Investors love stocks that consistently beat the Street without getting ahead of their fundamentals and risking a meltdown. The best stocks offer sustainable market-beating gains, with robust and improving financial metrics that support strong price growth. Does Marvell Technology Group Ltd. (MRVL -2.60%) fit the bill? Let's look at what its recent results tell us about its potential for future gains.

What we're looking for

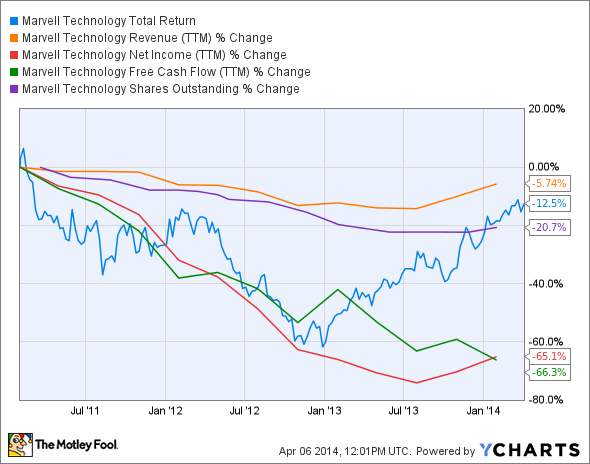

The graphs you're about to see tell Marvell's story, and we'll be grading the quality of that story in several ways:

- Growth: Are profits, margins, and free cash flow all increasing?

- Valuation: Is share price growing in line with earnings per share?

- Opportunities: Is return on equity increasing while debt to equity declines?

- Dividends: Are dividends consistently growing in a sustainable way?

What the numbers tell you

Now, let's look at Marvell's key statistics:

MRVL Total Return Price data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Revenue growth > 30% |

(5.7%) |

Fail |

|

Improving profit margin |

(63%) |

Fail |

|

Free cash flow growth > Net income growth |

(66.3%) vs. (65.1%) |

Fail |

|

Improving EPS |

(52.9%) |

Fail |

|

Stock growth (+ 15%) < EPS growth |

(12.9%) vs. (52.9%) |

Fail |

Source: YCharts.

*Period begins at end of Q1 (Jan.) 2011.

MRVL Return on Equity (TTM) data by YCharts

|

Passing Criteria |

3-Year* Change |

Grade |

|---|---|---|

|

Improving return on equity |

(61.3%) |

Fail |

|

Declining debt to equity |

No Debt |

Pass |

|

Dividend growth > 25% |

0% (since last assessment) |

Fail |

|

Free cash flow payout ratio < 50% |

32.8% |

Pass |

Source: YCharts.

*Period begins at end of Q1 (Jan.) 2011.

How we got here and where we're going

Things have worsened for Marvell since its last assessment -- the integrated chip specialist picked up a middling two out of nine possible passing grades today, compared to a robust six-of-nine showing. Over the past couple of quarters, Marvell has again started to show some signs of growth, but this has hardly turned around a miserable three-year performance in which virtually every important fundamental metric has faceplanted. Will Marvel be able to return its free cash flow and profitability to levels enjoyed before 2011? Let's dig a little deeper to find out.

Marvell did beat Wall Street's expectations for both revenue and earnings per share in its fourth-quarter results, due to steady improvement in its storage and networking business. Fool contributor Harsh Chauhan notes that Marvell continues to benefit from the growing adoption of solid-state drives (SSDs) by data-storage and mobile manufacturers. The company also enjoyed strong demand in its networking segment from enterprise clients and Internet service providers. Microsoft's (MSFT 0.73%) imminent forced obsolescence of Windows XP will also force many enterprise customers to upgrade to new systems, which should produce strong tailwinds for Marvell's storage segment -- the enterprise SSD market is expected to triple by 2017.

Fool analyst Jim Mueller points out that global data-storage demands are also expected to grow from under 1,000 exabytes (an exabyte is a billion gigabytes) today to 6,000 exabytes in 2020, a surge propelled by the demand for enterprise systems. Marvell recently introduced two new high-performance SSD products, and its pipeline boasts several hybrid-storage devices, which could help it either gain sales from, or steal market share from, the hard disk drive duopoly of Western Digital (WDC -3.85%) and Seagate (STX). Global hybrid-HDD shipments are expected to increase tremendously, from just 3.4 million units last year to 127 million in 2018.

Marvell also has several important design wins at Samsung's Galaxy phones and tablets, and should benefit from China Mobile's (NYSE: CHL) LTE network rollout in the Middle Kingdom. Marvell is a major supplier of LTE chipsets, and the upgrade process should earn it more placements in Chinese-targeted mobile devices. Marvell has also developed a new fabric technology to address real-time data demands in data centers and mobile infrastructures. On the other hand, Marvell lost a key spot in Samsung's new low-end Galaxy Tab 4 family, which now sports Qualcomm's (NASDAQ: QCOM) Snapdragon processor instead.

Marvell also recently lost two separate legal battles against both Carnegie Mellon University and Goldman Sachs (NYSE: GS). In the first case, the court ordered Marvell to pay Carnegie Mellon $1.54 billion for patent violations -- shares surged because the university was pushing for an award three times as large. Goldman won an arbitration decision against two Marvell executives, which as Fool contributor Dan Caplinger points out, stemmed from a large margin-call sale that the executives felt was improperly transacted.

Putting the pieces together

Today, Marvell Technology has few of the qualities that make up a great stock, but no stock is truly perfect. Digging deeper can help you uncover the answers you need to make a great buy -- or to stay away from a stock that's going nowhere.