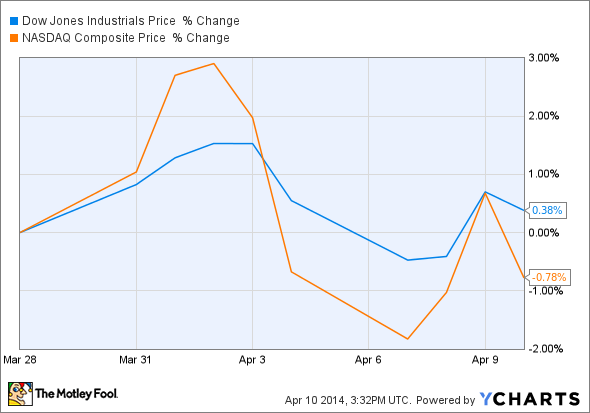

The Dow Jones Industrial Average (^DJI +0.55%) was up and then down (to the tune of 140 points) in Thursday trading as the index continued the roller-coaster ride that began last week.

Since reaching an all-time intraday high above 16,600, the Dow has been consistently inconsistent. Friday's employment numbers disappointed Wall Street and sent the Dow lower through Tuesday. The Nasdaq Composite (^IXIC 0.44%) fared worse thanks to its exposure to the tech industry, which led all sectors in the sell-off.

On Wednesday, the markets whipsawed back to gains on the release of the Federal Reserve's minutes for its March meeting. Both the Dow and Nasdaq finished the day higher as Wall Street embraced the Fed's continued low interest rate policies and general agreement among its voting members.

The sentiment on the Street has turned toward earnings season, as Dow component Chevron (CVX +2.61%) on Wednesday warned investors that first-quarter earnings would be lower than in the fourth quarter. The decline is being driven mostly by lower production due to weather related issues.

The focus on earnings was evident across the Dow and Nasdaq, as notable momentum stocks like Tesla and priceline were also down. These stocks have seen strong gains, but they are driven more by their future potential than earnings today. Earnings season is all about performance today -- profit and cash flow.

Welcome back, Carl

Carl Icahn was back in the news Thursday morning as a settlement was announced between the corporate raider and online auctioneer eBay (EBAY +0.81%). Icahn announced in January he was building an equity position in eBay, and began a proxy fight for two independent board seats to push eBay to sell a minority stake of its PayPal unit.

The online payment processor has been the primary driver of growth and profit at eBay, and Icahn contended that the value of the two units apart would be greater than the two together.

This morning's announcement effectively ended Icahn's push. eBay will appoint one new board member, former AT&T CEO David Dorman, and Icahn agreed to withdraw his proxy fight.

News of the settlement sent eBay 2% lower Thursday afternoon. Since Icahn first announced his proxy fight, eBay's stock is more or less unchanged (up 0.09% at the time of this writing). In the short term, this can be seen as at best a push and at worst a loss for Icahn.

However, over the long term, having an Icahn-backed board member is likely to be a positive result for both the investor and eBay. Love him or hate him, Icahn is a genius at creating shareholder value. Having his insights, ideas, and influence on the board will certainly be positive for shareholders. It also won't hurt that the other 11 board members and top management will constantly know that the most famous corporate raider is lurking just behind the scenes, ready to pick up the fight the moment the company fails its shareholders.