profit increased an astounding 92% year over year, led mainly by mass-market gaming growth in Macau. The company reported 35% growth in this segment of gamers in Macau, while VIP gaming grew by 24%.

Better transportation coming

Chinese developers are planning to extend intercity railways from the larger mainland city of Guangzhou to Hengqin Island by 2016, which is expected to then link to Macau in the future. Trains on the current Guangzhou-Zhuhai railway have been running at about 150 kilometers per hour since January 2013. Upon completion of the Hong Kong-Hengqin-Macau Bridge in 2016, Hengqin will become the only place in Chinese mainland directly connected to both Hong Kong and Macau.

The one issue that is slowing Hengqin as an option: Entry checkpoints

Visitors from Hengqin to Macau must pass through two border checkpoints, both leaving the mainland when leaving Hengqin, and then again for entering Macau, though the checkpoints are back to back. As a solution, Hengqin could sit between the two checkpoints. Visitors would go through China's border check before entering Hengqin. Then players could gamble in Macau and stay in Hengqin, only having to pass through the relatively easy Macau entry checkpoint before gambling. Still not ideal, but not a deal breaker for guests who want to stay in Hengqin.

Foolish takeway: Hengqin could be a "game changer?

Sands China President Edward Tracy has said that "Hengqin is the game changer for Macau." As Citi noted, Hengqin Island is a long-term play, and its prospects are underappreciated. But with the only place in China where gambling is allowed rapidly running out of space, Hengqin's supporting role seems to be a sure bet.