Source: Wikimedia Commons, Ron Reiring

In 2012, the seven largest freight railroad companies spent $11 billion to guzzle more than 3.6 billion gallons of diesel fuel. But new government projections point to massive savings if corporations like Berkshire Hathaway's (NYSE: BRK-A) (NYSE: BRK-B) BSNF Railway and CSX Corporation (CSX 0.27%) can make the switch from diesel to LNG. Here's what you need to know.

LNG is in

Ever since steam engines went by the wayside in the 1940s and 1950s, diesel has been the freight train fuel of choice. So much so, that current freight rail consumption accounts for a whopping 7% of all diesel fuel consumption -- and it's not hard to see why. Diesel is readily available, cheaper than most alternative fuels, and prices have proved relatively predictable over the past decades.

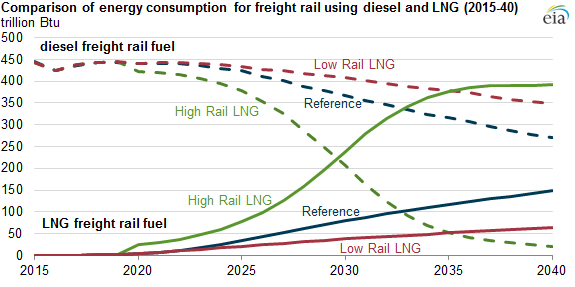

But booming natural-gas production is paving the way for a cheap competitor: liquefied natural gas (LNG). According to new projections from the U.S. Energy Information Administration, LNG could account for up to 95% of freight rail fuel consumption by 2040 -- an astronomically larger amount than its current near-zero percentage.

According to the EIA, the expected difference in costs between diesel and LNG are more than enough to offset the approximately $1 million in additional costs for building and running a LNG locomotive. Even in the EIA's "Low Rail LNG" case, the new fuel will still account for 16% of total freight consumption by 2040.

Source: EIA.gov

And for those worried that the increase in LNG demand might ironically push prices higher and dump diesel back in the competition, the EIA also notes that even if 95% of freight trains switched to LNG, the overall demand effect on natural gas would clock in at less than 1%.

Berkshire Hathaway's LNG Action

Rail-invested companies like Berkshire Hathaway and CSX Corporation are well aware of the major opportunity awaiting their industry. Berkshire Hathaway's BNSF Railway has big plans -- and they include LNG. The rail company has taken a two-headed approach to dealing with its diesel addiction: increasing efficiency and exploring alternatives.

On the efficiency front, BNSF has increased its fleet efficiency by 7.7% since 1999, and has added more than 2,700 new locomotives to its ranks in the past decade. The new engines are, on average, 15% more efficient than their retired counterparts.

In the alternatives arena, the Berkshire Hathaway rail company has already been exploring LNG opportunities for at least a year. When the news broke, The Wall Street Journal noted that "[i]f successful, the experiment could weaken oil's dominance as a transportation fuel and provide a new outlet for the glut of cheap natural gas in North America." For its part, BNSF call its LNG efforts "the cleanest-burning locomotive technologies in existence." But the rail company is undoubtedly looking forward to a boost to its bottom line, as well. In 2013, the Berkshire Hathaway subsidiary spent a whopping $4.3 billion to consume 1.4 billion gallons of diesel.

CSX Corporation's LNG Action

Source: CSX Corporation

CSX Corporation isn't idling, either. The company announced last November that it would partner with engineering stalwart GE to explore its own LNG opportunity. In the initial press release, CSX Corporation COO Oscar Munoz noted:

[A]ggressively exploring this technology is consistent with CSX's focus on tomorrow, its long-standing commitment to efficient and environmentally friendly transportation, and its role in helping to promote US energy independence.GE Transportation has the know-how to provide the right LNG solution for our locomotive fleet and help us better understand the feasibility of LNG technology from a safety, operations and economic perspective.

CSX Corporation and GE are currently running field tests and are exploring entirely new locomotive options, as well as cost-effective retrofits for its current diesel fleet. For its own part, CSX Corporation dished out $1.5 billion for 482 million gallons of diesel last year -- not exactly chump change.