Let's rewind the clock to 2012, when it became painfully obvious to investors that Ford (F 1.09%) had dropped the ball on getting into the world's largest automotive market, China. At that time, executives acknowledged the mistake and agreed the move should have been made half a decade ago.

But there's no use crying over missed opportunities, and the company set forth an ambitious plan to spend roughly $5 billion to double its production capacity, sales, and market share in China. Already, Ford is seeing proof that its plan is working.

Sales reach a milestone

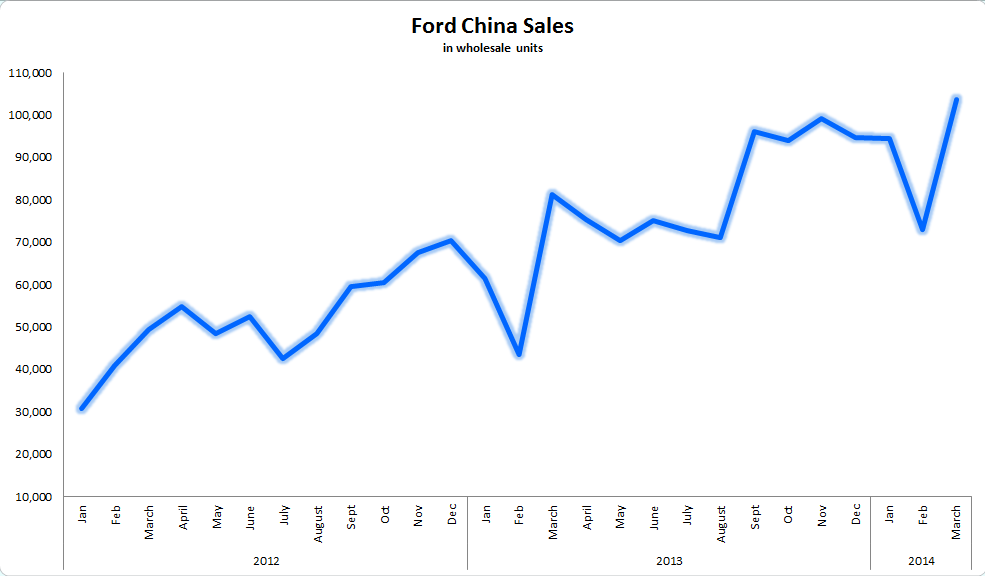

Ford sold 103,815 wholesale vehicles last month in China, which was the first time the Dearborn automaker's results topped 100,000 sales in a single month. Its March performance was a strong 28% improvement over that of March 2013; it capped off an excellent first quarter that saw sales surge 45% over last year's corresponding period.

Graph by author. Source: Ford's China sales releases

While Ford's market share in China still trails those of the two largest foreign automakers, General Motors and Volkswagen, it's caught up to the rest of the pack in a hurry. Ford's 2013 sales increased enough in China to edge out major Japanese rivals Toyota and Honda, both of which have struggled to fully recover from a Chinese consumer backlash caused by a territorial dispute between the two countries. Ford took another step forward this year -- the company's first-quarter results, of 271,321 vehicles sold, only trailed Hyundai's by 1% and Nissan's by 4%. As Ford continues on its plan to launch 15 vehicles in China by 2015, don't be surprised if it manages to top Hyundai or Nissan in sales, sooner rather than later.

For Ford, being within striking distance of becoming the third-best-selling foreign automaker in China before mid-decade is a definite victory.

Furthermore, Ford's success in China emphasizes a turnaround in the company's ability to compete with foreign automakers in passenger car sales -- a segment for which it had once been left for dead. Consider that roughly a decade ago most consumers, foreign or domestic, wouldn't have given Ford's passenger vehicles a chance while shopping around. That would have to change for Ford to expand successfully in China.

It is good news for the automaker's investors that consumers are giving Ford's passenger cars a chance; they are becoming a popular option in China.

Ford's Focus was China's best-selling nameplate in 2013. Source: Ford

Ford's passenger cars accounted for 204,196 of its 271,321 sales in the first quarter in China, and the Focus continues to draw strong demand after becoming the country's best-selling nameplate last year. Ford's Mondeo (Fusion) has caught on quickly and is improving sales at a rapid clip. Producing popular vehicles isn't the only trick to being successful in China: Automakers must mesh well with their Chinese partners.

"Ford expanded their dealer network and put together a strategy to focus on the Chinese market because this is the market that is really growing," Frank Schwope, an analyst at NordLB, told Bloomberg. "You have to produce in China to really earn money there, and you have to find joint-venture partners to help you build out those new plants. This is what Ford is doing well now."

Ford's joint venture offerings continue to experience healthy sales as well, and the company is preparing to increase its production capacity for additional demand. Ford has six major facilities under construction in its Asia-Pacific region. Two of those facilities will begin production in China this year and another two will follow in 2015.

What's it all mean?

Ford's surging sales in the world's largest, and still fast-growing, automotive market, is far from over. As the automaker continues to unleash new vehicles in China, look for it to challenge Nissan for the third-best-selling foreign automaker spot.

Expect China to represent more of the company's revenue. Ford expects its Asia-Pacific region to account for roughly 40% of company revenue by the end of the decade, compared to the current percentage of about 8%. This is great news for investors worried (not incorrectly) that Ford has become too reliant on its North American market for revenue and profits.

Ford's potential growth in China is one big reason to be bullish on the company. For investors, it's great to see signs that the company's ambitious plan is working.