For the last couple of years, Intel (INTC +3.39%) and the rest of the PC industry have expected a nice seasonal uptick for the back-to-school selling season, only to be left disappointed. During 2012, the "pitch" was that Microsoft's (MSFT +2.23%) Windows 8 and touch would renew interest in the PC. In 2013, Intel expected that its next-generation Haswell processor would drive sales back up, only to fall flat. During that entire time, Intel continued to make a fatal error that it appears to try to rectify this year.

It's the low end, stupid!

While Intel's Haswell processor was absolutely fantastic about driving tablet-like battery life in PC/convertible form factors, there were two problems with the Haswell ramp:

- It started late. While the desktop version of Haswell was readily available in June 2013, most PC vendors didn't have Haswell-powered Ultrabooks/convertibles until the end of the year, essentially missing the back-to-school season with these new chips.

- Haswell, while fantastic, is more of a high-end notebook part. So, while you had these wonderful high-end machines in the September/October timeframe, the low end of the market (the one susceptible to cannibalization by tablets) was still serviced by hobbled variants of the already relatively inefficient Ivy Bridge platform.

Intel's Haswell-ULT, the star of the MacBook Air's show. Source: Intel.

So, how does Intel finally solve this problem?

Bay Trail-M is a misused hero

Let's face it: Today's low end laptops make a ton of compromises. Even with a low power 7.5 watt Bay Trail-M (this is a low power system-on-chip for cheap PCs based on Intel's best tablet processor), OEMs are tempted to go cheap on important aspects of the system such as the display, storage subsystem, and chassis thickness. The Samsung (NASDAQOTH: SSNLF) Chromebook is a fine example of what an Intel OEM partner should be able to do with Intel's low power Bay Trail-M platform:

Samsung's hot-selling Chromebook, an update to which is due shortly. Source: Samsung.

Indeed, Samsung offers a slick, fast, and affordable machine that -- in many ways -- offers a more pleasant user experience than many low-end Microsoft Windows based machines. Naturally, Samsung benefits from the "free" Chrome while OEMs using Microsoft's Windows need to hand over a license fee, but Microsoft is allegedly cutting OS license costs for low-end machines precisely to allow Windows OEMs to be more competitive.

Unfortunately, the PC industry seems dead-set on fulfilling the self-fulfilling prophecy that the "PC is dead" by trying to cut corners and save a buck or two here or there. This leads to compromised systems such as the following machine from ASUS:

A typical, compromised low-cost Windows machine based on Intel's Bay Trail-M. Source: Amazon.com.

If this machine were to, instead of a slow 500 GB 5400 RPM (this is as slow as it gets these days) hard disk drive, include a 64GB or even 128 GB solid state drive, then it would be significantly more appealing and could help drive wallet share back to the PC. Users don't know why their iPads feel significantly smoother than these lower-end PCs, but a big part of it is the storage subsystem -- a 5400 RPM hard disk drive is simply unacceptable and a huge bottleneck for today's microprocessors.

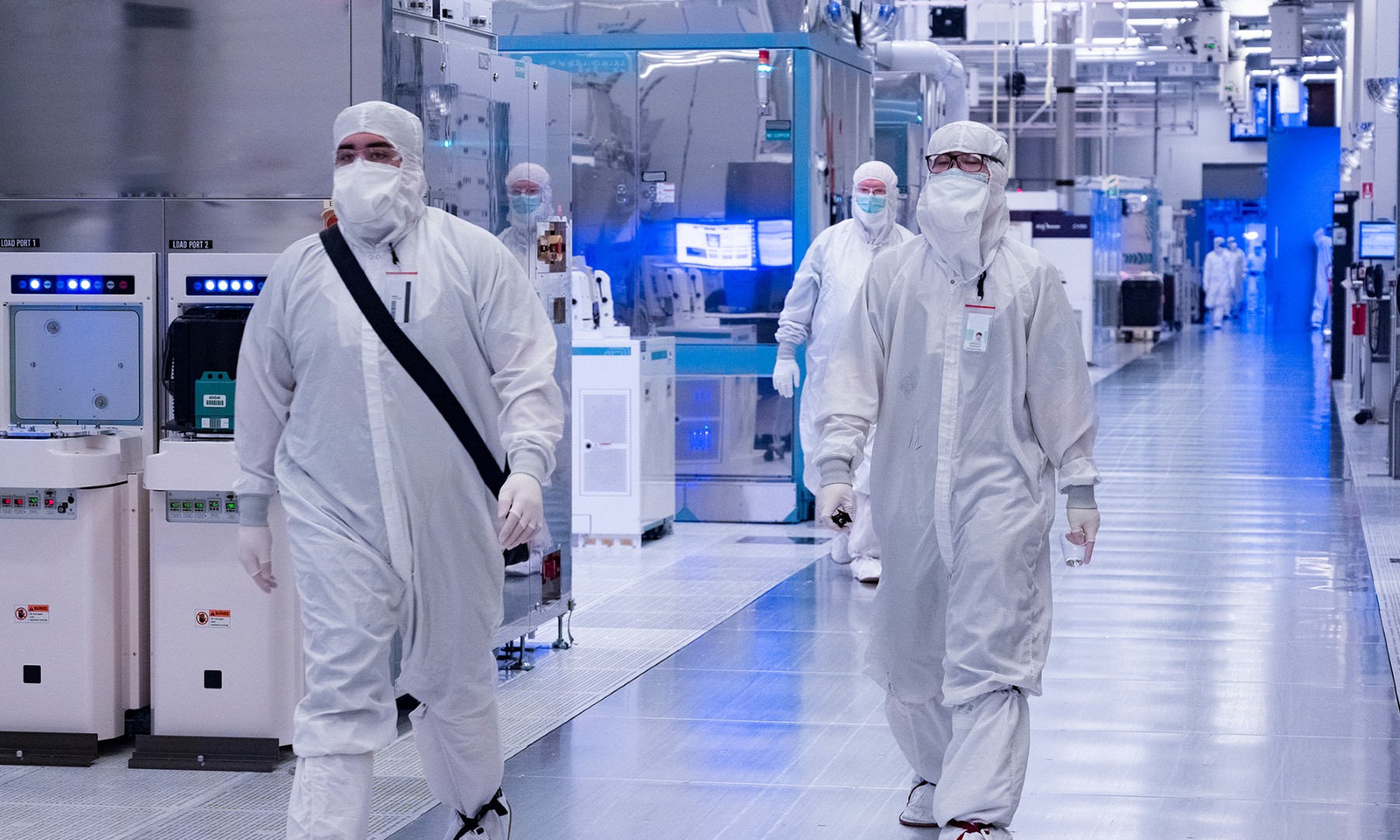

Intel lowers Bay Trail-M bill-of-materials cost, urges OEMs to improve quality of systems

At Intel's Developer Forum in Shenzhen, China, the company hosted a presentation titled "2014 Intel(R) Platform, Bay Trail-M/D: Platform Cost Reduction." The focus of the presentation was on how Intel was updating/refreshing its Bay Trail-M/D processors for the low end of the PC market. These updates would not only add new functionality, but they would meaningfully reduce the cost of the components that are required to build a system around Intel's chips.

Source: Intel.

Notice in the last bullet point how Intel is giving its customers a pretty strong hint that instead of using the bill-of-material cost savings to just capture more margin per unit or to drive selling prices they should be making more compelling devices. While this may be a tough pill to swallow for many of the PC makers, many of whom are basically running their PC businesses "for cash" until they can transition to phones/tablets, this is how Intel and its partners will thrive long term. It's now up to the OEMs to deliver affordable but sleek designs for back-to-school.