Perry Ellis International (PERY +0.00%) is an apparel company that designs, markets, and licenses its brand-name products. The stock has dropped by nearly half this year, and it has sparked the interest of many value investors. Last Thursday, fourth-quarter earnings results beat lowered expectations and gave the stock a small bump.

Yet with strong competitors like PVH Corp (PVH +2.85%) and Ralph Lauren (RL +1.39%) for its signature menswear lines, this stock may be stuck in neutral for a bit. Let's take a closer look at both the quarter and the competitive landscape for Perry Ellis International.

Earnings results clear a low hurdle

While the market may have viewed Perry Ellis' quarterly earnings beat (of only $0.06 per share) favorably, it's important to note that the company pre-released lower guidance for the quarter a few weeks back. To give some context, this result compares to EPS of $0.50 per share in the same quarter last year. Full-year results of $0.38 per share also beat the lowered expectations of $0.34-$0.37.

Revenues for Perry Ellis actually declined 16% for the quarter. The apparel sector is tough, but competitors Ralph Lauren and PVH both expanded revenues, 9% and 25%, respectively, in their most recent quarter.

Is it fair to blame the weather?

The explanation for Perry Ellis' rough quarter, as given by President and COO Oscar Feldenkreis, struck a familiar chord for retailers this season --he blamed it on the weather.

Feldenkreis stated: "We were disappointed with the results of fiscal 2014. The year saw significant challenges, with unseasonal weather, consumer indifference to apparel, and declines in mall and outlet-center traffic all negatively impacting our business."

Turning to a positive note, Feldenkreis mentioned the favorable results in licensing agreements, before he laid out more positive guidance for fiscal 2015. For the year to come, Perry Ellis management expects adjusted earnings per share in a range of $0.75 to $0.90, which would represent roughly double last year's output.

Examining the bull case for Perry Ellis International

The bull case for Perry Ellis typically centers around two key factors.

1. Licensing business

One of the exciting things about Perry Ellis is its licensing business. It's the largest profit driver for the company, it's expanding, and it's not capital-intensive. The bullish case for the licensing business, and the value case for Perry Ellis, is explained in further detail in this Foolish article by Mark Lin.

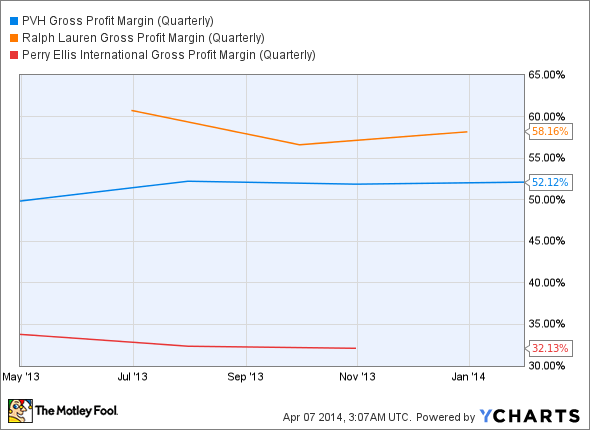

The problem I have with this argument is that Perry Ellis' gross profit margin is below the industry average (mid-40% range) and well below that of apparel leaders PVH and Ralph Lauren.

PVH Gross Profit Margin (Quarterly) data by YCharts.

The licensing business is a boost to profit margins, but Perry Ellis still lags the industry as a whole. I think this discrepancy exists because of brand strength (or lack thereof). Ralph Lauren is one of the world's most valuable brands; PVH Corp, through Calvin Klein and Tommy Hilfiger, has pricing power as well. And while Perry Ellis may have a wide brand portfolio, through its original namesake, Original Penguin, Jantzen, and others, it doesn't have brands that customers will pay extra for. The proof is in the profit (margins).

I compare Perry Ellis to PVH Corp and Ralph Lauren for a reason. They are two of the few apparel companies that have grown in this environment, they have great brands, but they still trade at reasonable valuations.

PVH P/E Ratio (Forward) data by YCharts.

2. Positive guidance

The other bullish argument for Perry Ellis is the aforementioned guidance for fiscal 2015. With a current stock price around $14, if Perry Ellis were to meet its goal of $0.90 EPS, a P/E of just 20 would give the stock upside of 30%-40% from here.

The problem with that argument is that it's hard to take management's "bad weather" excuse seriously, because it posted a loss in the third quarter on weak demand. The full-year results of $0.38 per share drastically trailed last year's earnings of $1.45.

Furthermore, management blamed weak mall traffic, thanks to the weather, as a primary reason for a weak fourth quarter. Even if we're to believe the weather excuse, it only highlights the reliance that this company has on shopping malls. With the rapid growth in e-commerce, that's not a good thing.

More questions than answers

Stocks go up for two reasons: Either the underlying business is growing or it's about to turn things around. I can't say, with any certainty, that Perry Ellis is doing either of those things. While management expects better results to come, they haven't given us concrete reasons to believe them.

If you own shares, considering the recent drop, you may want to hold. But I can't think of a good reason to commit new money to shares; this stock may be stuck in neutral for a bit.