Wal-Mart Stores (WMT +0.42%) is moving forward with a deal with Wild Oats, a privately held maker of organic and natural packaged foods, to roll out around 100 products to 2,000 of its domestic stores this year. Is this going to destroy Whole Foods Market's (WFM +0.00%) competitive advantage by removing the premium that consumers have been willing to pay for organics?

After years of market-beating returns, is it finally time for investors to move on from Whole Foods?

An amazing growth story

WFM Total Return Price data by YCharts.

Whole Foods has been a truly life-changing stock for early investors. If you invested $1,000 on the day of Whole Foods' IPO in 1992, that investment would be worth more than $73,000 today. Investing $1,000 in 2000 would also have paid amazingly well during the 14 years since, netting a return of more than $9,200.

Whole Foods now has 374 stores, with another 10 in development, and has largely had little competition for the high-end produce, prepared foods, and organics that it sells.

Already feeling the squeeze?

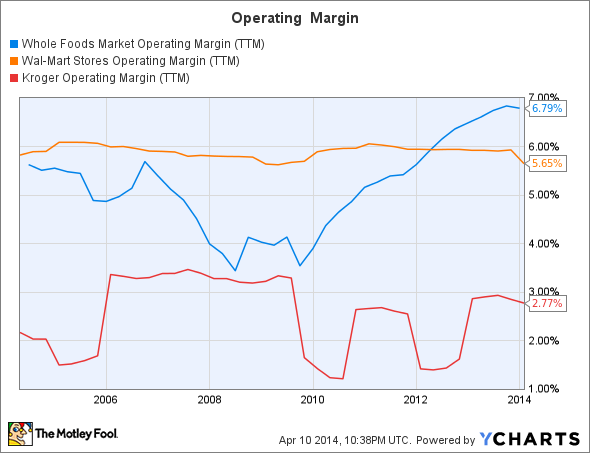

This lack of competition has partly led Whole Foods to industry-leading operating margins:

WFM Operating Margin (TTM) data by YCharts

Because Wal-Mart sells much more than groceries, Kroger offers some context to just how strong Whole Foods' operating margins are. As you can see, we're talking essentially twice that of one of the largest grocers in the world, whose scale should give it tremendous pricing power and operational efficiencies.

If you look closely, you'll see how, in the most recent quarter, Whole Foods' operating margin is declining, falling from almost 6% to 5.65%. Management specifically talked about competitive threats, and said that it would be working to be price-competitive as mainstream grocers -- like Wal-Mart and Kroger -- expand their offerings of organic and better-for-you packaged and fresh foods.

What will the Wal-Mart expansion look like?

As it stands, Wild Oats' website only lists 15 organic food categories, and three "natural" food categories. Wal-Mart's website currently lists 31 different Wild Oats Organics products. While we know that the initial rollout will include about 100 products, the question is, how many more products will be added in the future? Wild Oats Organics brand products will -- according to Wal-Mart -- be priced up to 25% less than similar name-brand organic products. It's easy to see how this could be concerning for retailers like Whole Foods.

Adding a lot of organic items to its shelves in half of its U.S. stores is a clear indication that organic and "better-for-you" packaged foods are here to stay, and Wal-Mart isn't playing around. Within months, Wal-Mart will have these products in more than six times as many stores as Whole Foods operates in its entirety. That has to be a threat, right?

Stopping there, however, ignores Whole Food's real strength

The reality is, this is less of a threat to Whole Foods' business, and more of an additional validation that organic, sustainably grown food is becoming mainstream. More consumers are becoming aware of the potential health implications, and maybe more important, the ecological impact of unsustainable conventional farm practices. At the end of the day, this is more data to support Whole Foods' decision to increase its targeted store count from 1,000 to 1,200.

Here's the key: The average Whole Foods customer doesn't shop at Whole Foods based solely on price. Don't get me wrong... all consumers want value for their dollar, but Whole Foods customers know that they can pick up any product on a shelf in their local Whole Foods store and it will meet certain standards in terms of the ingredients and the practices of the company that produced it. They'll also know that the farmer who produced it was paid fairly.

Can you get that at Wal-Mart? Not even close. After all, even if Wal-Mart stocks hundreds of organic products on its shelves, the majority will still be the conventional stuff that most Whole Foods shoppers are trying to avoid. Add in the amazing selection of (high-margin) prepared foods that Wal-Mart and other grocers won't compete on, and Whole Foods' competitive advantage remains as strong today as ever.

Final thoughts: Wal-Mart acting because of the opportunity

US Grocery Store Sales data by YCharts.

The grocery market in the U.S. is enormous -- more than $550 billion in 2013 -- and organics is the fastest-growing part. Wal-Mart grew sales just more than a paltry 1% -- that's less than inflation -- last year. Expanding its grocery business into a growing market is a must for this retail behemoth. The reality? The Krogers of the world probably will feel more of an impact than Whole Foods.

Nonetheless, facing new competition is the reality for any growing business; Whole Foods is no exception. Seeing a titan like Wal-Mart move more heavily into organics isn't the threat it seems on the surface. If anything, it's more of a validation that the market is much bigger today than it was when Whole Foods went public in 1992. I don't know about you, but I'm holding my shares: The future looks pretty big from here.