Farm equipment maker Deere & Company (DE 0.86%) has registered solid growth over the years, but can it keep up the momentum or will it lose steam? What if we say that a single chart can help dispel all doubts?

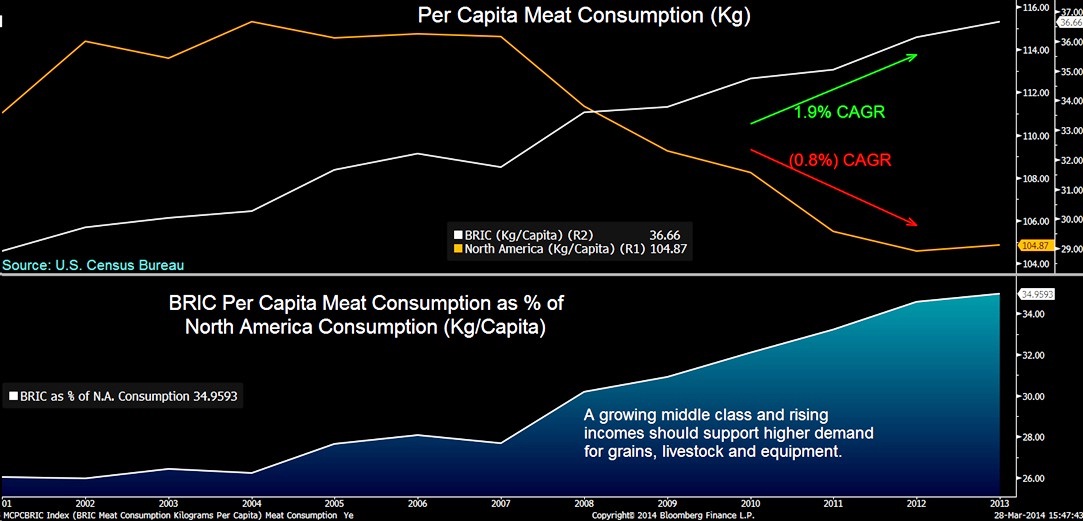

This chart put together by analysts at Bloomberg shows that Deere's future looks to be secure and bright:

Source: Bloomberg

The stats show that the amount of meat eaten by a person in Brazil, Russia, India and China (hence, BRIC) is 35% of what a person in North America consumes. But, in the past 12 years, meat consumption has increased at a compounded annual growth rate, or CAGR, of 1.9% in BRIC, while it has de-accelerated in North America. Now, the question is: How does Deere benefit from this?

The opportunity

Meat comes from animals or livestock, and livestock live on feed. Grains serve as an important feed. Farmers grow grains. And farm machinery helps in not just raising these crops, but also in increasing yield. So, demand for more meat actually pushes up demand for farm equipment -- and demand for meat is on the rise in BRIC countries. This is a huge opportunity for Deere.

Insatiable appetite

The burgeoning middle class with increasing income is at the forefront of BRIC's food requirements, especially for meat. Of the BRICs, Russia belongs to the high-income category, Brazil and China to the upper-middle income, while India is a lower-middle-income economy, according to the World Bank.

With rise in income, a person's eating habits graduate from basic commodities (bread, cereals) to livestock products (meat), then to processed products (frozen food), and at the uppermost end, to services, like quick service restaurants and hotels. So, people tend to eat more meat when economic conditions improve. This is the effect visible in the meat-eating patterns of BRIC nations in the above chart, and it's just started.

Let's look at some numbers:

- In China, the urban household income is set to double by 2022.

- In Brazil, 9.4 million households will have yearly disposable income of more than $50,000 by 2020, which is greater than a 50% hike.

- India's middle class is expected to touch 200 million by 2020, up from 50 million now.

- Russia's middle class may rise 16% by 2020, constituting 86% of the population and spending $1.3 trillion.

This suggests that demand for meat, and consequently grains (livestock feed), will explode over the coming years. To meet this demand, a high level of mechanization of farm functions is required, and the BRIC governments are committed to the cause.

The Chinese government has the most ambitious target of mechanizing 70% of its farm jobs by 2020. Various schemes adopted by the Indian government provide farmers subsidies to buy machinery and even train them on proper usage. Russia's Agriculture Development Program 2013-2020 is expected to increase support by more than 60% by 2020, while Brazil's budget for agriculture and livestock plan for 2013-14 stands at R$156 billion.

All these facts point toward one conclusion -- huge demand for Deere's products over the coming years.

You cannot make BRICs without straw

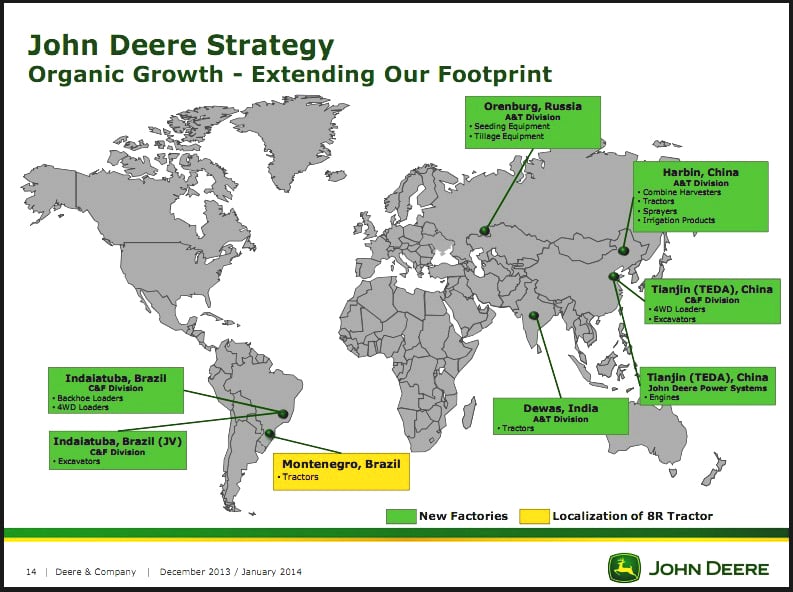

Deere has stepped on the gas to tap the overwhelming opportunities and grab bigger market share. In the past couple of years, it has opened six factories in the key BRIC markets. The company has adopted a differential approach depending on the needs of each country.

In India, the market is mostly for tractors, so the Indian factories manufacture tractors and combines. China and Brazil are warming up to advanced machinery, and factories there cater to this demand. Deere CEO Samuel Allen had said that more advanced machinery can increase grain produce by 20%-30% in China. Agriculture equipment sales in China are expected to grow 10%-15% a year.

Russia, being a high-income economy, has graduated to Deere's advanced products. The country is a net ag product importer and is trying hard to achieve self-sufficiency. Moreover, Russia wants to increase wheat exports to countries like China. Since the use of farm land in the country has been going down over the years, Russia's aspirations can be achieved through higher levels of mechanization. Deere is focusing on Russia for this very reason. The farm major has doubled manufacturing capacity and opened a new factory in Russia in recent years.

Deere is a pioneer in precision ag equipment that helps "enhance productivity and increase efficiency". A few examples could be FarmSight, an integrated agriculture management solution, or the 7R and 8R series of high-horsepower, fuel-saving tractors or even the path-breaking planters, MaxEmerge and ExactEmerge, which cover more area in lesser time.

Though not all of Deere's innovative products have a market in the BRIC nations right now, things are changing fast, and these countries are steadily adopting newer methods and products. As a case in point, Deere will produce 8R tractors, currently being made in Iowa, at its factory in Montenegro, Brazil, starting in 2015. Deere offers farm technology management solutions in all BRIC nations except India.

Source: Deere presentation

Summing up

More demand and less food isn't quite a picture-perfect scenario, but it no doubt is a great opportunity for companies like Deere to make a difference while boosting their revenues. The meat consumption pattern in the BRIC nations is an augury of Deere's future prospects, and the strongest tailwind one could hope for.