Air delivery and freight services provider FedEx (FDX +2.60%) didn't have a merry Christmas as cold weather and a pile-up of last-minute online orders made difficult to get its packages delivered. And FedEx did not just upset customers with delayed Christmas presents; it also failed to cheer analysts with its third-quarter results. True, the numbers were better than last year's, but revenue of $11.3 billion and earnings of $378 million, or $1.23 per share, were below the Street's expectations.

Surprisingly, the company's share price did not react much to this series of bad news, hinting that investors don't want to be shortsighted and miss out on FedEx's future prospects. After all, the stock's appreciation has been more than 150% in the last five years. Here are three positive factors that suggest FedEx's story is strong.

FedEx Ground carrier. Source: Wikimedia Commons.

Restructuring program on track

FedEx's restructuring program (initiated in October 2012) looks encouraging. The plan to take out $1.6 billion from the Express segment's 2013 costs by the end of the 2016 fiscal year seems to be on track, and could help garner higher earnings. Express is FedEx's largest business segment, and its profitability has dwindled over the past few years as more priority international services customers opted instead for economy services.

But FedEx may have moved the needle -- in the recent third quarter, Express' operating income grew 14% to $135 million, and operating margin improved to 2% from 1.8% in the year-ago period. The 2% may not look like much, but this is just the beginning -- FedEx has already clarified that the full benefits of its program will become apparent only in the 2015 and 2016 fiscal years, when the voluntary employee retirement scheme bears results.

The restructuring plan focuses on five things: optimizing staff costs and build process efficiencies; using more fuel-efficient planes for the air fleet; consolidating surface routes for domestic deliveries; boosting international profits through cost cuts and productivity gains; and extending the services offered by Express.

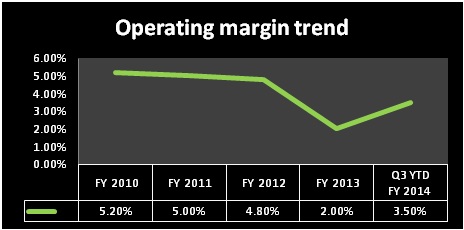

Source: FedEx Q3 fact Sheet. Chart made by author.

FedEx Ground -- a key driver

The Wall Street Journal estimates the total ground package segment in the U.S. to be about $32 billion in value, and United Parcel Services (UPS +2.31%) holds the majority of this market. Historically, FedEx has focused more on air deliveries, but maintaining margins in the face of high fuel prices has been difficult. So, over the past few years, the company has started to build its ground delivery business.

FedEx's journey began with the acquisition of the regional delivery company, RPS, in the mid-1990s, which has evolved into the FedEx Ground segment -- it handles smaller packages that are less time-sensitive and operates in the U.S. and Canada. The company also started FedEx Home Delivery, a money-backed fully dedicated residential delivery service. The $11 billion FedEx Ground segment has proved to be a big driver for both sales and profits.

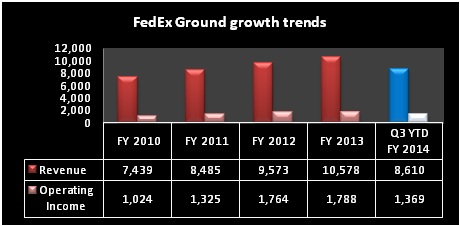

Source: FedEx Q3 fact Sheet. Chart made by author.

Profitability in ground delivery is much higher than other delivery segments. Having the bigger ground delivery business has always helped UPS post higher overall margins compared to FedEx. In respective 2013 fiscal years, UPS boasted an operating margin of 12.7%, while FedEx's was only 5.8%. Nearly 44% of UPS's revenue came from ground operations while FedEx's Ground division made up less than 25% of the top line.

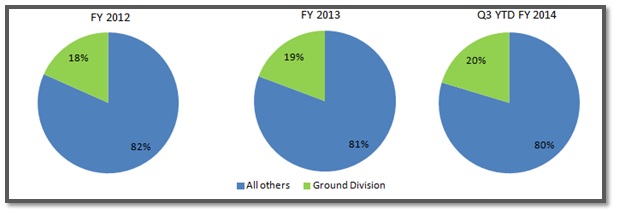

But in the last three years, the proportion of FedEx Ground division revenue has increased steadily, and the trend could continue, which bodes well for the company's future earnings prospects.

Growing proportion of FedEx Ground's revenue

Source: FedEx 2013 Annual Report. Chart made by author.

Growing demand for e-commerce

FedEx's future prospects are tied to the evolution of the e-commerce industry, both domestically and globally. The enormity of the opportunity is clear from the three forecasts the company has cited in its 2013 annual report.

According to data from Forrester research:

- Global e-commerce sales could rise to $1 trillion by 2016, accounting for 1% of global GDP.

- Online spending in the U.S. could reach $371 billion in 2017, up 42% from $262 billion in 2013.

- Online spending could account for 10% of total retail spending in the U.S. by 2017.

Obviously, online retail giants such as Amazon.com (AMZN +1.60%) would be the big beneficiaries. Amazon is the world's largest e-commerce retailer, and it saw 22% sales growth in 2013 to $74.45 billion. Amazon's success hinges on the efficiency of its delivery management, and the behemoth had even considered acquiring FedEx a couple of years ago. While the plan didn't come to fruition, Amazon and other e-retailers will keep working with their delivery partners to maximize the e-commerce opportunity. Not a bad proposition for the likes of FedEx and UPS. In the third quarter, FedEx Ground's average daily volume grew 8% purely on the back of huge online orders.

The takeaway

Improving margins in the Express business, a growing Ground segment, and burgeoning e-commerce are positive things for FedEx. These could be the company's pillars of success in the years to come. FedEx is on track to make the most of these opportunities, and gearing up to usher in an era of more profitable growth.