First-quarter results from Intel (INTC +3.39%) are out, and for the most part, they're unimpressive. Intel managed to meet analyst expectations on earnings, but its underlying business shrank compared to the same quarter a year ago. The stock shot up in after-hours trading after the results were released, but came back down once the market opened the next day. That seems to imply that Intel's "so-so" quarter showed some progress, but significant uncertainties still linger.

By now, it's universally known that Intel still clings to the personal computer. This has proved to be a cumbersome shackle on the company's efforts to branch out into new product categories. Intel's chief executive officer has promised the company's huge investments in mobile devices will pay off this year, but the first quarter was yet another in which that goal proved elusive.

Take the good with the bad

It's important to note that Intel stemmed the decline seen over the past several quarters. It finally hit expectations on profits and showed stability on margins, which had eroded in recent periods. In all, Intel generated $12.7 billion in revenue, representing a 1.5% decline year-over-year. Diluted earnings per share clocked in at $0.38, a 5% decline versus the first quarter of 2013.

Among Intel's business segments, certain units performed better than others. For example, Intel is doing very well in data centers, which grew revenue by 11%. Unfortunately, the anchor weighing down Intel continues to be its PC client group, where revenue fell 1% year-over-year. This was a manageable decline, but the PC client group still represents 62% of Intel's revenue, which makes it difficult to move the needle, even if its other businesses perform well.

Continued erosion in personal computers is holding back a slew of companies still reliant on the PC. Hewlett-Packard (HPQ 0.46%) delivered 17% growth in GAAP earnings per share in the first quarter, mostly thanks to significantly reduced costs. Revenue declined by 1%, because HP still has a large printers business, which is not doing well; revenue in that segment fell by 2% year-over-year.

Technology companies still reliant on the PC, like Intel and HP, are getting credit for producing satisfactory profits. But, that's mostly due to harsh cost cuts, not revenue growth, which can only go so far. It seems that a lot of optimism over Intel's first quarter involves margins. This metric is heavily scrutinized by analysts when it comes to technology stocks.

Fortunately for Intel, its 59.7% gross margin in the first quarter wasn't a shock. And, it expects a 63% margin in the current quarter. Going forward, Intel sees gross margin coming in at 61% for the full year. That's a full percentage point higher than its prior expectations.

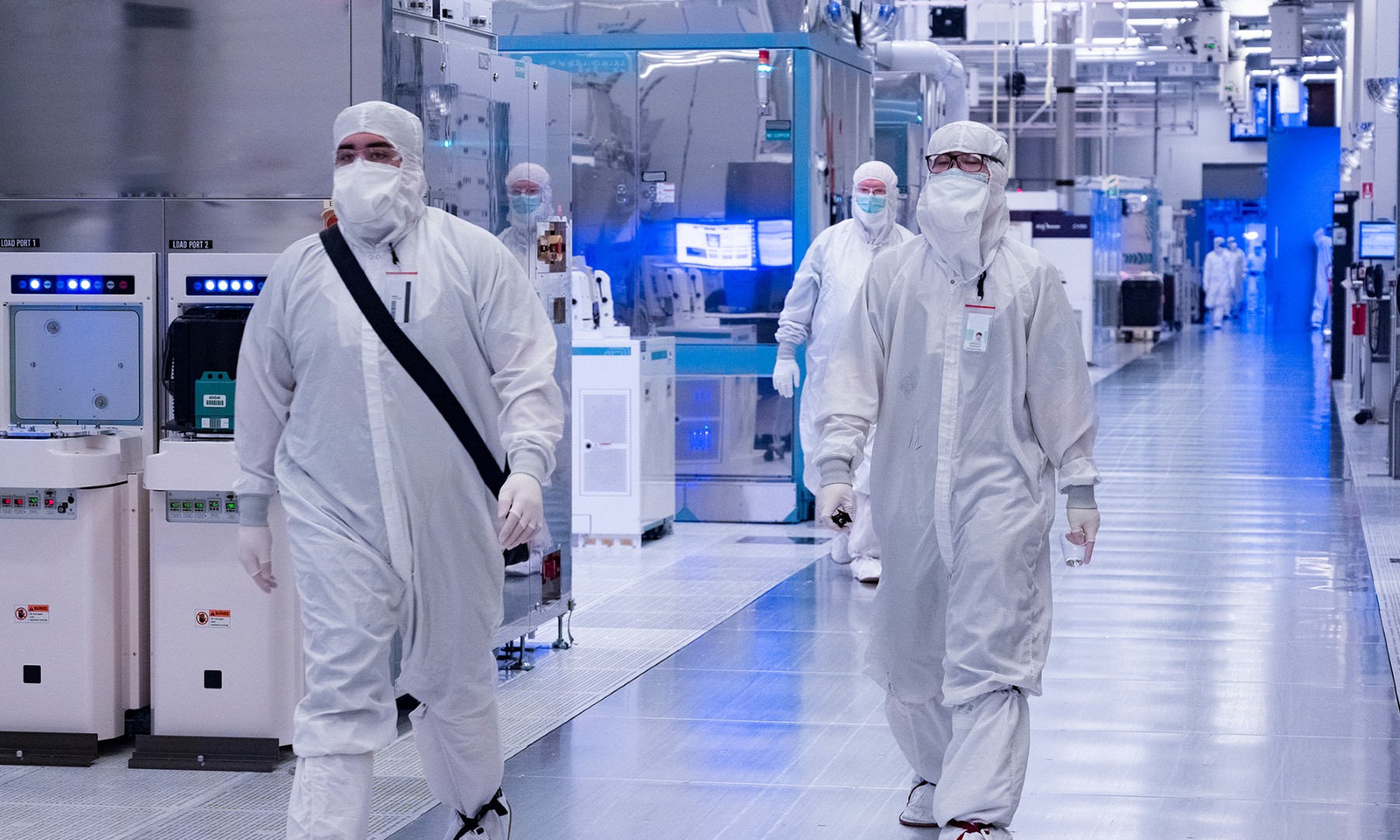

The hunt for 40 million tablets

Intel CEO, Brian Krzanich, has long vowed to get his company's chips into 40 million tablet processors by the end of 2014. Intel managed to ship 5 million tablet processors in the first quarter, and management is confident it will reach its goal. Intel was very late to the smartphone device market, and has spent a lot of money over the past couple of years trying to catch up. Intel's percentage of R&D and marketing, general, and administrative costs rose to 35.5% last year, up from 29.5% in 2010.

The key takeaway from Intel's quarter is that, while the company realized stabilization in the personal computer space and is showing growth in data centers and other businesses, a lot of progress still needs to be made. The future of computing is clearly in the smartphone category. Intel is still held back by a large and underperforming PC business, and that needs to change soon if Intel is to grow once again.