The first quarter is in the books and earnings season is now upon us. And there are three things every investor should watch when Bank of America (BAC +1.07%) announces earnings April 16.

1. Top-line revenue of global wealth and investment management

Bank of America truly is a diverse bank and receives income not only from its consumer and corporate lending and banking services but also its wealth management and investing unit for individuals. In 2013, its, global wealth and investment management (GWIM) business delivered $3 billion in income, representing nearly 20% of the total for Bank of America.

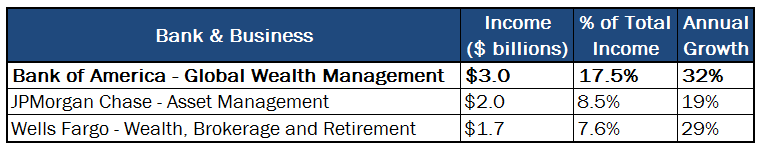

Wells Fargo (WFC +0.18%) and JPMorgan Chase (JPM +0.36%) also have wealth management units, but they are not nearly as large, nor do they represent the same importance to the income profile for the banks relative to Bank of America's division:

Source: Company investor relations.

As you can see, while Wells Fargo and JPMorgan Chase both saw impressive growth in the bottom-line results, Bank of America was able to outpace each of them there as well.

When the full-year 2013 results were announced, Bank of America CEO Brian Moynihan said of the GWIM line, "We continue to break records on top line and profitability. We just recorded the best year in the Company's history for wealth management results. We have more customers and clients doing more business with us and now we manage client assets of over $2.4 trillion."

As a result, in the first quarter of 2014 investors should look to see if the impressive growth continues -- total revenue grew by 8% from 2012 to 2013 -- which would be further reason for optimism from the line with a staggering return on capital of 30% last year being able to fuel growth for the bank as a whole.

Source: Company investor relations.

2. Improved efficiency

Bank of America has long trailed peers in its efficiency ratio, which essentially measures the cost of each dollar of revenue. As shown in the chart to the right, even despite the turnaround, 2013 was no exception.

As with any cost, it's a number you'd like to see as low as possible, and a back-of-the-envelope calculation reveals it could add a staggering nearly $11 billion to Bank of America's pre-tax income if it dropped its efficiency ratio to 65%.

While the monstrous $9.5 billion settlement will be reflected on Bank of America as a whole skewing its numbers, dive into its four principal business lines -- consumer, business and investment banking, plus wealth management -- to see how they're faring. All four saw improvements in their efficiency ratios from 2012 to 2013, and one would like to see this continue for years to come.

3. More security

One of the biggest headlines from the first three months of the year was the release of the Federal Reserve stress tests. While Bank of America passed and had its plan to raise its dividend buyback shares approved, its results were somewhat troubling. Despite having higher initial levels of capital and liquidity than almost all of its four peers, under the stressed scenario, it got resoundingly crushed.

It was encouraging to know the Federal Reserve felt comfortable approving the plans of Bank of America even with the seemingly poor results, but it would be nice to see Bank of America continuing to work toward better positioning itself from a risk perspective in the future.

Although improvements in capital and liquidity won't garner headline attention or raise many eyebrows, improvement in this regard for Bank of America would be nice to see.