How would you like to have surgery performed in a way that's been shown to reduce bleeding, speed up recovery time, and generally produce the same results as conventional methods? For most people, that's a no-brainer, and it helps explain why Intuitive Surgical (ISRG 1.49%) has performed so well as both a company and a stock.

But recently, shares are under a lot of pressure, as Intuitive announced preliminary first-quarter results that are well below what investors were expecting. Does this mean you can buy shares of the company -- which could rewrite how surgery is performed in America and across the globe -- for cheap?

Let's dig into why Mr. Market has soured on the company.

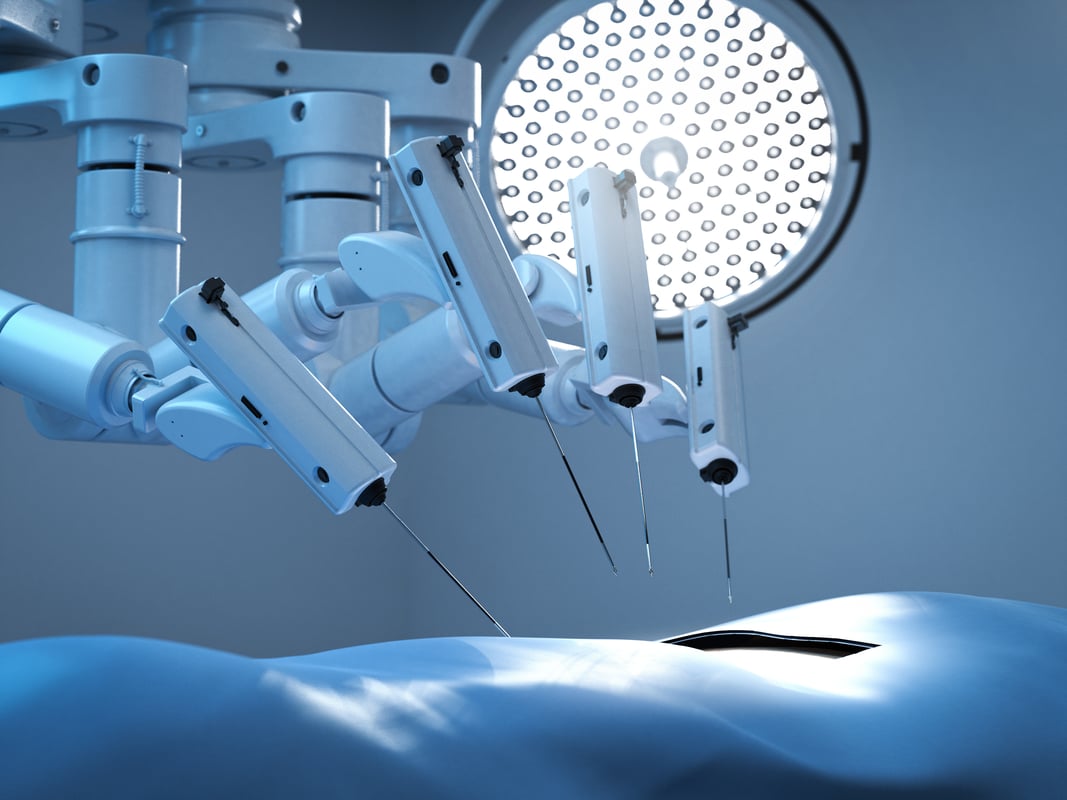

The new da Vinci Xi. Photo: Intuitive Surgical

No one likes a high growth stock with shrinking revenue

Intuitive won favor with the medical community by showing that procedures could be performed quicker, with less blood loss, and with speedier recovery times. The company likewise impressed investors with its consistently strong growth rates, and the fact that it had no competition in the world of robotic surgery.

But those trends came to a screeching halt last year. First, many in the medical community began to question whether or not it was really worth the additional cost to perform hysterectomies with the da Vinci as opposed to traditional surgical methods.

The negative mojo continued to pile up in the second-half of the year as -- for the first time as a public entity -- sales of the company's da Vinci systems showed serious signs of weakness. The primary culprit was believed to be the onset of the Affordable Care Act, and the economic uncertainties it created. Hospitals, it was reasoned, were far less likely to pay for a multimillion dollar machine in tight times.

And then yesterday, Intuitive came out with preliminary earnings numbers that were well below what many believed the company would report. Looking at the chart below, it's clear that the primary culprit was a drastic slowdown in sales of da Vinci systems (red section).

A shifting landscape in surgery

As it stands, the vast majority of procedures performed using the da Vinci fall under gynecology and urology. There's nothing wrong with that, but for an investor to believe that Intuitive is worth 27 times its earnings, there has to be more to the story. There are only so many of these operations to be performed, and there's a growing backlash in the medical community for their overuse.

In fact, Intuitive announced that there was "a low, single-digit decline in U.S. gynecologic procedures" during the first quarter of 2014. Though this trend could reverse itself, I believe investors would be wise to assume that doctors won't be overwhelmingly encouraging their patients -- especially hysterectomy patients -- to use of the da Vinci.

Is there a silver lining here?

What we have ignored thus far is the fact that just one week ago, Intuitive announced that it had come out with its newest surgical robot, the Xi. The robot is leaps and bounds above what was previously offered, as it allows for four-quadrant and unobstructed physical and visual access to the patient.

Source: Intuitive Surgical, via Engadget

Ever since I personally began investing in Intuitive, I've made it clear that I was doing so not because I thought the company would change and improve surgeries in just the gynecological and urological fields, but far more fields of surgery.

In 2010, the Center for Disease Control and Prevention estimated that there were a total of 51.4 million surgical operations performed in America alone. Hysterectomies -- where the da Vinci is most often used -- accounted for less than 1% of all these procedures.

By no means do I believe all surgeries will be performed with the da Vinci, but certain areas where Intuitive is focusing for future procedures have much larger volumes. For instance, thoracic surgery -- just one of six areas where Intuitive believes its robot can make surgery easier -- accounted for roughly 9 million procedures in 2010. That's a whopping 20 times the size of hysterectomy procedures!

Though there isn't a system-wide consensus on whether or not the da Vinci improves the medical outcomes from the procedures it performs, this usually doesn't take into account blood loss and recovery times. When patients learn that using the da Vinci can significantly reduce both of these, I see the value that Intuitive adds as being a bet worth taking in the future.

But its important to note that it may take years for these advancements to take place, and between now and then the company's stock price could go down even further. Because I'm a long-term, buy-to-hold investor, that really doesn't bother me.

Intuitive currently makes up just under 5% of my real-life holdings, but after getting time to digest what the company has to say during its conference call on April 22, I may strongly consider adding even more shares.

Everyone has to evaluate their own comfort with owning shares of Intuitive, but for me it's a long-term bet worth taking.