On Thursday, Advanced Micro Devices (AMD 2.67%) will release its quarterly report, and shareholders have high hopes that the chipmaker will be able to build on its huge growth from the previous quarter on the back of growth in specialty game-console chip sales. But even with the momentary respite, investors are skeptical as to whether AMD can catch up with Intel (INTC 5.80%), NVIDIA (NVDA 0.30%), and other competitors to carve out a niche that will be viable for the small company in the long run.

Advanced Micro Devices has a reputation for playing second-fiddle to other companies in the tech space. In the PC processor segment, AMD has long lagged behind Intel's dominance of the sector. Yet even as Intel has been slow to realize the value of the mobile-chip segment, NVIDIA and other companies have been more effective than AMD at making a splash in the fast-growing space. Will game consoles hold the key to a better long-term strategy going forward? Let's take an early look at what's been happening with Advanced Micro Devices over the past quarter and what we're likely to see in its report.

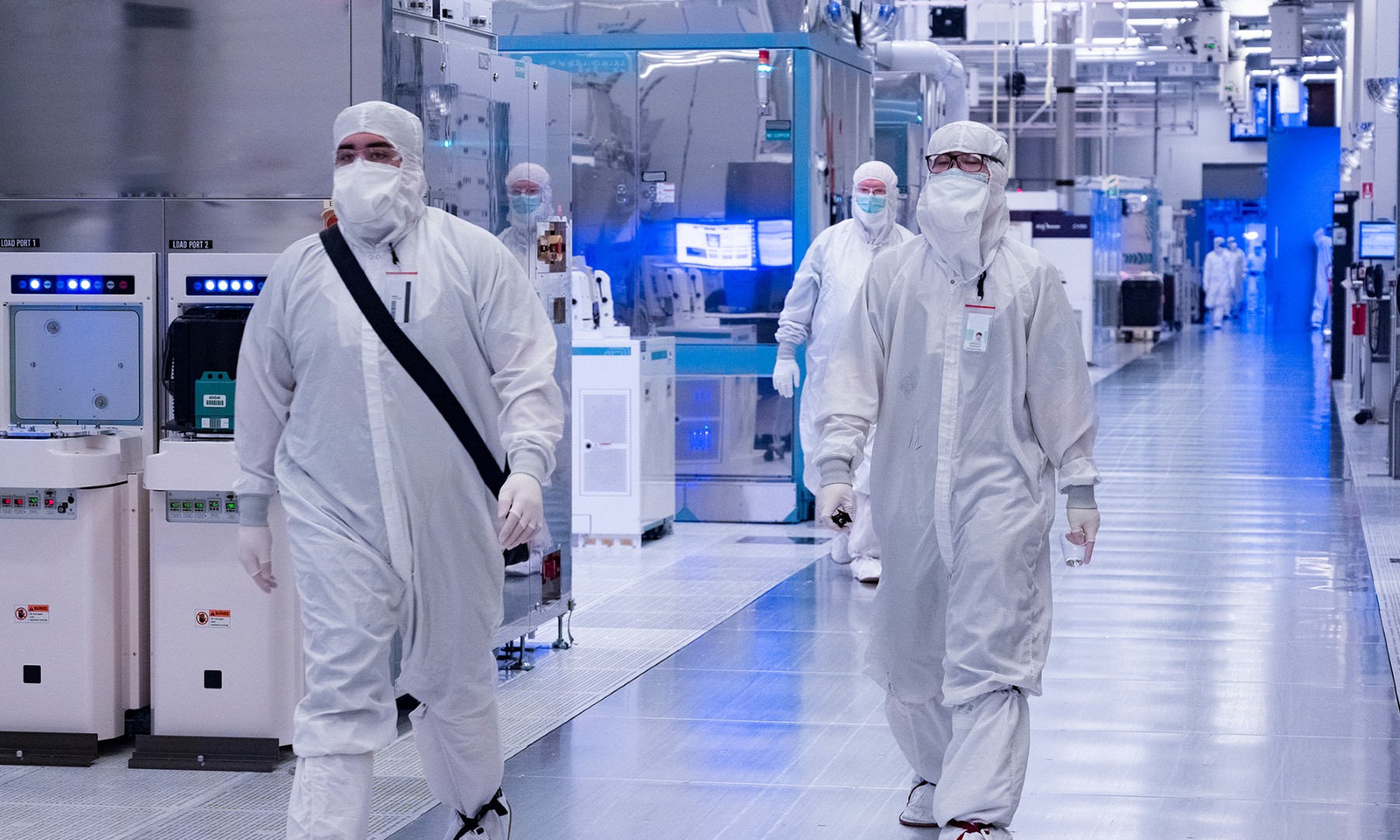

Source: AMD.

Stats on Advanced Micro Devices

|

Analyst EPS Estimate |

$0.00 |

|

Year-Ago EPS |

($0.13) |

|

Revenue Estimate |

$1.34 billion |

|

Change From Year-Ago Revenue |

23% |

|

Earnings Beats in Past 4 Quarters |

4 |

Source: Yahoo! Finance.

Will AMD earnings hold up this quarter?

In recent months, analysts have had mixed views on AMD earnings, raising their first-quarter estimates by a penny per share but cutting their full-year 2014 projections by a penny as well. The stock has faced challenges, falling 9% since early January.

A big portion of the share-price drop came after AMD announced its fourth-quarter results. As predicted, sales in its graphics business soared, rising 165% because of sales related to its providing chips for next-generation game consoles Xbox One and PlayStation 4. Yet elsewhere in its business, AMD saw poorer results, with the company losing market share to Intel in the PC segment, and AMD also projected that revenue in the first quarter would be far below fourth-quarter results.

Yet AMD also faces some longer-term issues that pose even bigger challenges. The company had hoped its Mantle graphics application programming interface would help boost performance over competing APIs. But the need to get game developers onboard to support Mantle could prove problematic, especially given its proprietary nature to AMD graphics processing units. With NVIDIA having made its own advances in GPU technology, AMD will keep having difficulty competing. Similarly, Intel's move to develop low-cost chips that feature low power consumption and an overhauled graphics engine could threaten AMD's remaining grip on the PC industry.

Still, AMD has plenty of hope that it can compete against Intel and NVIDIA. At the Consumer Electronics Show earlier this year, AMD touted its Beema and Mullins processors, suggesting that they could be used for ultrabooks, tablets, and hybrid devices and challenge Intel's attempts to gain share in that area. With substantial improvements in computing and graphics handling, the chips could offer a way forward for AMD in the mobile space. Moreover, its Radeon 295X2 GPU could give AMD a high-end market win against NVIDIA, capitalizing on a niche where NVIDIA hasn't yet provided a strong alternative.

In the Advanced Micro Devices earnings report, watch to see whether the company can surprise on the upside from an earnings perspective. With so much riding on its most recent gaming-console success, it's important for AMD to help investors see a future even after the hype over the PlayStation 4 and Xbox One dies down.

Click here to add Advanced Micro Devices to My Watchlist, which can find all of our Foolish analysis on it and all your other stocks.