Intel's CEO showing off Edison. Source: Intel

At Intel's (INTC +0.22%) Developer Forum, CEO Brian Krzanich showed off the company's first effort for "wearable" devices and the "Internet of Things," known as Quark. At CES 2014, Krzanich took the stage and showed off its "Edison" platform for embedded devices. This platform essentially fit in an SD-card and sported a second-generation iteration of its Quark architecture. However, Intel just gave Edison a makeover.

Quark looked pretty terrible

Even as an Intel bull, it was hard to get excited about the Quark micro-architecture. The 32-nanometer and the 22-nanometer iterations were essentially modernized versions of the very old Intel 80486. Even implemented on a modern manufacturing process (and clocked higher), the architecture is antiquated. To put it into context, CEO Brian Krzanich noted that the Quark core built on the 32-nanometer process was one-fifth the size of Silvermont (Intel's latest shipping Atom core on 22-nanometer).

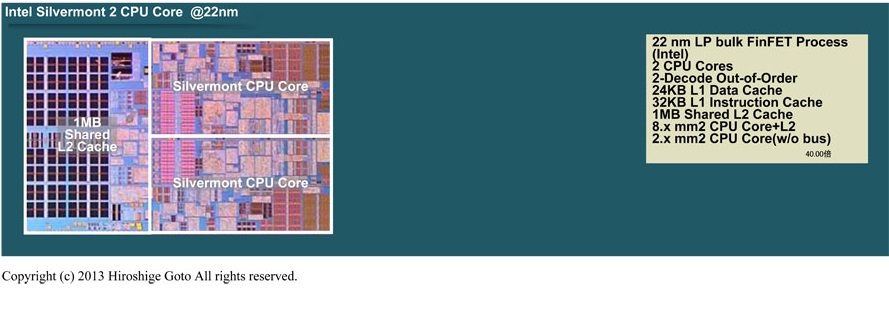

What does this imply? Well, according to journalist Hiroshge Goto, a dual-core Silvermont comes in at roughly 8mm^2 (this is along with a fairly large 1MB block of L2 cache). Just eyeballing the die-shot, the two CPU cores look as though they make up 60% of the block. This would imply that a single Silvermont core works out to be about 2.4mm^2. A fifth of that implies a core size of 0.48mm^2. An ARM (ARMH +0.00%) Cortex A7 – which is significantly higher performance architecture – is roughly that size.

Edison gets a massive upgrade

With the original Quark offering lukewarm performance, it seems that Intel has decided to give its Edison platform a shot in the arm by equipping it with dual Silvermont cores running at 500 MHz (Silvermont cores run at about 2.4 GHz in top bin tablet/phone implementations). This should give substantially better performance, but of course at higher power consumption and die-size. That said, the performance/power gains are likely to show this implementation of Edison to be much more efficient on both performance per watt and performance per mm^2, so this is an unequivocal "win" for Edison.

The future, however, could see a much better Quark

The first Quark isn't very impressive on 32-nanometer, and it is unlikely to do much better on the 22-nanometer FinFET process – a fundamental architecture shift is needed. Once Intel has invested the proper amount of money/time into developing future Quark processors, and once it can offer highly integrated system-on-chip products based around future Quark cores, then Intel could very well be a strong contender in the low-power/low-cost embedded market (i.e. the "Internet of Things"). Until then, though, this is ARM's territory (via its licensees) through and through.

Atom is a good stopgap, but Quark needs to compete for Intel to succeed in IoT

It's good to see Intel aggressively push its Atom cores into new markets, but for Intel to be a truly viable player in many of the low power Internet of Things applications that ARM has talked about at length, it will need a more competitive, smaller, and lower-power processor core. Intel can certainly afford to invest in this, so it'll be interesting to see what solution Intel's architects come up with longer term and just how much money Intel could conceivably make in this market.