Google (GOOG +0.42%) wants to get loonier. The Internet giant announced recently that it will buy the New Mexico drone maker Titan Aerospace, beating Facebook (FB +0.09%), which also had designs on the company, to the punch. The social networker didn't want to get left behind and instead acquired a British company, Ascenta, that also makes unmanned aerial vehicles, for $20 million.

Titan would fit nicely into Google's "Project Loon," an attempt to bring wireless service to areas of the world that do not have it. Facebook would probably use drones and other technology that Ascenta is working on for the same reason. Previously, Amazon.com (AMZN +2.63%) indicated it wants to deliver packages using unmanned aerial vehicles.

How will the drone wars drive investor returns?

Searching for growth

Google, recognizing that growth in its primary cash cow, Search, may plateau in developed countries, is looking for ways to connect people living in hard to reach areas to the Internet. There's a big untapped market, too; two thirds of the world's population does not yet have access.

As part of that effort, Project Loon, as originally conceived, proposed to use high-flying balloons to close gaps in wireless coverage in certain geographical areas of the globe. Theoretically, once connected, some of these people would begin using Google products. Adding drones may become part of the process.

Any payoff from Project Loon would likely take several years to contribute to Google's bottom line. However, investors who believe in Google's vision and are willing to delay gratification could reap the benefits down the road.

Liking the drone

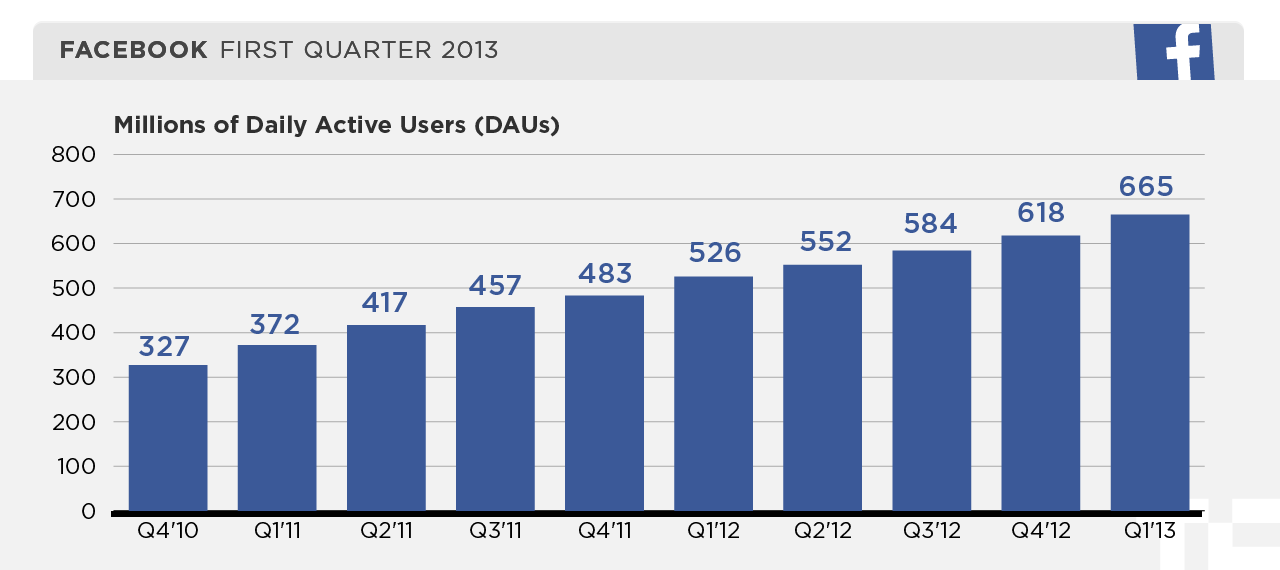

Although its user base is rapidly increasing (see the chart below), Facebook doesn't want to rest on its laurels. Part of the company's strategy is to expand globally to compensate for any potential domestic slowdown. The company wants to attract people, especially those in developing countries, to its experience. Using drones may be necessary to reach people who currently do not have Internet access.

Source: Facebook

Package in a hour

Amazon wants to get a package to your front door within an hour after you place an order. Delivery via drone is one way the company thinks it could happen. With no pilot needed, Amazon could accomplish this less expensively than today's overland methods, which would boost Amazon's low profit margins. If not for a long history of double-digit revenue growth, the company would likely be just another run-of-the-mill outfit instead of one of the most successful companies in recent times.

However, the Seattle-based company would have to overcome many obstacles, including getting regulatory approvals, to fly drones in confined airspace in certain areas of the country. So, don't look for any immediate benefit from drones for Amazon, if at all. Stick with the company if you believe it has the potential to keep satisfying e-commerce customers using traditional delivery methods.

Foolish conclusion

Google wants to use Titan Aerospace drones to expand its user base by connecting more people to the Internet. Long-term investors will benefit if the company's seemingly loony plan pans out.

Facebook will probably use unmanned aerial vehicle technology from Ascenta, a British company recently acquired, to help do the same. The social networker wants to ensure its already-high user growth rate continues.

Amazon's lofty vision of using drones to deliver packages might have a tough time getting off the ground. Overcoming regulatory hurdles would be just one of the issues affecting the plan. Investors might have to just accept profit via traditional delivery methods.