Investors looking for a hot sector of IT spending should look no further than data analytics. IT companies like IBM (IBM +0.50%) and Oracle (ORCL +7.23%) managed to generate growth with their analytics solutions. In addition, there is also a burgeoning opportunity for companies like Verint Systems (VRNT +0.00%) and NICE Systems (NICE +0.26%) to add analytics solutions to their core customer interaction capture solutions. Verint gave results recently, and there was much to suggest that the company's prospects have a lot further to run in 2014.

Verint Systems tops guidance

Verint and fellow Israeli company NICE Systems are world leaders in developing hardware to capture customer interactions. However, it's not just about product sales; both companies are developing the capability to offer software that analyzes that captured data. The idea is that customers will appreciate the opportunity to buy a total solution from one vendor, rather than a plethora of sellers across multi-platforms. It's a compelling story, at least from the look of Verint's latest results.

After having raised guidance for the third quarter, Verint promptly delivered revenue at the high end of its estimates. Moreover, fourth-quarter diluted EPS came in at $0.91, higher than the guidance of $0.81-$0.86. In addition, the company's 2015 revenue guidance of $1.08 billion-$1.13 billion implies a growth rate of 21%. Furthermore, non-GAAP EPS is forecast to rise by more than 16% at the mid–point of its guidance.

While these figures are impressive, they are partly due to the January 2014 acquisition of customer service solutions company KANA Software. Verint expects KANA to generate $140 million-$150 million in revenue during calendar year 2014. The KANA deal is an integral part of Verint's plan to double the total addressable market for its offerings to $6 billion, mainly via KANA increasing Verint's potential to sell actionable intelligence solutions. NICE Systems and Verint have seen growing demand from customers for analytics, so the KANA deal makes perfect sense for Verint.

IBM and Oracle report strong analytics growth, too

Foolish investors could have expected a strong set of numbers from Verint because IBM and Oracle reported good results with their own analytics solutions. Overall, Oracle didn't report impressive results in its third quarter (new software licenses and cloud subscriptions came in below the mid-point of guidance), but on the conference call, Oracle's CEO, Larry Ellison, spoke bullishly of data analytics:

Our data analytics business is going to take off and of course the intention is to sell a lot of those data analytics products in the cloud as opposed to our premise. We will give customers a choice, but will offer those data analytics in the cloud, data analytics on premise... ...an opportunity once again to move to the front of the pack to become the number one data analytics company in the world.

Similarly, IBM's overall revenue was down 5% in its fourth quarter, but Fools should note that IBM hit its target for $16 billion in revenue from big data analytics-related revenue a year earlier than expected. Furthermore, it raised its 2015 target to $20 billion, which is a good sign for the data analytics industry.

How Verint Systems is transforming its business

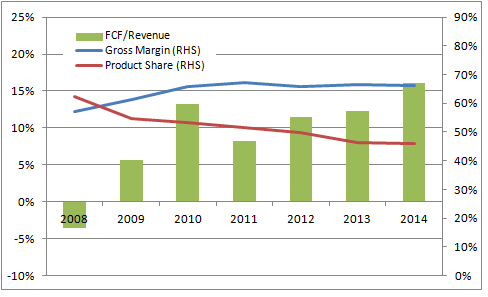

The KANA deal creates an opportunity for Verint to add customer relationship management, or CRM, to its existing workflow optimization solutions. It also adds 900 KANA customers to Verint's installed base of 10,000. It's another acquisition in line with a gradual shift in how Verint's generates revenue. The following chart illustrates how this is making the company a more attractive investment proposition.

Source: Verint Systems Presentations

Product share of revenue has declined as services revenue and free-cash flow conversion have increased; software and service-based businesses tend to generate more free-cash flow. The one disappointing aspect is that operating margins are forecast to be flat this year.

The bottom line

On a forward P/E ratio of 14.4 times estimated earnings, Verint still looks like a good value. There is obviously an execution and integration risk with the KANA, but Verint will be supported by a positive industry backdrop -- at least if what IBM and Oracle are reporting is a good barometer. Verint has good growth opportunities, and Foolish investors should watch for NICE Systems' earnings report at the start of May for confirmation of these trends.