Traditionally, the carbonated-beverage industry has been seen as almost unshakable. Regarded as a product almost as necessary as toilet paper, the consumer staple for a long time enjoyed rock-solid international sales regardless of the macro-economic backdrop.

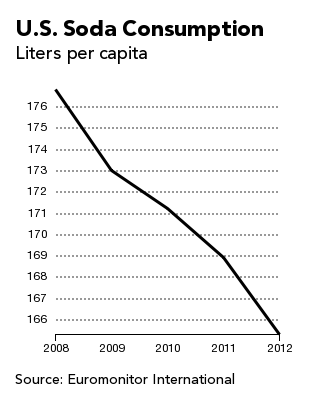

However, over the last few decades this situation has been changing. Soda sales seem to be in free-fall across many parts of the United States, largely as a result of shifting consumer habits which now favor more healthy alternatives. The question for Foolish investors, of course, is what does this mean for consumer-staples juggernauts such as Coca-Cola (KO +0.43%), PepsiCo (PEP 0.19%), and Dr Pepper Snapple Group (DPS +0.00%)?

Shift in consumer preferences

In essence, dropping soda sales are nothing particularly new. After growing throughout most of the 1990's, they started slowing by 1999 and actually began to drop by around 2005. Health concerns are perhaps the biggest contributor to the drop in sales, as critics believe the soda industry has played a large role in the US obesity epidemic. Additionally, light soft-drink sales have suffered from worries over the potential health risks of artificial sweeteners.

Wikimedia Commons

According to a recent Beverage Digest newsletter, carbonated soft-drink sales hit their lowest point since 1995, with 2013 marking the ninth consecutive year of declining soda sales. The volume of diet soda drinks is falling faster than regular carbonated soft drinks, with Diet Coke sales plunging 6.8% last year versus a 0.5% decline in regular Coke sales. Overall, soda sales are estimated to have dropped by 3% in 2013.

There are some bright spots in the industry though. Caffeinated energy drinks are still seeing strong demand, up 5.5% last year, while ready-to-drink coffee volume was up an impressive 6.2% last year. Sales of sports drinks also grew, while fruit-drink volumes dropped 1.9%. As such, it seems as if makers of carbonated soft drinks will have to come up with something new in order to sustain sales.

Writing on the wall

So what does this mean for the major US soft-drink producers? Coca-Cola is the clear leader in the US soda market, with nearly 1.5 times the market share of its closest competitor, PepsiCo. In order to address the slowing sales trend, Coca- Cola will be working on product innovation.

Perhaps most importantly, the company will be switching to the natural sweetener stevia for its diet soda brand line-up. Additionally, the company is looking to cut some $550 million to 660 million in costs and is hoping that its partnership with Keurig Green Mountain's home carbonation system, Keurig Cold, scheduled for this year will boost sales.

Meanwhile, PepsiCo has also been looking for ways to boost its ailing diet soft- drink business, also experimenting with new sweeteners such as Sweetmyx, which is not a sweetener as such but rather a flavor modifier. Also, it has been experimenting with natural sweeteners such as stevia. Like Coca-Cola, PepsiCo has been trying to get into the home carbonation market, partnering with European beverage-system company Bevyz, an avenue which still appears to offer lucrative opportunities for growth.

Dr Pepper may have even more to worry about, as it is the most highly reliant on the US market of the companies mentioned here. The company derives more than two-thirds of its revenue from this region and as such is more sensitive to US regulatory changes and shifting consumer preferences. The company already has a partnership with Keurig for its Snapple iced teas and like its rivals will probably be looking to increase its footprint in the home carbonation market.

The bottom line

Things are difficult for soda manufacturers at the moment, as health concerns are leading consumers to reconsider their beverage preferences. With the ninth consecutive yearly drop in soda sales last year, the main soft-drink manufacturers are scrambling for ways to prop up revenue growth.

First of all, they are switching to natural sweeteners, which may rekindle consumer confidence in diet sodas. Secondly, all three manufacturers are looking to partner with home carbonation companies, as this category still seems to be delivering solid growth. In any case, it seems as if the industry will have to reinvent itself to regain its popularity with consumers.